FTSE bounces after pullback

The FTSE 100 Index (daily chart) pulled back below the key 6650 support this past Friday before starting the new week with a bounce. From […]

The FTSE 100 Index (daily chart) pulled back below the key 6650 support this past Friday before starting the new week with a bounce. From […]

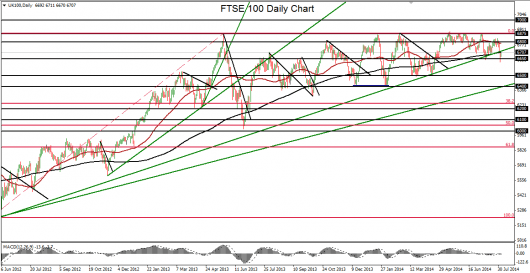

The FTSE 100 Index (daily chart) pulled back below the key 6650 support this past Friday before starting the new week with a bounce.

From a three-week high of 6835 early last week, the UK equity index dropped sharply for three consecutive days late last week to hit a three-month low of 6622 on Friday. This low was just slightly under the previous low established in early July around the 6641 level.

Prior to these two recent drops below the 6650 support level, the FTSE had been pushing up against a key resistance zone around the 6875-6885 area, struggling to break out to new long-term highs but without success.

Last week’s pullback below 6650 was a minor respite from the strongly bullish price action that has pervaded most of the major global indices for the past several months. The FTSE, however, remains due for a larger pullback or correction that could bring the index down at least to a price target around the 6500 level, last hit in mid-April.

To the upside, any extension of the current bounce off support should meet key resitance around the 6800 level.