Following the short-lived market tumult in the wake of Donald Trump’s election victory, the U.K.’s benchmark index has followed the same range bound and volatile path as its U.S. counterparts.

The FTSE avoided a multibillion dollar sell-off in reaction to the controversial business man’s shock win, though like U.S. stock markets, it has not made a great deal of progress on the upside amid nervy rallies following 8th November.

In fact, the blue-chip index has set lower highs for all but one of the sessions since impulsive leaps on the two days following Trump’s win. In the latter session, the FTSE traded at its highest so far this month, but actually closed markedly lower, and has been nowhere near those highs since.

At the same time, daily lows have been setting a mild upward gradient too.

Overall, this is not a particularly ebullient picture, and, as per other global indices, the general tone undermines the notion that unwinding of yield-hungry market factors is a consequence of a fresh appetite for more moderately-yielding ‘higher-value’ assets.

The FTSE 100′s tardy if not outright weak performance this week in our view, underlines that global markets have not quite crossed the Rubicon yet from their post-financial crisis bias for ‘high-yield growth’ to one favouring ‘high-quality value’.

Since in, our view, most FTSE stocks meet the latter criteria, we would have expected the index to have strengthened more decisively, if the trend was anything like clear-cut.

We believe other important fundamentals in close-proximity are now almost entirely priced into Britain’s top-tier market. For instance Janet Yellen’s testimony on Capitol Hill on Thursday did little to disrupt the narrative that a 25 basis points Fed hike would come in December.

Similarly, the FTSE’s earnings season is all but complete, leaving few further overhangs from scheduled disclosure on sentiment. All this suggests recent range bound trading is largely driven by investor caution over the nature of the incoming U.S. administration. We expect current equity market stability to deepen if investors judge that a (mostly) prudent direction is being mapped out at Trump Tower.

As for next week’s Autumn Statement ‘mini-Budget’, the primary impact on the FTSE is likely to be via the conduit of sterling, where the pound ailing against the dollar has tended to lift blue-chip investors’ spirits at the expense of sterling bulls.

Regardless of new signals that Chancellor of the Exchequer Philip Hammond may offer on forthcoming fiscal largesse, we believe the likelihood that such comments will significantly depress sterling anew is low.

On that basis, we do not see another major FTSE boost from weak sterling in the medium term.

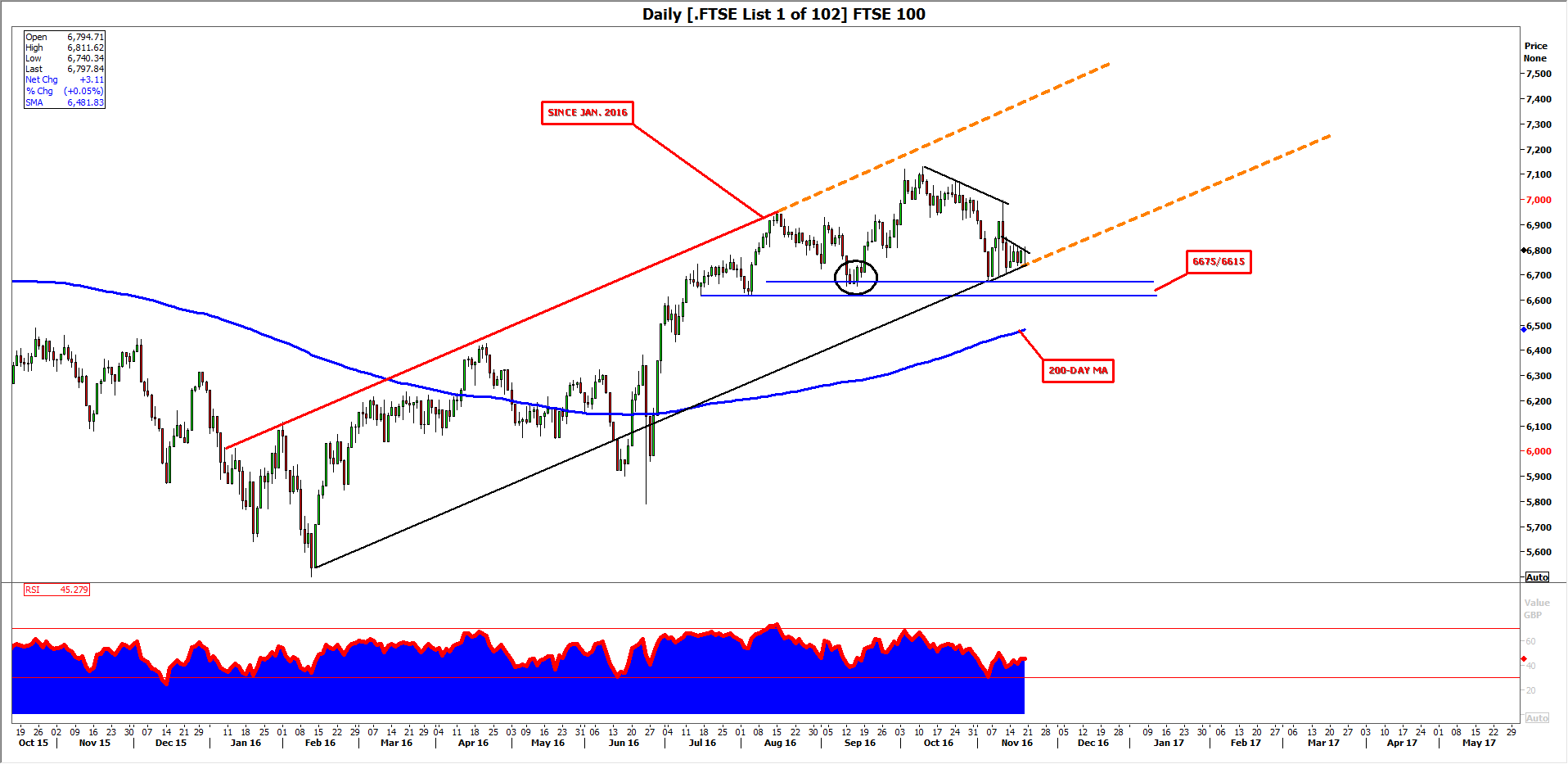

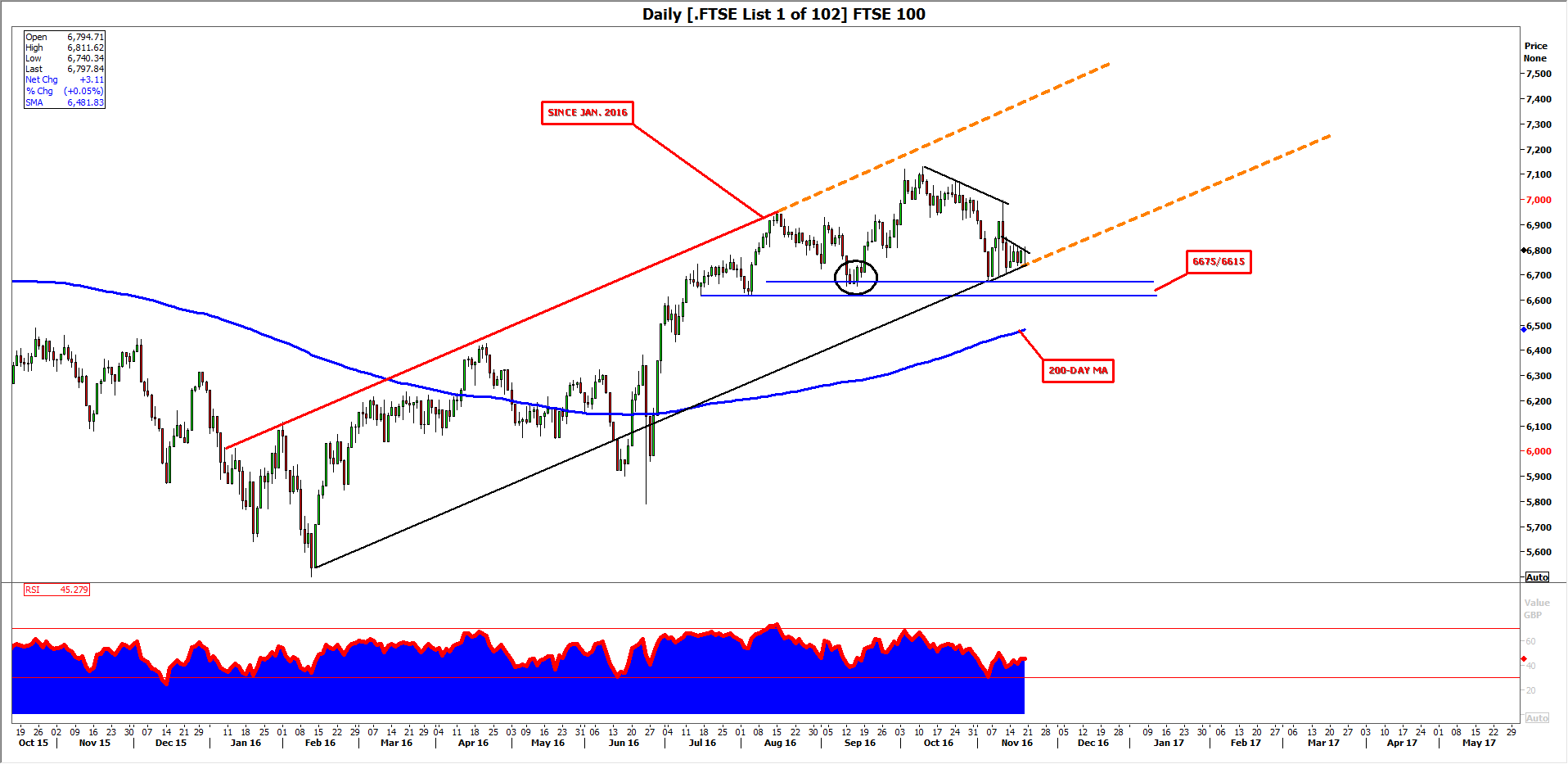

From a technical chart perspective, as noted, FTSE price action has recently been angling downwards at the upper reaches, and slightly upwards at the lows.

Triangulation abounds and a breakout looks possible within a few sessions, particularly given the potential for large positions having been taken during volatile trading in mid-September (marked by an ellipse on the chart).

Price action should become more aggressive as the smaller pennant on our chart tightens, at which point the uptrend since February (interrupted by the Brexit vote whipsaw) may be revalidated or not.

A 6675/6615 support zone backs the case for an upside breakout. However, the market has clearly been tetchier and volatile in recent months than it has been for years, perhaps rendering support less reliable.

That is regardless of the gently upswing in the 200-day moving average that points to a toughened underlying trend.

We expect investors to wait for a strong test of the support zone before buying with any great conviction. By then, further clarity may be available regarding the tenor of U.S. politics next year, as well.

DAILY CHART

Please click image to enlarge

Singapore Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.