1. ECB’s Olli Rehn pointed towards more "impactful" monetary policy measures.

2. China unveiled plans to cut corporate borrowing costs.

3. Several central banks have cut interest rates

4. Eyes are turning towards the Fed Jerome Powell’s speech at the annual central bankers meeting at Jackson Hole, Wyoming on Friday.

The next move by the market depends on whether Jerome Powell will indicate another slashing of interest rates is on the cards, potentially for September. An indication that more stimulus is around the corner could see risk sentiment pick up further.

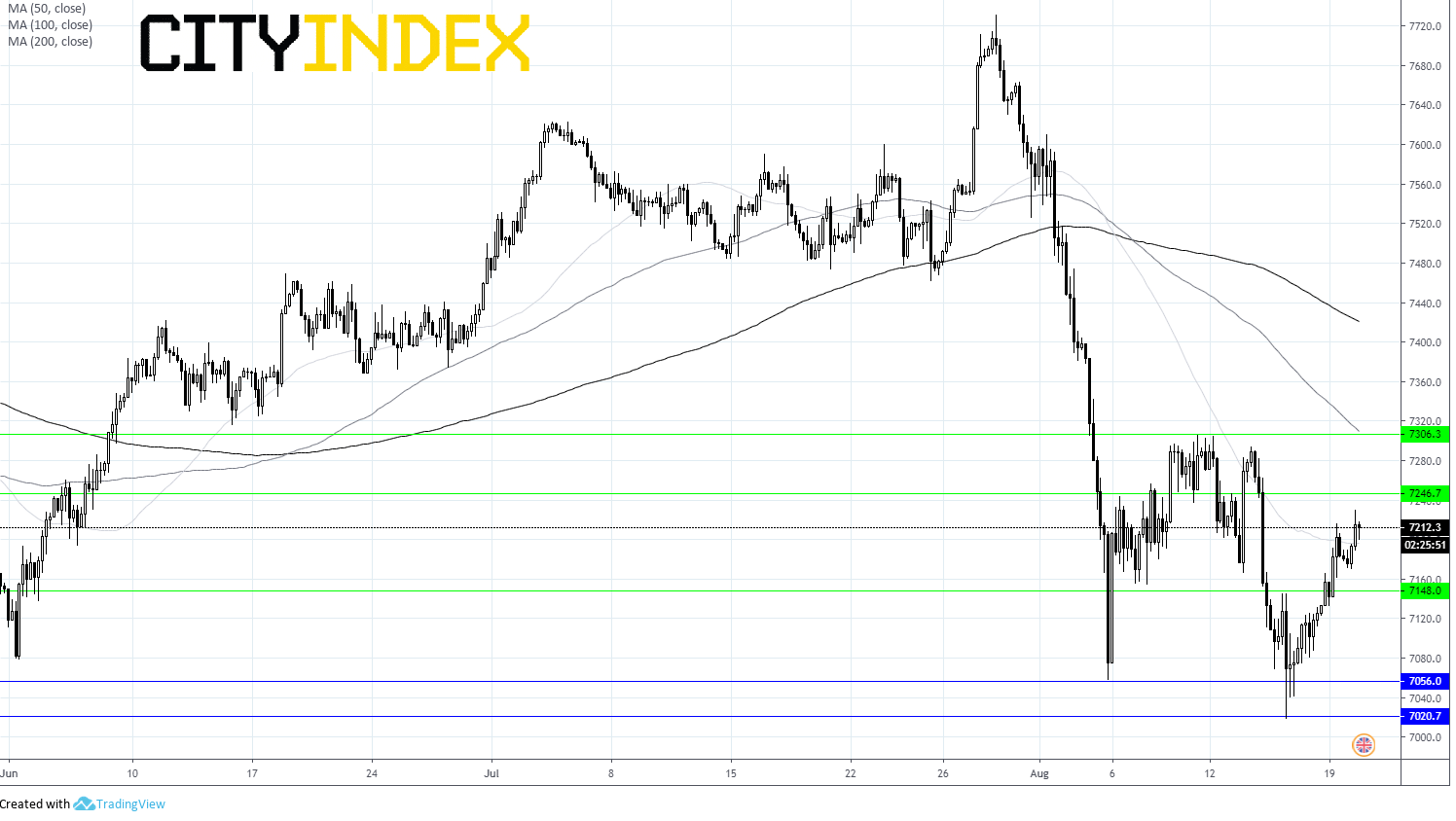

FTSE levels to watch:

The FTSE continues to rebound from last week’s 6 month low. Yesterday saw the FTSE rally 1%. Today the FTSE is picking up where it left off. A break through 7245 could open the door to 7305 We are looking for a break through resistance at 7305 to negate the current bearish outlook.