After a brief stint in the red the FTSE has powered higher on Monday as risk on dominated, as the prospect of economic stimulus for China lifted the FTSE at the start of the week.

Chinese GDP data showed that the economy grew by 6.2% its lowest level of growth in almost a decade. However, rather than depressing the market, hopes of stimulus for the world’s second largest economy have boosted risk appetite, lifting demand for riskier assets such as stocks. Just as we are seeing with the US, the prospect of easing financial conditions is not being interpreted as bad news for stocks. Instead the prospect of cheaper borrowing in the case of the Fed and support from the PBOC is giving investors plenty of confidence to buy in.

Miners gain

Miners are featuring on the FTSE leader board, with the likes of Antofagasta, Evraz and Anglo American all trading over 1.6% higher. The prospect of economic stimulus in China, the world’s largest consumer of metals is like Christmas come early for the miners.

House builders struggle on falling house prices

House builders dominated the lower reaches of the FTSE following Rightmove data showing that prices slipped by -0.2% year on year. Ongoing political and economic uncertainty means that potential homeowners are delaying the decision to buy a new property. With lingering Brexit uncertainty, the current political climate means that confidence, a crucial ingredient for a strong housing market, has been hit. As a result, both buyers and sellers are hesitating. The likes of Persimmon, Berkeley Group and Barratt Development traded over 1% lower.

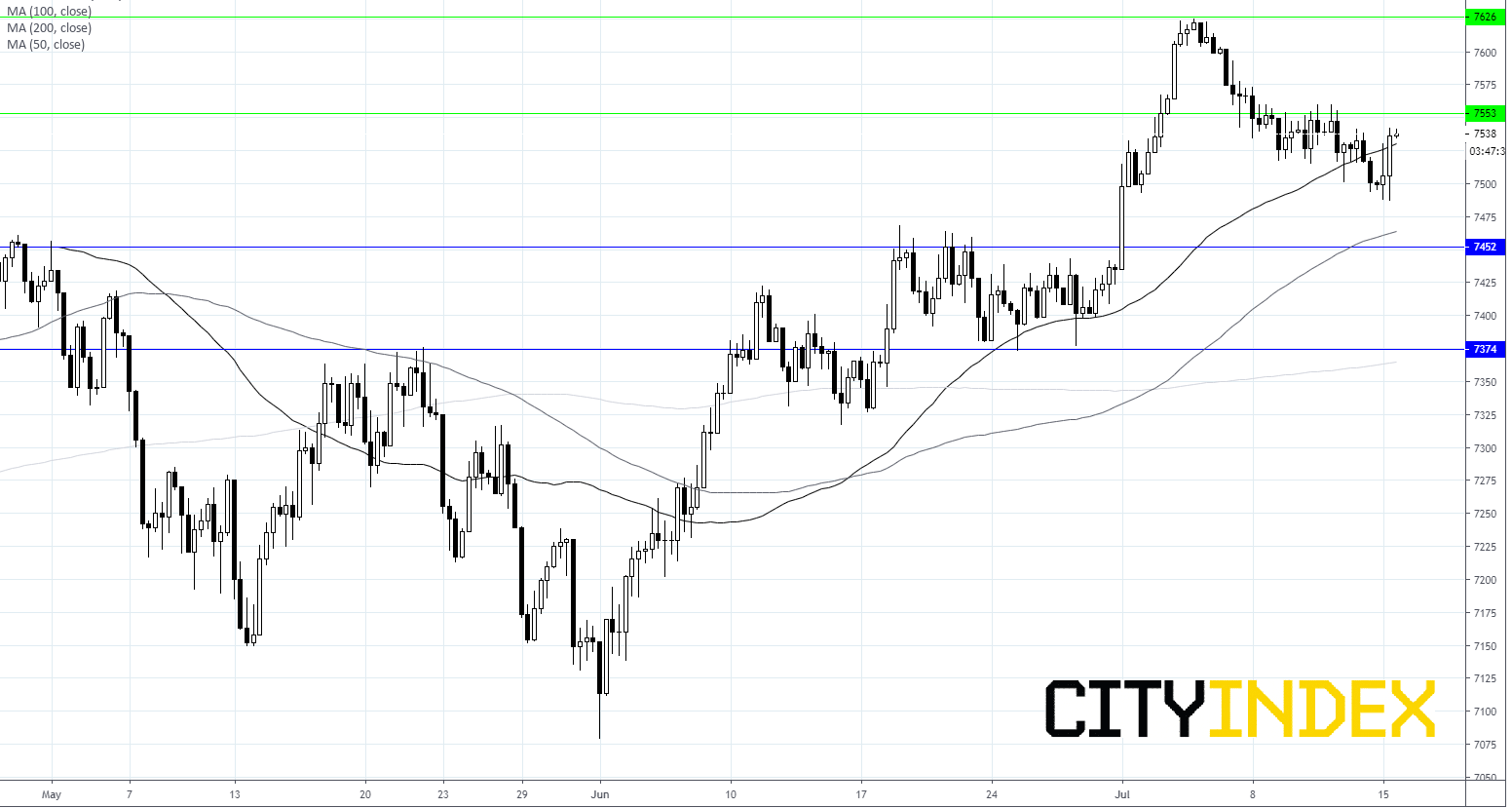

FTSE levels to watch:

The FTSE is trading 0.4% higher on the day, snapping a 7 session losing streak. FTSE bulls will be looking for a move above 7550 to confirm a break out, prior to resistance in the region of 7625. On the downside support can be seen in the region of 7450, prior to 7375.