The FTSE is seen opening on higher ground, outperforming its European peers whilst the Pound was holding 1.3450 as Brexit remained in focus. Headlines continue to be mixed, with the latest suggesting that today’s soft deadline will be passed. Even so, with the Pound at 12-month highs investors remain optimistic that a deal will be achieved.

Oil majors will be in focus as oil prices are rising after OPEC+ group agreed to a smaller than feared cut to output come January. The agreed cut of 500,000 barrels per day will put production cuts at 7.2 million bdp, down from the current 7.7 million. The group failed to agree on policy strategy beyond that. At the time of writing Brent trades up 2% at an 8 month high of $45.

US non-farm payrolls

Looking ahead US non-farm payroll will be in focus. Expectations are for a more modest gain in non farm payrolls in November following on from a sharp increase in jobs added in November.

500,000 new jobs are expected to have been created in November after 638,000 in the previous month. The unemployment rate is expected to edge down to 6.8% from 6.9%.

Leading indicators this month have been disappointing, with the ADP payroll coming in steeply lower and ISM manufacturing PMI Employment subcomponent also weakening, although the ISM services PMI employment component edged higher.

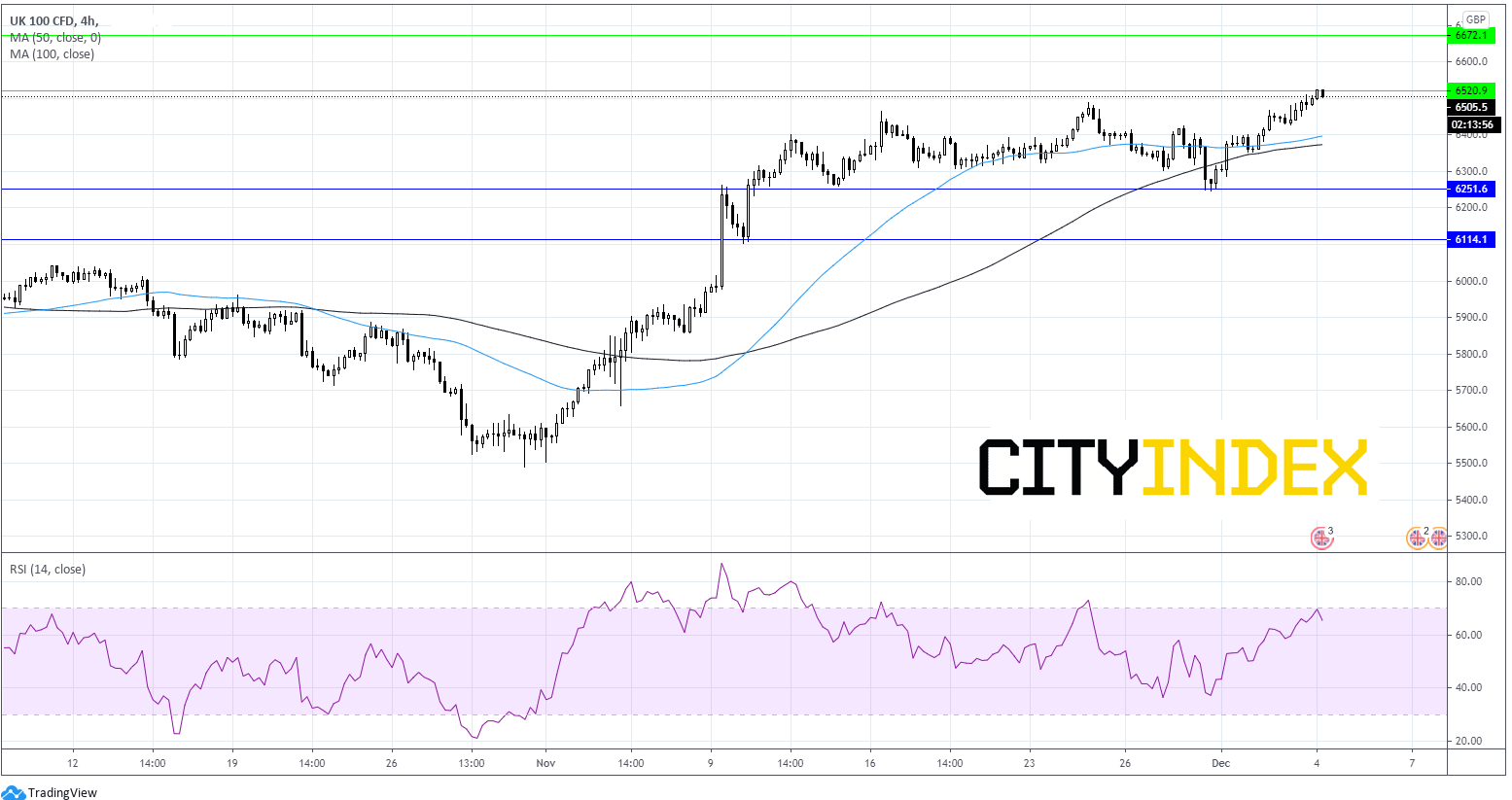

FTSE Chart

The FTSE is extending gains at a 9 month high of 6525, testing the upper band of the channel that it has traded in across November. A break through here could open the door to resistance at 6670. On the flip side, failure to break resistance could see the price head back towards 6400 50 & 100 sma on 4 hour chart.