The FTSE is heading for a cautiously stronger start after upbeat UK retail sales but tumbling consumer confidence data and stronger than forecast results from Barclays which bode well for the sector as a whole.

US Debate & Stimulus still slow coming

Overnight President Trump & Joe Biden faced each other in the final live Presidential election debate. A more civilised affair than the first, with policy even being touched on but caused little market reaction. With less than 2 weeks to go until election day, investors are now starting to show caution, with narrow ranges traded in Wall Street and across Asia.

Developments surrounding a US stimulus package are slow, although House Speaker Nancy Pelosi confirmed that talks have progressed, and a deal could be agreed pretty soon. These are rather vague comments but enough to keep the market content for now.

Overnight President Trump & Joe Biden faced each other in the final live Presidential election debate. A more civilised affair than the first, with policy even being touched on but caused little market reaction. With less than 2 weeks to go until election day, investors are now starting to show caution, with narrow ranges traded in Wall Street and across Asia.

Developments surrounding a US stimulus package are slow, although House Speaker Nancy Pelosi confirmed that talks have progressed, and a deal could be agreed pretty soon. These are rather vague comments but enough to keep the market content for now.

UK retail sales beat but consumer confidence tumbles

UK retail sales showed that Brits continued to spend with retail sales beating forecasts for a fifth consecutive month. Retail sales ex fuel jumped +1.6% in September versus expectations of 0.6%. The annual sales rate is now above their level before the pandemic.

However, sales could start to slow going forward after consumer confidence has fallen sharply. According to the GFK consumer confidence index, morale fell this month by -6 points, the most since the start of the 25 point decline at the start of the pandemic. Rising covid cases and tightening lockdown restrictions are reviving fears over personal economic situations and the broader health of the economy. The data was collected even before Manchester moved into Tier 3 so the current figure is actually likely to be even worse. This doesn’t bode well for the outlook.

UK retail sales showed that Brits continued to spend with retail sales beating forecasts for a fifth consecutive month. Retail sales ex fuel jumped +1.6% in September versus expectations of 0.6%. The annual sales rate is now above their level before the pandemic.

However, sales could start to slow going forward after consumer confidence has fallen sharply. According to the GFK consumer confidence index, morale fell this month by -6 points, the most since the start of the 25 point decline at the start of the pandemic. Rising covid cases and tightening lockdown restrictions are reviving fears over personal economic situations and the broader health of the economy. The data was collected even before Manchester moved into Tier 3 so the current figure is actually likely to be even worse. This doesn’t bode well for the outlook.

PMI’s in focus

Sticking with the economic calendar, PMI data from both the UK and the Eurozone will be in focus. UK PMI’s are expected to show that activity in both the service sector and manufacturing sector remain in expansion territory but are growing at a slower pace.

In Europe, which saw the resurgence of co vid slightly earlier than the UK, the service sector looks set to contract at a faster rate in October as tighter lockdown restrictions and people opting to say away continue to damage the service sector.

Sticking with the economic calendar, PMI data from both the UK and the Eurozone will be in focus. UK PMI’s are expected to show that activity in both the service sector and manufacturing sector remain in expansion territory but are growing at a slower pace.

In Europe, which saw the resurgence of co vid slightly earlier than the UK, the service sector looks set to contract at a faster rate in October as tighter lockdown restrictions and people opting to say away continue to damage the service sector.

Barclays beats

Corporate updates have been coming through thick and fast. Barclays reported better than expected Q3 earnings as its consumer business moved back into profit and bad loan provisions eased compared to the massive impairment charges in the first half. Barclays set aside £600 million in bad loans, less than the £1 billion that the market had been eyeing. Barclays is the first of the big banks to report. The figures bode well for the likes of Lloyds, NatWest and HSBC next week.

Corporate updates have been coming through thick and fast. Barclays reported better than expected Q3 earnings as its consumer business moved back into profit and bad loan provisions eased compared to the massive impairment charges in the first half. Barclays set aside £600 million in bad loans, less than the £1 billion that the market had been eyeing. Barclays is the first of the big banks to report. The figures bode well for the likes of Lloyds, NatWest and HSBC next week.

IHG still in crisis

Whilst the banks are starting to show signs of turning a corner, the travel and tourism industry is still in the depths of crisis. InterContinental Hotels reported a plunge in Q3 hotel room revenue which fell 53.4%. Whilst performance had improved slightly compared to the previous quarter, it was certainly nothing to sing home about.

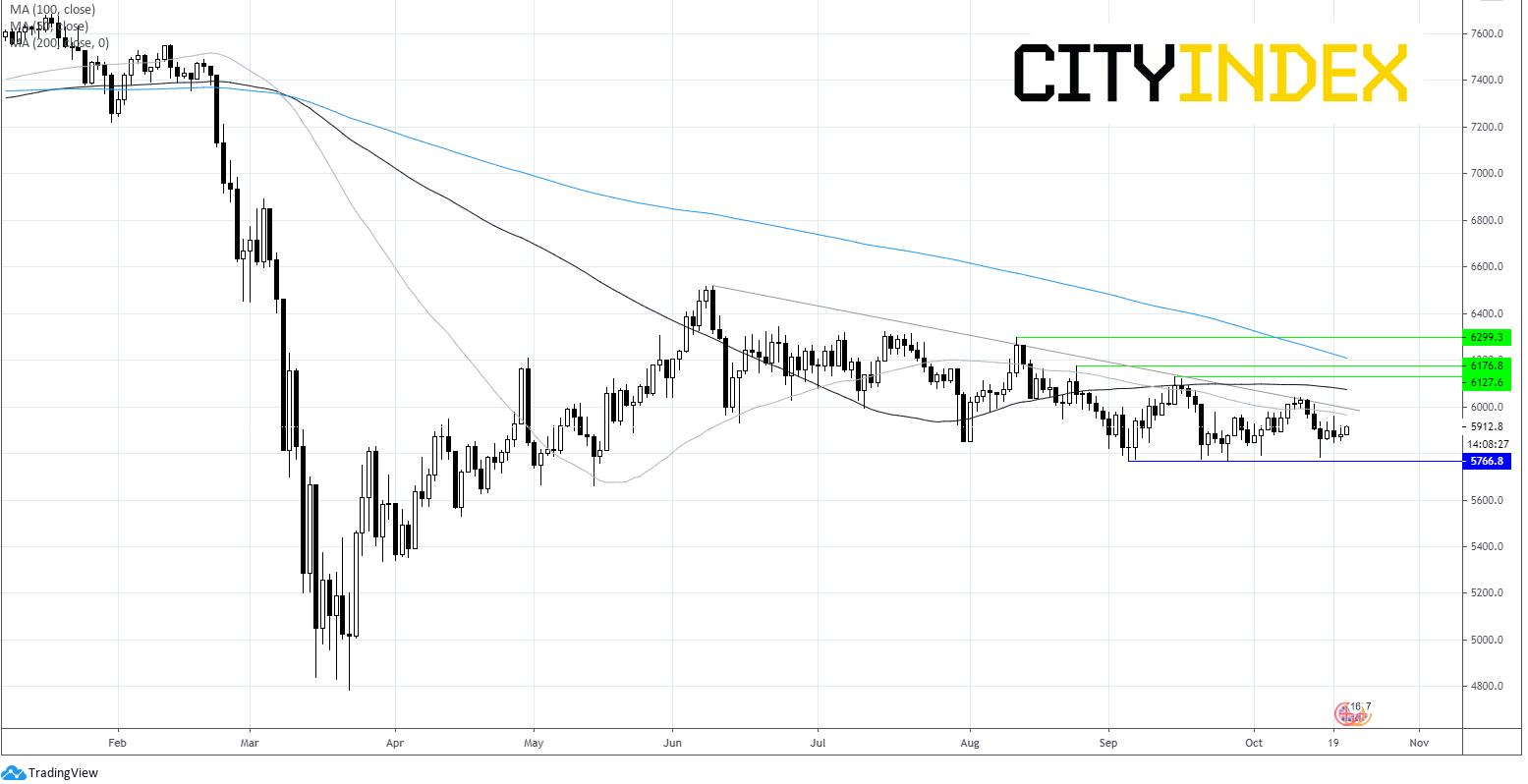

FTSE Chart

Latest market news

Yesterday 08:33 AM