Medium-term technical outlook on FTSE China A50

click to enlarge charts

Key Levels (1 to 3 months)

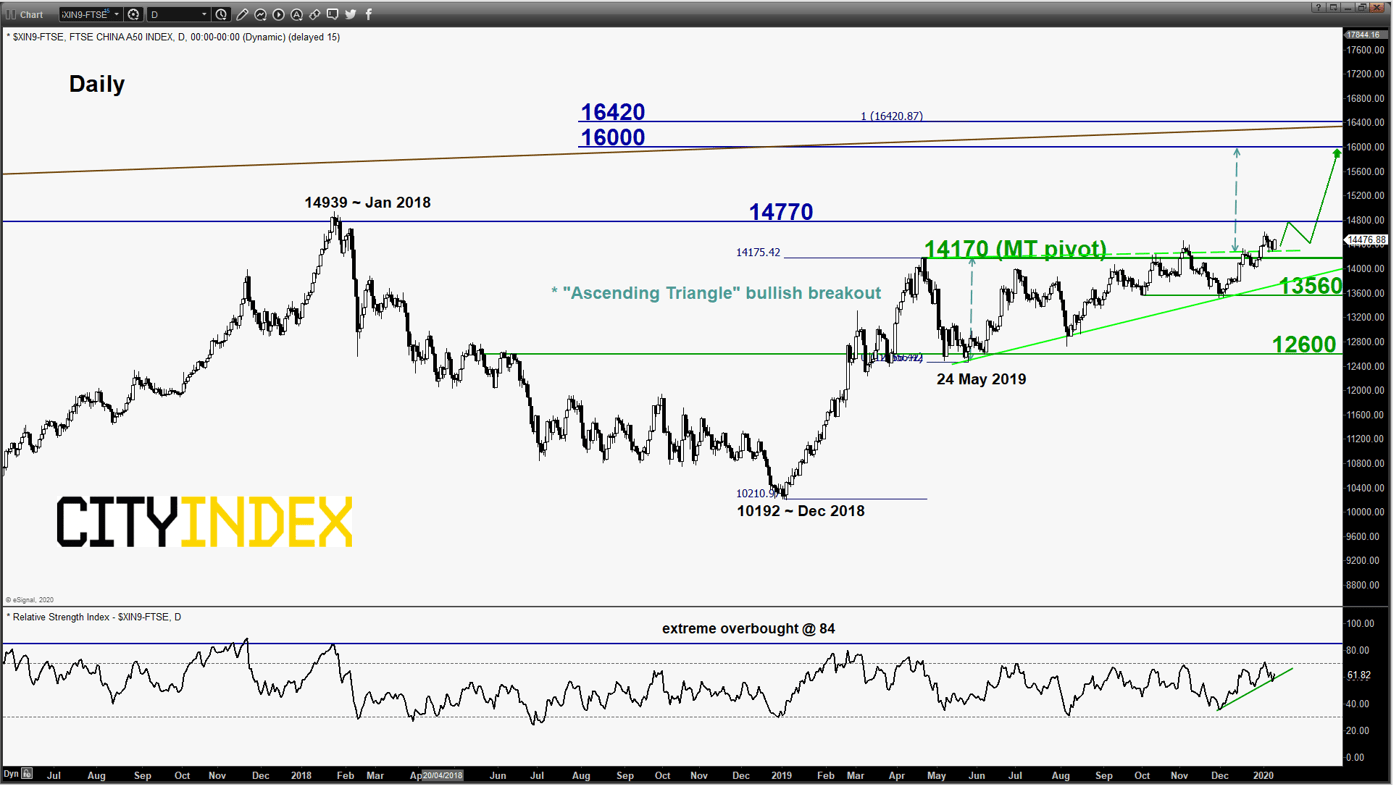

Pivot (key support): 14170

Resistances: 16000 & 16420

Next supports: 13560 & 12600

Directional Bias (1 to 3 months)

Bullish bias in any dips above 14170 key medium-term pivotal support for a further potential upleg up to test 14770 before targeting the next resistances at 16000 and 16420 next.

However, a break with a daily close below 14170 invalidates the recent bullish breakout for a slide back to retest the ascending trendline from 24 May 2019 acting as a support at 13560.

Key elements

- The FTSE China A50 has managed to stage a rebound of 1.19% today after a recent retest 3 days ago on the former range resistance of the 7-month “Ascending Triangle” range configuration from 24 May 2019 low. This observation suggests a positive follow-through that indicates a potential fresh round of bullish participation after the earlier bullish breakout from the “Ascending Triangle” range on 30 Dec 2019.

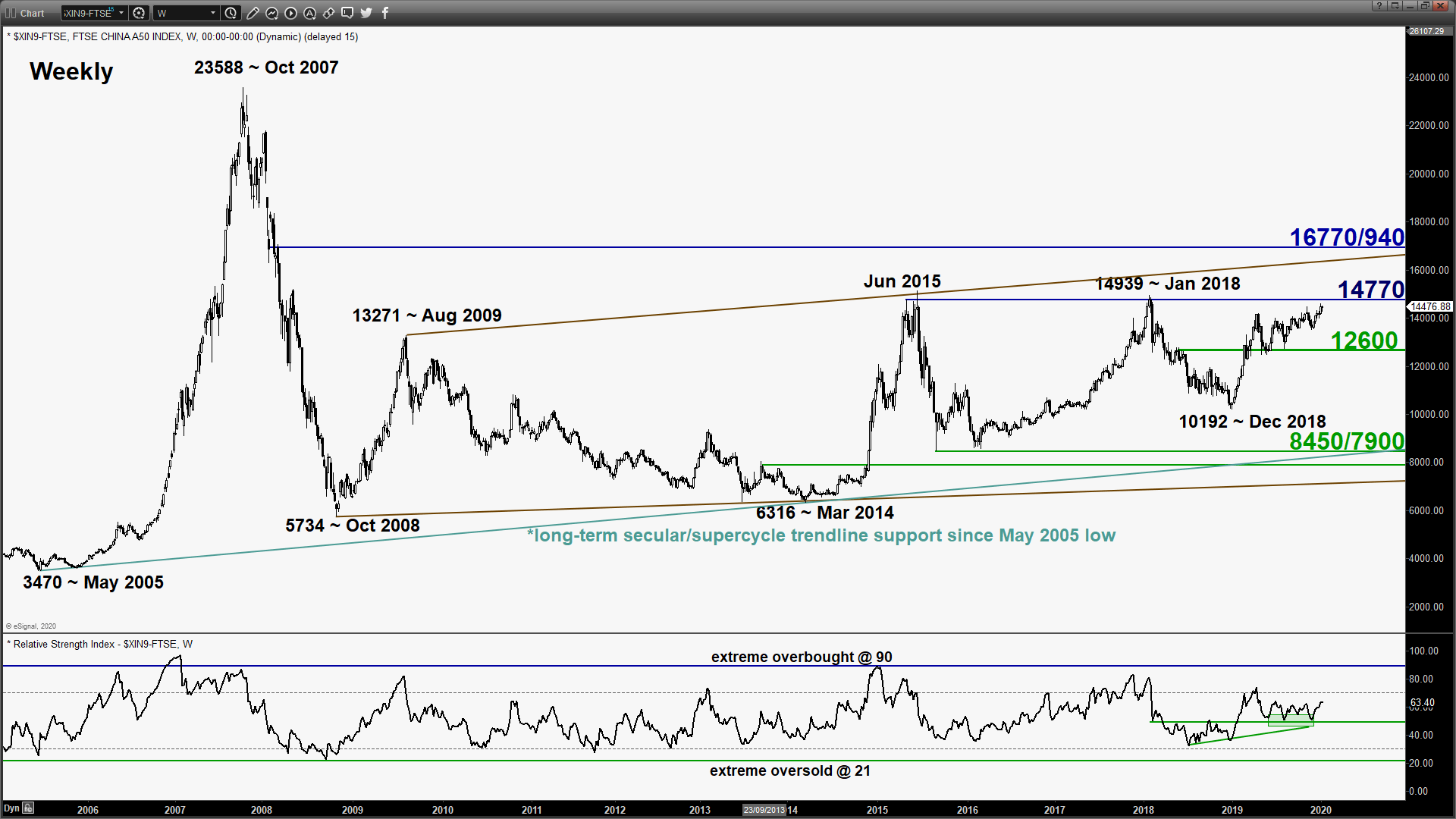

- Long and medium-term upside momentum of price action remains intact as indicated by both the weekly and RSI oscillators that has continued to inch higher from their respective corresponding supports and have not reached extreme overbought conditions.

- The significant medium-term resistances of 16000 and 16420 are defined by the 1.00 Fibonacci projection of the up move from 04 Jan 2019 low to 19 Apr 2019 high projected from 24 May 2019 low and the exit breakout potential from the “Ascending Triangle” range.

Charts are from eSignal

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM