The latest data indicates that more patience is needed before we start seeing these figures decline in any meaningful and persistent way.

Boris Johnson remains in intensive care, although is stable and in good spirits. Foreign Secretary Dominic Raab who is leading the country in his absence indicated that any review on ending the current UK wide lock down will most likely be pushed back. A decision was due to be taken early next week on whether o extend the lock down. An extension almost goes without saying.

There are growing signs of the economic hit that is coming. British employers demand for staff plunged in March with job vacancies declining for the first time in 11 years as the pandemic has brought hiring activity to a halt.

Meanwhile online fashion retailer also provided some insight as to the disruption that the sector is seeing amid on the ongoing lockdown. The online retailer warned that sales have dropped 20-25% in the last three weeks of trading. Bricks and mortar retailers will experience and even bigger hit; a potentially fatal blow for many that were already teetering on the edge.

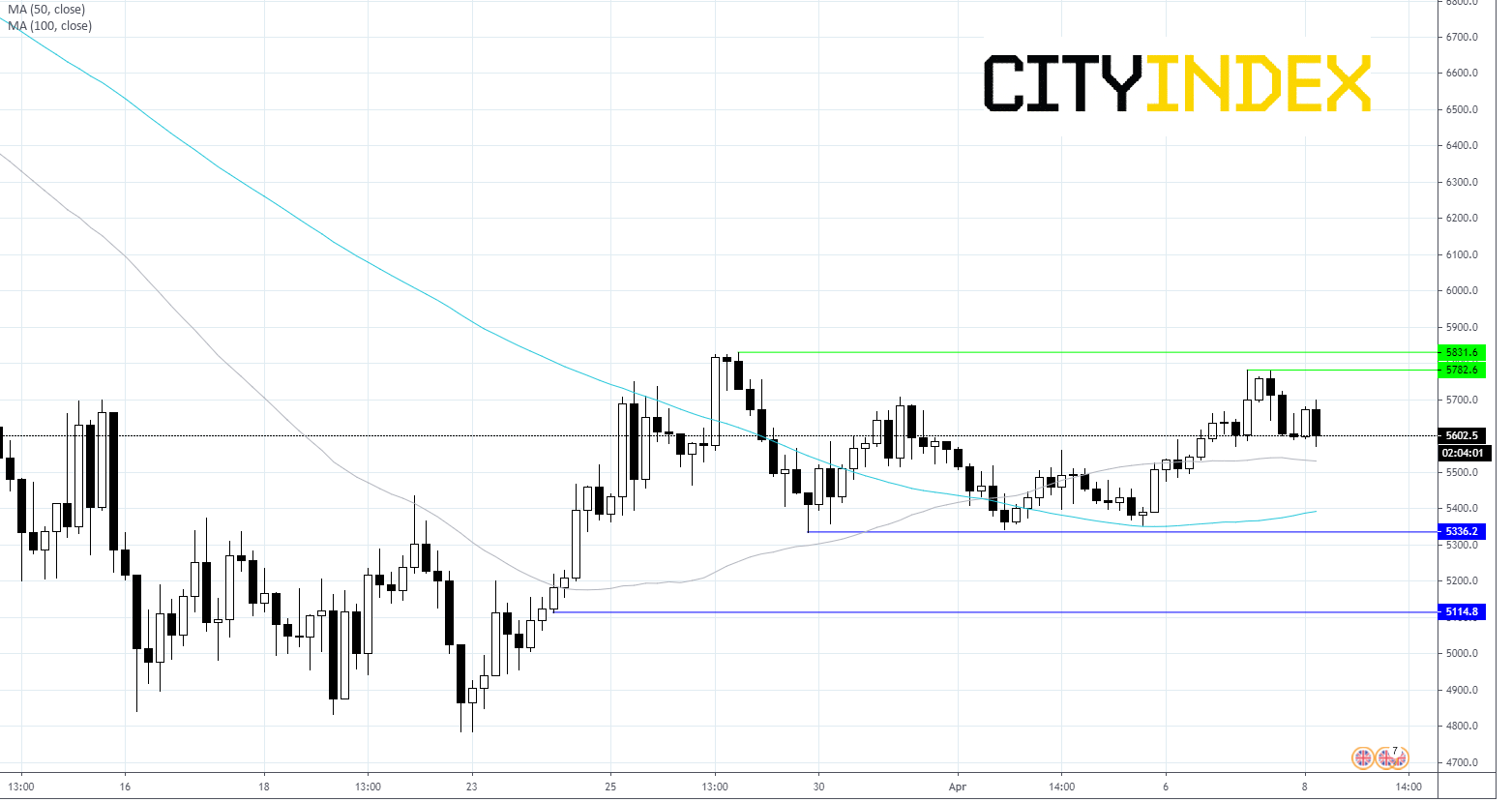

FTSE Levels to watch

After rallying over 5% across the past 2 sessions, the FTSE is trading on the back foot, down 1.2% on the open. The FTSE remains above its 50 & 100 sma on 4 hour chart but within the horizontal channel that it has been in since around 25th March.

Immediate support can be seen at 5530 (50 sma) and 5400 (100 sma) prior to 5340 (lower support horizontal channel)

Resistance can be seen at 5780 (high 7th April) prior to 5831 (upper bound horizontal channel) a break above here could see the FTSE break out.