Risk aversion is dominating early trade on Tuesday, with losses in Asia spilling over into Europe. The FTSE is on track for its worst day in 7 weeks as traders fret over the outbreak of coronavirus in China. The virus has so far resulted in 4 deaths and is being likened to the SARS outbreak 17 years ago. Authorities confirming that the disease can spread between humans means that contagion could be far reaching, particularly with the high levels of travel around Chinese Lunar New Year.

Upbeat wage growth lifts pound

A stronger pound is also weighing on the FTSE. Upbeat wage data has helped GBPUSD snap a 3-session losing streak. After some particularly poor UK data recently, wages growth surprised to the upside increasing 3.2% versus an expected 2.9%. Following the unexpected contraction in November’s GDP, inflation striking a 3-year low in December and weak retail sales, traders were pricing in a 70% probability of a rate cut by the BoE. The upbeat wages data is helping push back on easing expectations. GBP/USD is advancing towards $1.3050.

Pound strength is weighing on the multinationals on the FTSE, which earn profit and revenue abroad.

A stronger pound is also weighing on the FTSE. Upbeat wage data has helped GBPUSD snap a 3-session losing streak. After some particularly poor UK data recently, wages growth surprised to the upside increasing 3.2% versus an expected 2.9%. Following the unexpected contraction in November’s GDP, inflation striking a 3-year low in December and weak retail sales, traders were pricing in a 70% probability of a rate cut by the BoE. The upbeat wages data is helping push back on easing expectations. GBP/USD is advancing towards $1.3050.

Pound strength is weighing on the multinationals on the FTSE, which earn profit and revenue abroad.

Movers & shakers

There are fewer climbers on the FTSE leader board this morning. However, Easyjet is standout gainer up just shy of 5% following an impressive trading update. Revenue +10%, passenger numbers +2.3%. Miners and Burberry dominated the loser board, these are stocks which are closely tied to the health of the Chinese economy.

There are fewer climbers on the FTSE leader board this morning. However, Easyjet is standout gainer up just shy of 5% following an impressive trading update. Revenue +10%, passenger numbers +2.3%. Miners and Burberry dominated the loser board, these are stocks which are closely tied to the health of the Chinese economy.

Levels to watch

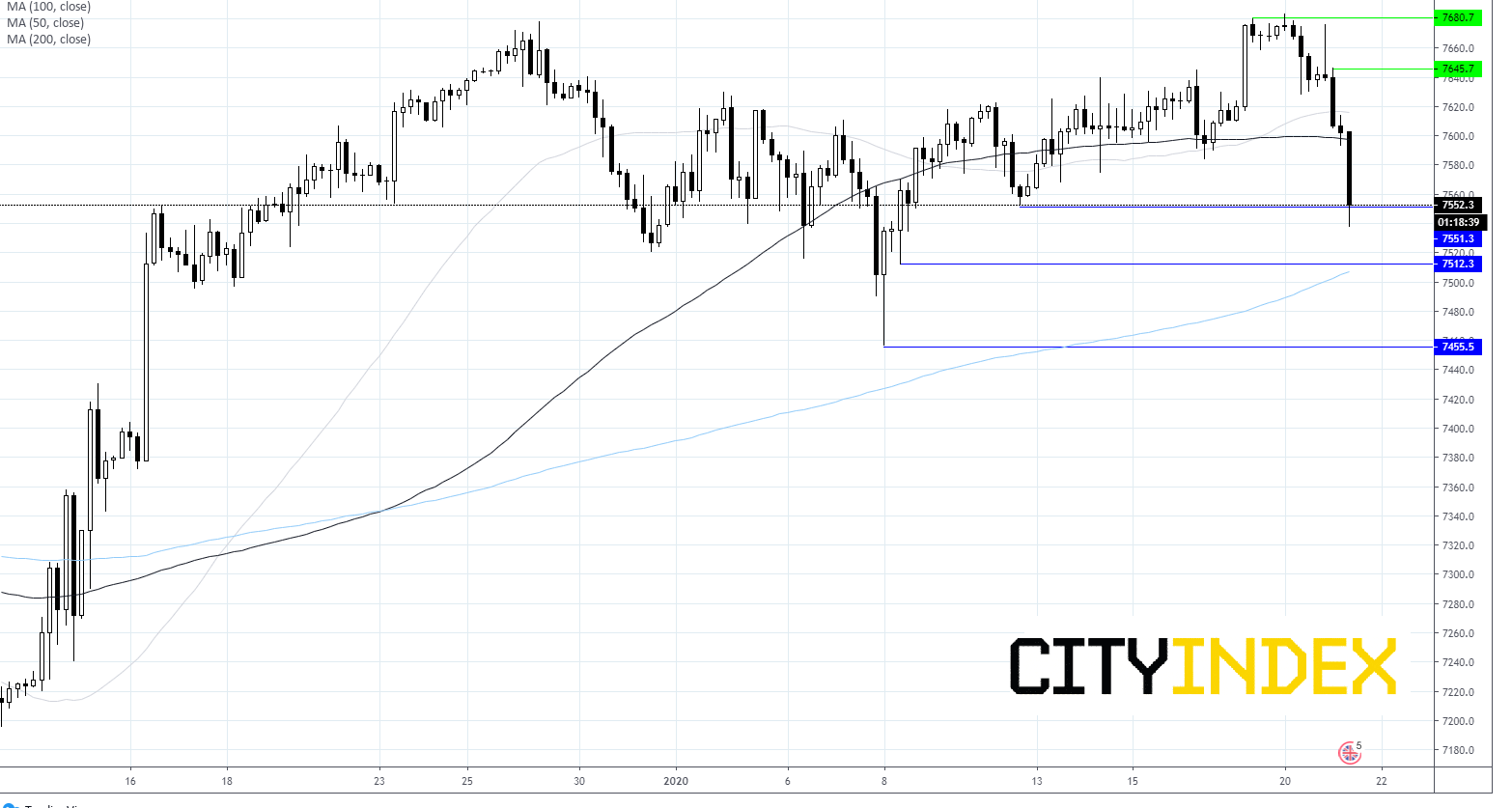

FTSE has sunk 1.2% in early trade, breaking through 100 & 50 sma and support at 7584. It is testing support at 7550 a breakthrough here could indicate momentum is building for a wider sell off.

Support can be seen at 7515 (an 8th low) opening the door to 7456. On the upside resistance is at 7650 (daily high) followed by 7680 ( 17th Jan high).

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM