The FTSE looking to claw back a few points on the open after experiencing its worst sell of since June in the previous session, amid a selloff in two separate sectors.

Firstly, the banks got hammered in response to yet another banking scandal involving suspicious transactions. Secondly fears of second lockdown saw retails, hospitality and travel and leisure stocks hit as another lockdown could derail the fragile recovery in these sectors, potentially marking the final blow to many companies. As fears over a second wave become reality, the UK is bracing itself for another round of tightening lockdown measures in an attempt to stem the spread of the virus. After government attempts to boost the UK economy over the summer months, Autumn is shaping up to be a time when the brakes will need to be applied again.

Yesterday’s comments by Britain’s chief medical advisor that the UK could be seeing 50,000 new daily cases and 200 deaths a day in a matter of weeks sent a chill down the spine of the market. Today Boris Johnson will head up a COBRA meeting before addressing the nation later this evening where is is expected to outline the extent o the new restrictions. He is widely expected to announce a curfew for pubs, bars, restaurants and hospitality venues of 10pm.

Covid trade returns

Yesterday we saw the return of the covid trade, the steep selloff travels stocks and hospitality tocks in the face of tougher restrictions for longer. We expect these sectors to remain under pressure whilst Britain moves through the more dangerous Autumn and Winter periods.

Yesterday we saw the return of the covid trade, the steep selloff travels stocks and hospitality tocks in the face of tougher restrictions for longer. We expect these sectors to remain under pressure whilst Britain moves through the more dangerous Autumn and Winter periods.

US closes off lows

The US also saw a steep sell off overnight. However, managed to close well above session lows thanks to a rebound in tech stocks. The Nasdaq even managed a close in positive territory, however Asia stuck to the negative tone with travel and tourism particularly under pressure. Still European futures are heading for a slightly positive start.

The US also saw a steep sell off overnight. However, managed to close well above session lows thanks to a rebound in tech stocks. The Nasdaq even managed a close in positive territory, however Asia stuck to the negative tone with travel and tourism particularly under pressure. Still European futures are heading for a slightly positive start.

Pound looks to BoE’s Andrew Bailey

The Pound came under pressure in the previous session as investors weighed up the economic impact of the risks to the UK economy. Tighter restrictions and potential negative rates leave little for the Pound to cheer. Whilst Boris Johnson’s speech could impact sterling, an appearance by BoE’s Governor Andrew Baily could direct the Pound in the near term. Andrew Bailey could use this as a chance to clarify the central bank’s thinking over negative rates following an admission last week that the BoE is heading in that direction.

The Pound came under pressure in the previous session as investors weighed up the economic impact of the risks to the UK economy. Tighter restrictions and potential negative rates leave little for the Pound to cheer. Whilst Boris Johnson’s speech could impact sterling, an appearance by BoE’s Governor Andrew Baily could direct the Pound in the near term. Andrew Bailey could use this as a chance to clarify the central bank’s thinking over negative rates following an admission last week that the BoE is heading in that direction.

Powell & Mnuchin promoting stimulus?

In the US session attention will be firmly on Fed Reserve Chair Jerome Powell & Treasury Secretary Steve Mnuchin as they appear before the Hose and Senate. Both players are expected to press Congress for additional fiscal stimulus, after the Republicans and Democrats have failed to agree to additional stimulus since the expiry of the $600 unemployment benefit top up in July.

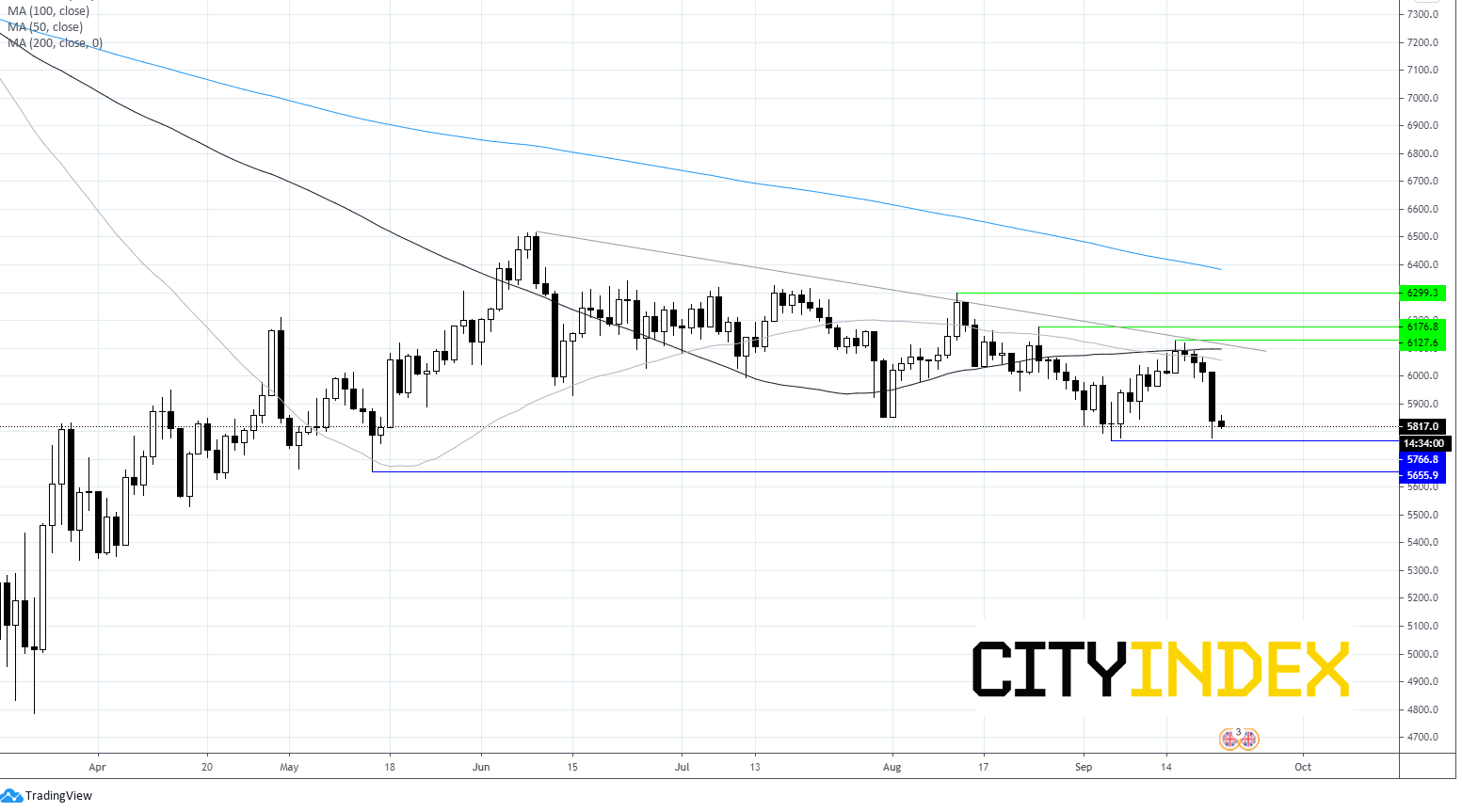

FTSE Chart

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM