Whilst stocks on Wall Street saw their worst session in a month, European bourses are pointing to a mildly stronger start. Upbeat Chinese data is managing to distract investors, at least for now, even as covid cases continue to surge across the US and Europe and in the absence of additional fiscal stimulus from the US.

Chinese factory profits rose for a fifth straight month in September and economic growth roared back to life in South Korea. Profits at Chinese industrial firms rose 10.1% year on year in September, down from the 19.1% growth recorded in August, but still a solid reading as strong exports, pent up demand and government stimulus keep the recovery in motion. All in all, data from Asia is improving which is helping to off set nervousness surrounding rising covid numbers in Europe and US. China’s 14th Five Yer Plan will be in focus.

Investors are unnerved by the surging number of covid cases which are dampening the economic recovery outlook. News on Monday that talks over a coronavirus relief package have slowed could keep the lid on gains, although House Speaker Nancy Pelosi remans upbeat that an agreement can still be made before the US elections. Given that talks have been deadlocked for months and that the elections are less than a week away this seems a rather ambitious expectation.

HSBC revamp as profits fall 35%

Banks will be in focus after HSBC reported a less than feared 35% decline in quarterly profits amid an easing in bad loan provisions and an improvement in the outlook for its main markets. HSBC also announce significant changes to its business, including moving away from net interest income as a main source of income towards a fee based focused business, whilst also accelerating plans to reduce the bank’s size and slash costs. This marks a huge shift in strategy but one that make absolute sense given the rock bottom interest rates that have dominated the banking scene for years and are look set to stay for the foreseeable future.

Banks will be in focus after HSBC reported a less than feared 35% decline in quarterly profits amid an easing in bad loan provisions and an improvement in the outlook for its main markets. HSBC also announce significant changes to its business, including moving away from net interest income as a main source of income towards a fee based focused business, whilst also accelerating plans to reduce the bank’s size and slash costs. This marks a huge shift in strategy but one that make absolute sense given the rock bottom interest rates that have dominated the banking scene for years and are look set to stay for the foreseeable future.

HSBC reported pre-tax profit of $3.1 billion in Q3, above $2.07 billion forecast. HSBC also announced hat it expected bad loan provisions for the year to be towards the lower end of guidance of $8 - $13 billion. The stock listed in Hong Kong trades +5%.

HSBC follows Barclays in reporting an improved picture for bad loan provisions. This bodes well for Lloyds and NatWest which are due to report later this week.

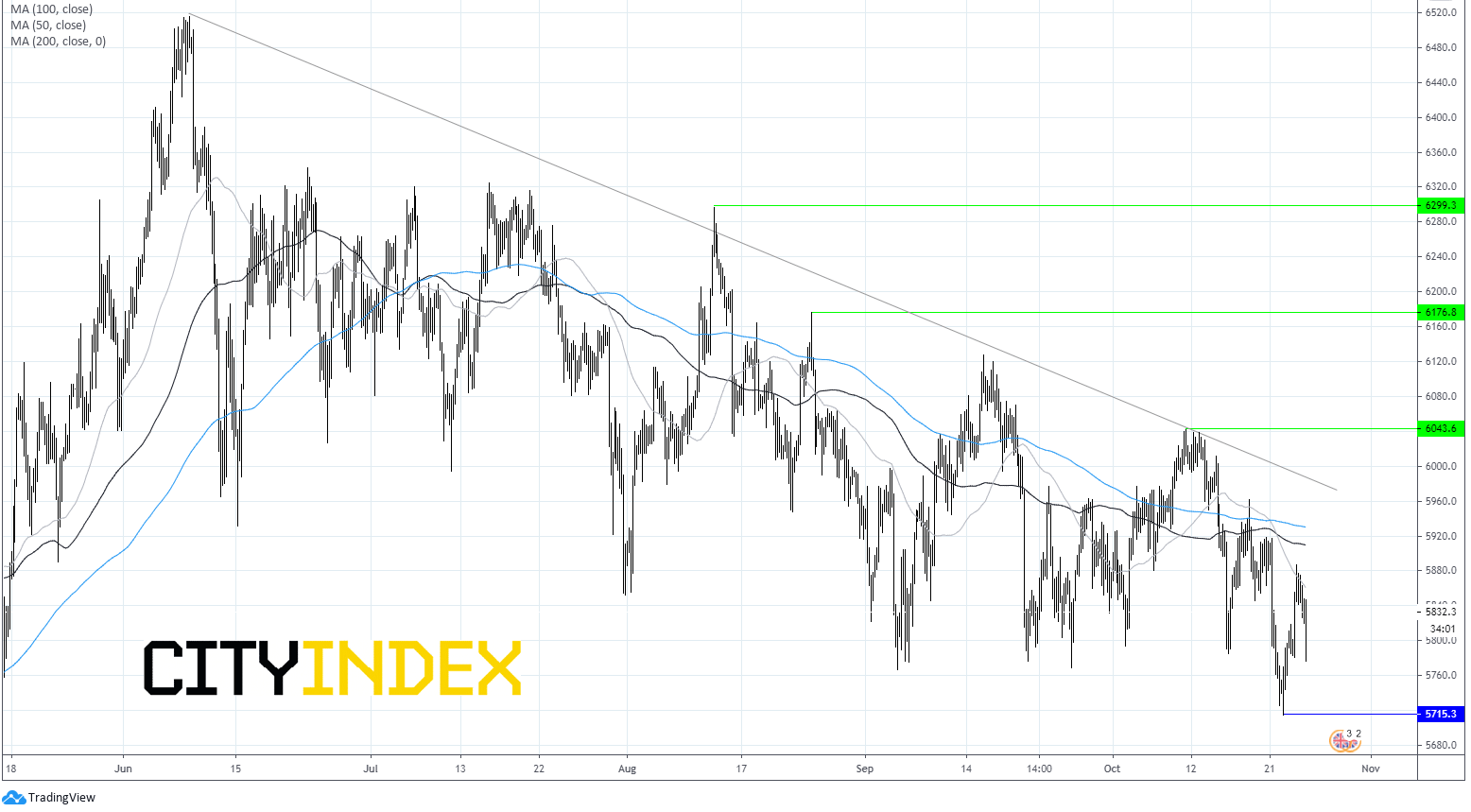

FTSE Chart

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM