FTSE 8217 s break from the grind looks short lived

The UK’s top market saw some relief on Friday from a week frustration, though longer-term niggles remained.

The UK’s top market saw some relief on Friday from a week frustration, though longer-term niggles remained.

Having spent much of the week at the bottom of the index, Anglo, Antofagasta, Rio, Glencore and BHP rotated to the top on Friday, riding a wave of relief after No.1 steelmaker ArcelorMittal’s surprisingly firm fourth-quarter underlying profits. BHP’s declaration of force majeure (an unforeseen stoppage due to an accident, etc.) on copper shipments from the giant Escondida mine in Chile triggered a surge in the commodity, underpinning miners’ shares. Industrial action at Escondida, the biggest copper deposit in the world, has been key for London-listed miners this week. Signs that a strike was brewing eclipsed a solid set of earnings from Rio Tinto on Wednesday. The commodity-related news has a thread to another factor that’s lifting sentiment: China. Trade data for December confounded expectations. Timing was apparently fortuitous, though there are strong signs of seasonal effects. President Donald Trump has also in the last few days changed tack on China, now seeking a “constructive” relationship with the world’s biggest trading nation, instead of focusing on its supposed currency manipulation. Along with signs of what will be grown-up discussions on Friday with the prime minister of Japan, investors perceive a slight softening of the Presidency’s initial aggressive international outlook. Throw in something “phenomenal”, to quote the president again, this time referencing long-trailed corporate tax cuts, and you have one of the handful of gains above 0.5% by the Dow Jones Industrial Average and benchmark S&P 500 index, since mid-December, buttressing global shares too, including in London.

Investors have also had an eye on the ongoing quarterly earnings season among the biggest capitalised London shares. According to Thomson Reuters data, these are forecast to grow by 75% year-on-year, the highest forecast growth rate in Europe. Such a rise will go some way to removing wariness at some of the highest price/earnings ratios for decades—trailing at 26 times. Another root cause of long-standing angst is that a tailwind from sterling’s Brexit-tinged devaluation has turned out to be more complicated than it looked at first glance. Whilst still 15% worse off against the dollar, the key currency for the FTSE 100’s most heavily weighted stocks, the pound has, like Britain’s consistently confounding economic resilience, not tarried at its deepest multi-year lows for long. Investors’ waning interest in top-line benefits from a discounted pound was shown again on Friday. There was little FTSE 100 reaction to cable’s inability to hold on to a 56 pip spike from data showing the biggest annual rise in factory output for five years. With diminishing boosts from sterling, the lever for the FTSE’s latest all-time peaks in January, uncertainty over Trump’s fiscal renaissance will come into sharper focus. If it materialises, the president’s growth programme will drag the dollar and U.S. yields higher and perhaps the FTSE too. If it only half transpires, or worse, benefits for global indices will be weaker. Deleterious aspects of Trump’s vision—protectionism and anything else that brings global geopolitical anxiety—will also pull the FTSE in a downward direction. Meanwhile, the FTSE’s institutional investors, an increased majority of whom are now UK-based, continue to wonder when billions of pounds of flows that left the index after the Brexit vote may return. Net purchases of FTSE 100 shares by non-residents remain soft after average monthly inflows from overseas halved in August.

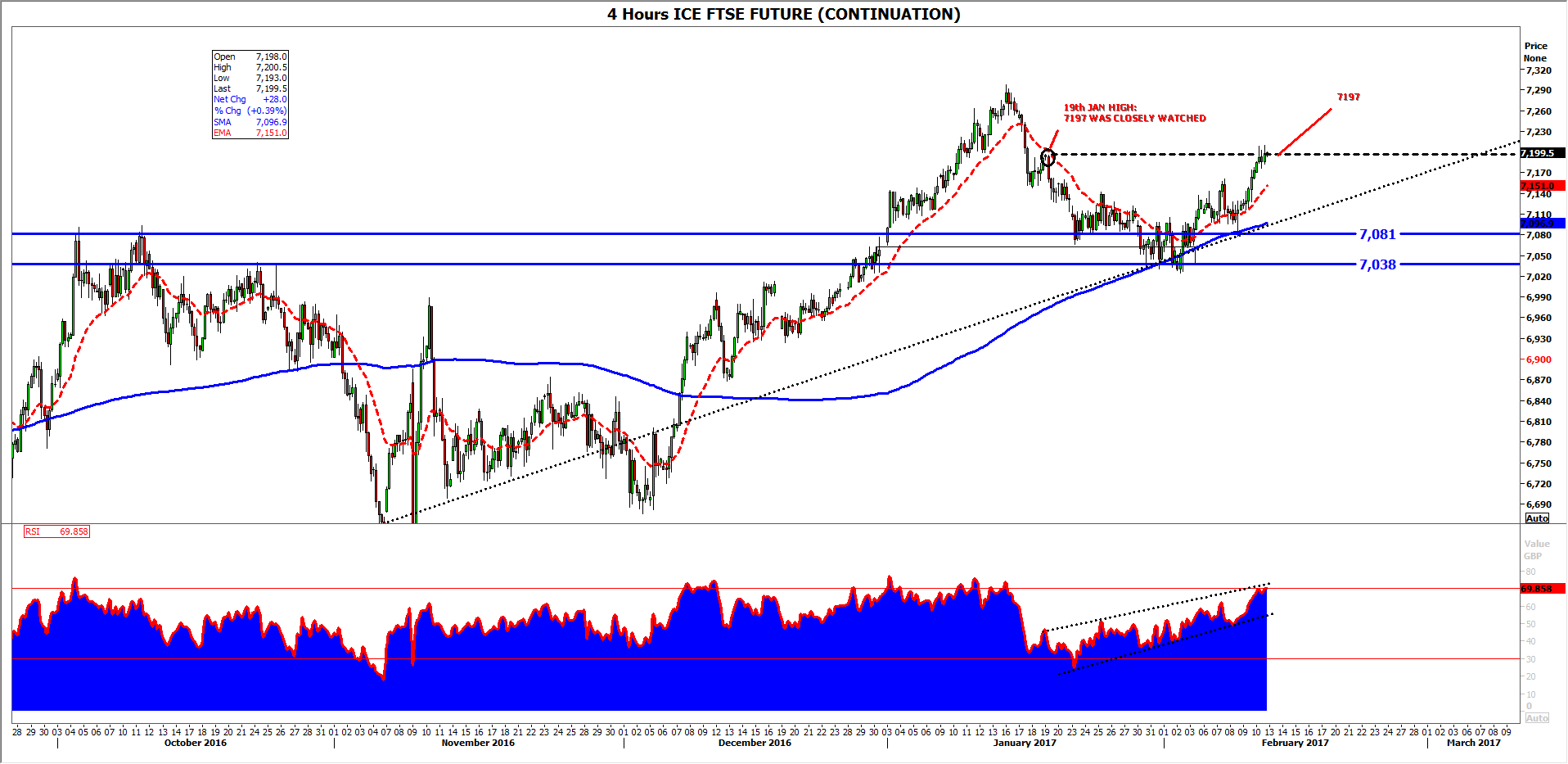

Technical chart dynamics in the FTSE’s most liquid derivative, ICE FTSE Futures, suggest the underlying gauge will continue to grind higher, so long as its clearest rising trend lines remain intact. The market looks set to continue a pattern of painstaking basing too though. On Friday the future contract tested liquidity corresponding to the high on 19th January. Judging by the speed and determination of the down draft that followed in January, large volume selling occurred around that high—7197. FTSE Future will make more work for itself if it fails to end Friday’s session above the marker, an event that will suggest persisting selling interest in the region.

Source: Thomson Reuters, City Index / please click image to enlarge

Source: Thomson Reuters, City Index / please click image to enlarge