Traders have been fretting over Coronavirus statistics and the impact that it is expected to have on Chinese economic growth. These fears saw equity indices across the globe slump last week. The latest developments, however, are providing the markets with a level of assurance that the situation is getting under control, boosting risk sentiment.

Whilst the FTSE was up over 1% on Coronavirus hopes, at one point, the UK index has since pared some gains, despite the pound also giving up an early rally.

FSTE lags peers on stronger pound

Sterling pushed comfortably back over the key $1.30 psychological level following upbeat service sector pmi figures. Activity in the UK’s dominant sector measured 53.9, well up from the 52.9 forecast and the strongest reading since September 2018. This makes it a hat trick of stronger than forecast pmi data, proving that the U.K. experienced a bounce in business and consumer confidence following the decisive Conservative win in the December elections.

However, by the afternoon, dollar gains dragged sterling lower. This was more of a dollar strength story rather than owing to a fundamentally weaker pound. However, unusually, the effects of a more beneficial exchange rate didn’t result in an extra boost for the FTSE.

Levels to watch

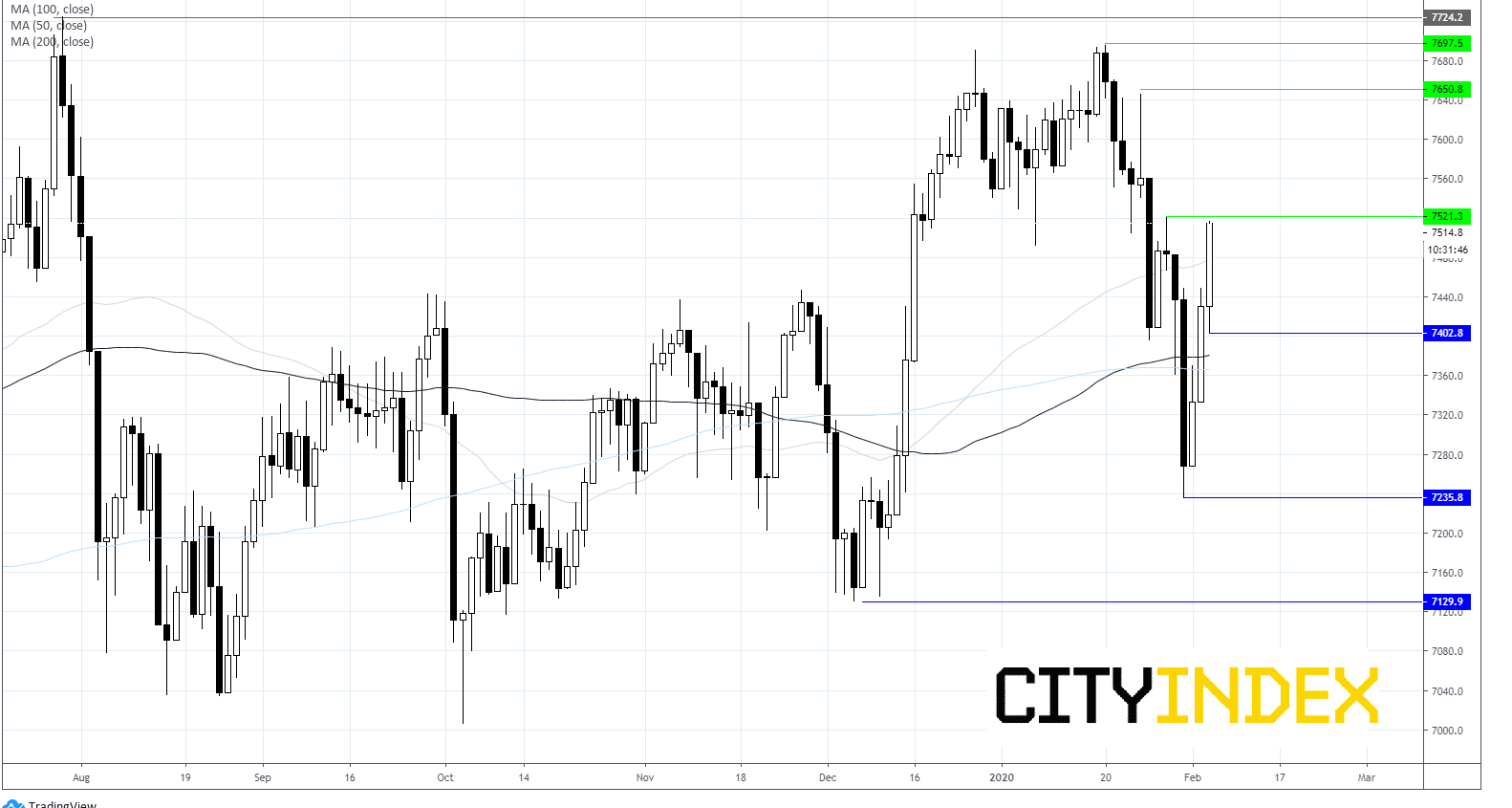

The FTSE is trading 0.6% higher, having pared some earlier gains. The index pushed above its 100 sma in the previous session and briefly breached its 50 sma today at 7474. A close above the 50 sma could indicate that the bulls are back in control.

Immediate resistance can be seen at 7474 (50 sma) 7503, the daily high, followed by 7632 (high 24th Jan)

On the downside support can be seen at 7386 today’s low, prior to 7377 its 100 sma and 7297 (yesterday’s low).

Despite a brief dip lower on the open the FTSE, along with other European bourses bounded higher following unconfirmed reports of a breakthrough in the development of a Coronavirus vaccine breakthrough. Additionally, China TV reported that a research team from Zhejiang University has found a drug that is effectively treating people infected with the virus. Whilst unconfirmed, these reports have gone some way to improving sentiment surrounding the spread of the deadly virus.

Traders have been fretting over Coronavirus statistics and the impact that it is expected to have on Chinese economic growth. These fears saw equity indices across the globe slump last week. The latest developments, however, are providing the markets with a level of assurance that the situation is getting under control, boosting risk sentiment.

Whilst the FTSE was up over 1% on Coronavirus hopes, at one point, the UK index has since pared some gains, despite the pound also giving up an early rally.

FSTE lags peers on stronger pound

Sterling pushed comfortably back over the key $1.30 psychological level following upbeat service sector pmi figures. Activity in the UK’s dominant sector measured 53.9, well up from the 52.9 forecast and the strongest reading since September 2018. This makes it a hat trick of stronger than forecast pmi data, proving that the U.K. experienced a bounce in business and consumer confidence following the decisive Conservative win in the December elections.

However, by the afternoon, dollar gains dragged sterling lower. This was more of a dollar strength story rather than owing to a fundamentally weaker pound. However, unusually, the effects of a more beneficial exchange rate didn’t result in an extra boost for the FTSE.

Levels to watch

The FTSE is trading 0.6% higher, having pared some earlier gains. The index pushed above its 100 sma in the previous session and briefly breached its 50 sma today at 7474. A close above the 50 sma could indicate that the bulls are back in control.

Immediate resistance can be seen at 7474 (50 sma) 7503, the daily high, followed by 7632 (high 24th Jan)

On the downside support can be seen at 7386 today’s low, prior to 7377 its 100 sma and 7297 (yesterday’s low).

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM