European bourses are heading out of the blocks on the front foot despite a mixed session on Wall Street overnight. The markets remain very much stuck balancing vaccine optimism against near term economic fallout that covid and the lockdowns imposed to stem the spread of the virus are causing. Although better than forecast UK retail sales have given the FTSE a solid leg higher.

Retail sales surge

The FTSE is one of the better performers in Europe following significantly stronger than expected retail sales data. Retail sales +1.2% MoM in October well above the 0% increase expected. Retail has seen a remarkable recovery from the March / April collapse in sales. Even as parts of the UK economy saw lockdown restrictions tighten in October, consumption remained strong, an encouraging sign for retailers. Retail sales are now a solid 7.8% higher than a year earlier, whilst the UK economy still remains 8% below its pre-virus size.

The upbeat data has boosted retailers with the likes of JD Sport, Next and Burberry putting in solid performances.

However, with lockdown 2.0 upon us the question is whether retail sales can produce an equally impressive rebound after this lockdown? The fear is that this latest lockdown will amplify the growing gulf between online stores and bricks and mortar.

The FTSE is one of the better performers in Europe following significantly stronger than expected retail sales data. Retail sales +1.2% MoM in October well above the 0% increase expected. Retail has seen a remarkable recovery from the March / April collapse in sales. Even as parts of the UK economy saw lockdown restrictions tighten in October, consumption remained strong, an encouraging sign for retailers. Retail sales are now a solid 7.8% higher than a year earlier, whilst the UK economy still remains 8% below its pre-virus size.

The upbeat data has boosted retailers with the likes of JD Sport, Next and Burberry putting in solid performances.

However, with lockdown 2.0 upon us the question is whether retail sales can produce an equally impressive rebound after this lockdown? The fear is that this latest lockdown will amplify the growing gulf between online stores and bricks and mortar.

Sage dives 10% on margin concerns

Sage is a notable decliner despite lifting its dividend after reporting an 8.5% rise in recurring revenue to £1.6 billion, thanks to a boom in subscriptions growth of 20.5%. However, 2021 recurring revenue forecast is lower at 2% -5% and concerns over declining profit margins, a trend which is set to continue unnerved investors. The stock dived 10% in early trade.

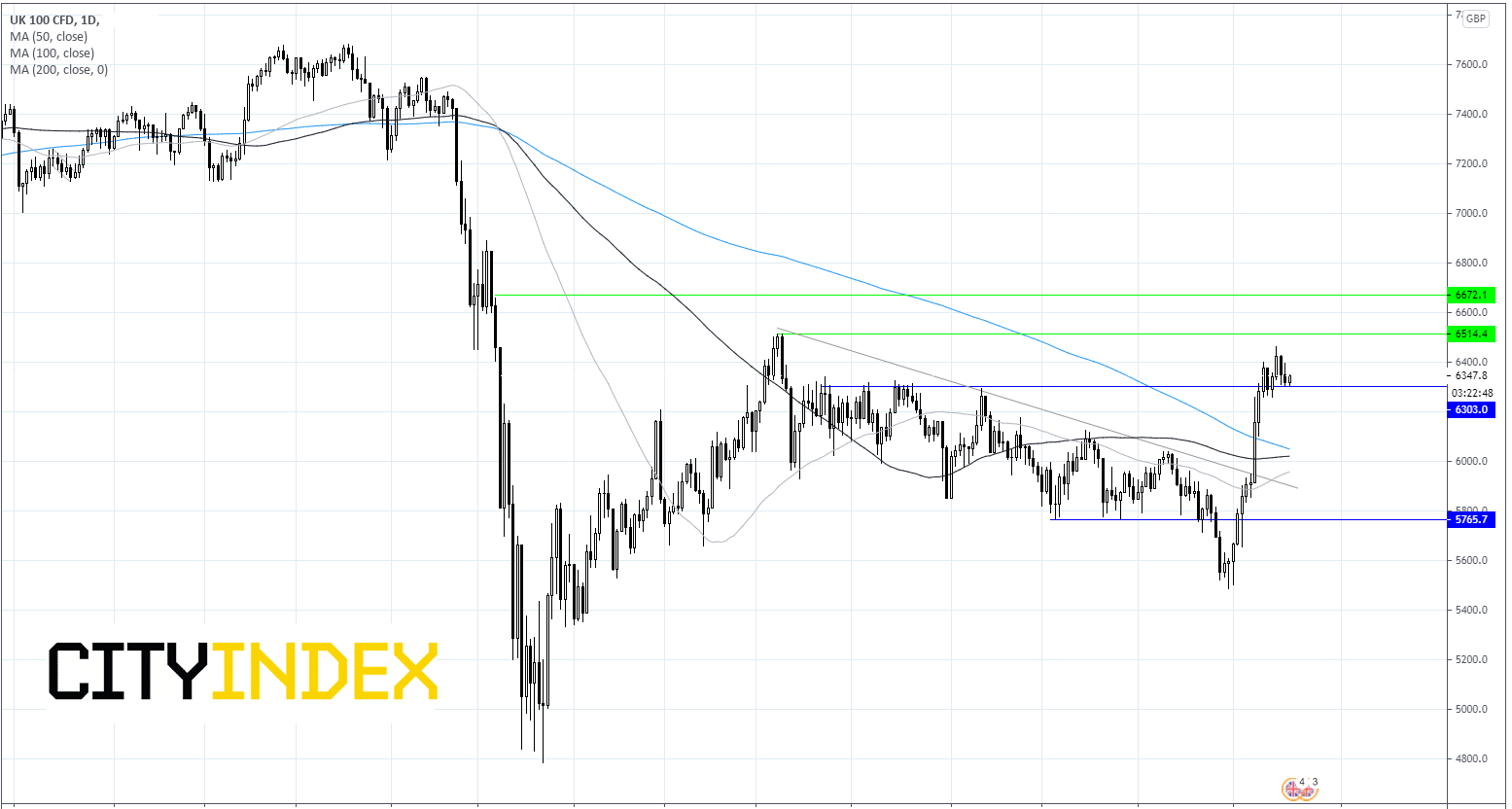

FTSE Chart

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM