Asian markets followed the US lower overnight amid an onslaught of dire corporate earnings and disappointing economic data. Today European stocks are clawing back losses despite there bring little to cheer out there at the moment.

The covid-19 figures coming out of Europe brought little comfort with France recording its worst daily death toll so far, whilst fatalities in Spain rose to the highest level in 6 days. In the UK coronvirus deaths remained below 800 for the fourth day at 761. The number of new cases dropped by 12%t to 4600 bringing some hope that the curve in Britain is flattening.

BRC Retail Sales Plunge -4.5%

Retailers are lagging this morning after the British Retail Consortium laid bare the extent of the impact of the coronavirus lock down on the UK economy. Retail sales fell by 27% in the two weeks following the government-imposed lock down. Sales had jumped 12% in the three weeks prior as households stockpiled. The overall decline in retail sales for March was -4.5% the largest drop since record began in 1995.

Retailers are lagging this morning after the British Retail Consortium laid bare the extent of the impact of the coronavirus lock down on the UK economy. Retail sales fell by 27% in the two weeks following the government-imposed lock down. Sales had jumped 12% in the three weeks prior as households stockpiled. The overall decline in retail sales for March was -4.5% the largest drop since record began in 1995.

UK Lock down extension

Today the UK government is widely expected to extend the lock down by an additional three weeks. However, there is also growing pressure on the government to reveal its exit strategy as the size of the hit to the economy become apparent. This is particularly the case after the OBR warned that the UK could experience its deepest downturn 3 centuries.

Today the UK government is widely expected to extend the lock down by an additional three weeks. However, there is also growing pressure on the government to reveal its exit strategy as the size of the hit to the economy become apparent. This is particularly the case after the OBR warned that the UK could experience its deepest downturn 3 centuries.

US jobless claims in focus

Investor sentiment is likely to hinge on US initial jobless claims. Expectations are for 5.1 million more Americans to sign up for unemployment benefit. This would take the four-week total to over 21 million or 13% of the US workforce.

Investor sentiment is likely to hinge on US initial jobless claims. Expectations are for 5.1 million more Americans to sign up for unemployment benefit. This would take the four-week total to over 21 million or 13% of the US workforce.

Last week, traders were able to remain upbeat despite the eye wateringly awful figures. However, as the weak data starts to add up and traders are finding it increasingly difficult to remain upbeat.

News that the lock down is coming to an end will be the ultimate pick up for stocks. However, this needs to come hand in hand with evidence that a second wave of coronavirus infections isn’t around the corner. Trump said he will unveil the US exit strategy in the coming days. This, in addition to a UK exit plan could help put a floor under stocks

Levels to watch

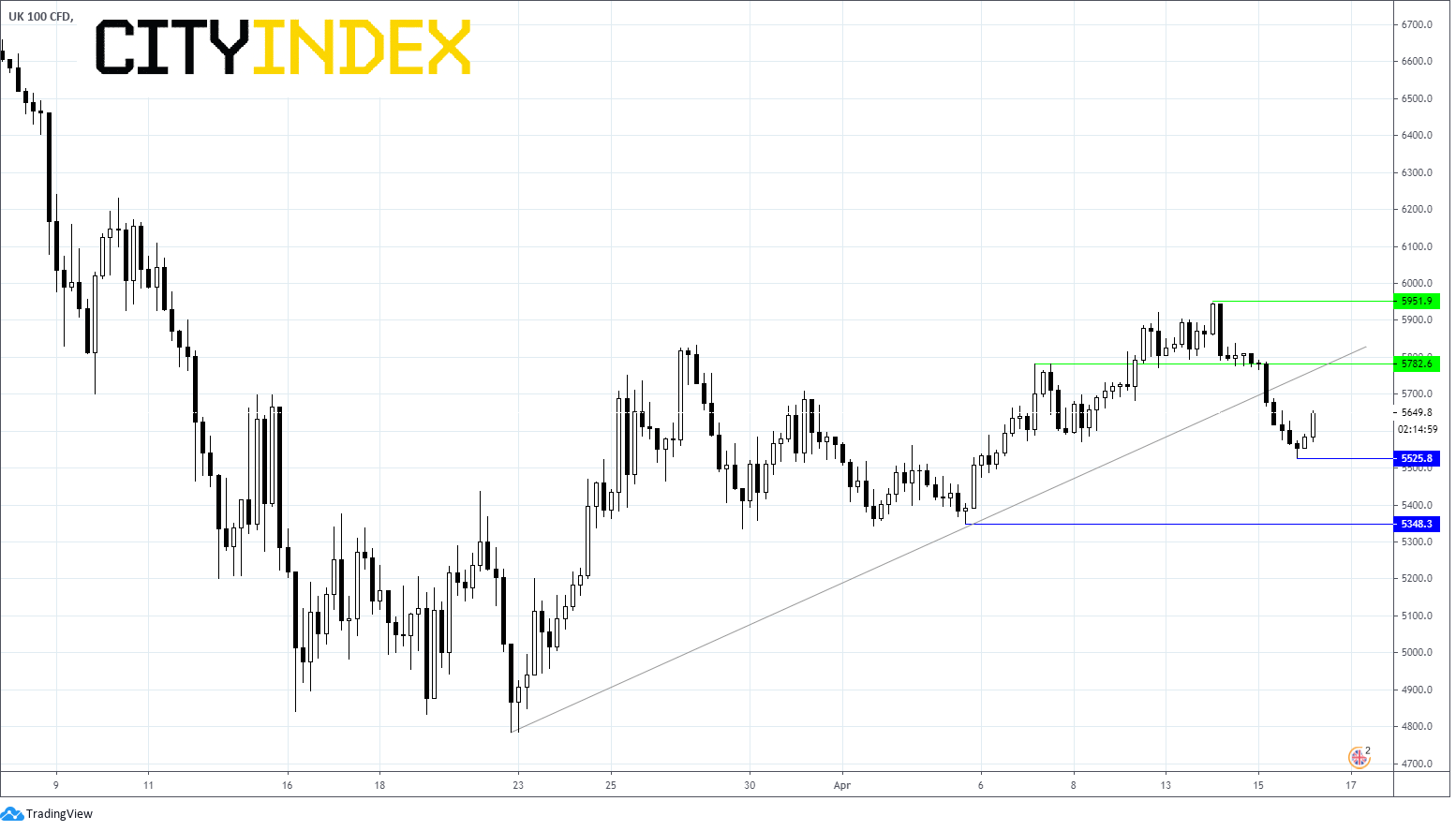

The FTSE slipped below trend line support in the previous session. Despite a 0.9% jump on today’s open the FTSE remains below this support. A move above this support at 5775 could see more bulls jump in.

A move over the trend line support could see the FTSE attack resistance at 5950 (high 14th April).

Immediate support can be seen at 5525 (overnight low futures) prior to 5350 (low 3rd April).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM