In an otherwise lacklustre session, one of the main points of interest today has been the release of weaker than expected Australian construction work data for Q2. Thereby, providing another reminder that growth in the Australian economy remains subdued and a warning ahead of next week’s Q2 GDP print.

Specifically, the details of today’s data showed construction work fell by -3.8% in Q2, following a -2.2% fall in Q1. Year on year construction is now down -11.1%. Residential construction fell -5.1%, driven by falls in both apartments and detached, while non-residential fell -7.3%. Based on the sharp decline in building approvals in 2019 and the lags that occur in the construction cycle, another fall in residential construction is likely in Q3.

Ongoing weakness in construction activity remains a key risk to the activity and the employment outlook. It is also a primary reason why the domestic interest rate market has priced in another 25bp interest rate cut from the RBA at its November meeting. Beyond 2019, the market has also priced in a further 25bp rate cut in February 2020, which would take the official cash rate to 0.50%.

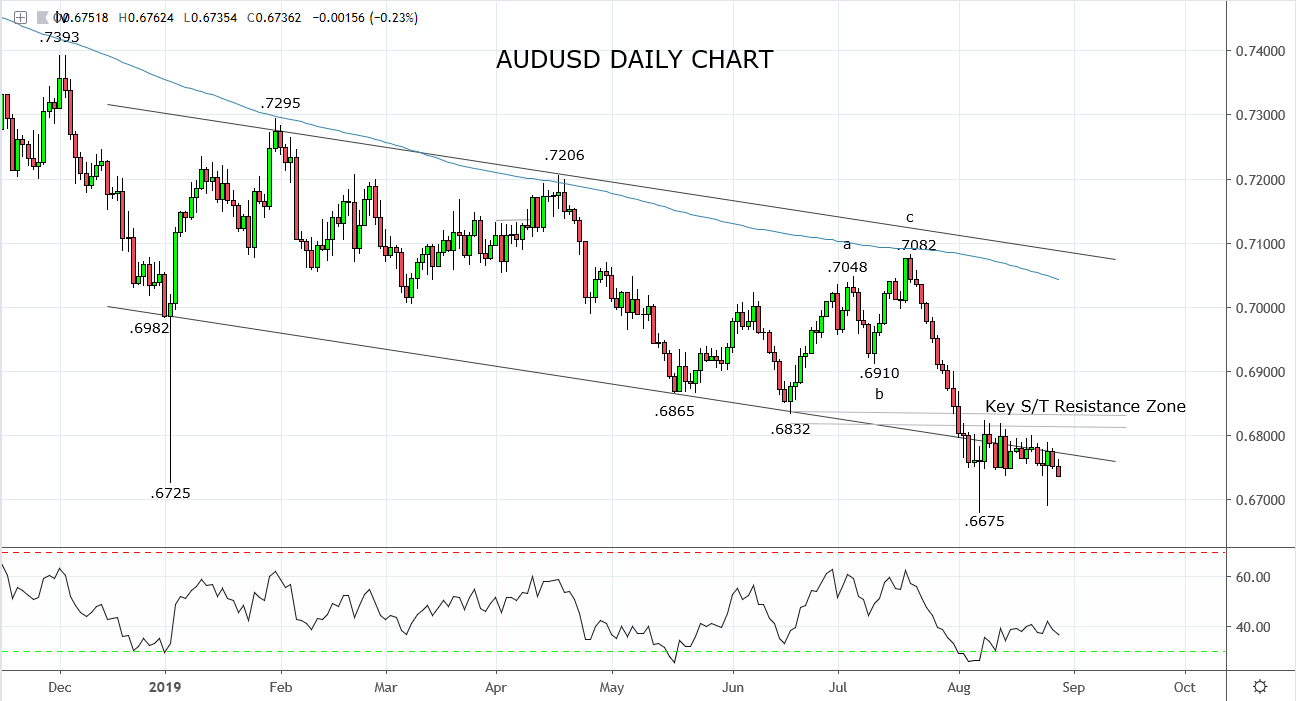

Turning to the charts, for the better part of August, the AUDUSD has mostly tread water, buoyed by the formation of two major potential bullish reversal candles. Ominously, on neither occasion has the AUDUSD been able to build on the upside momentum provided by either of these reversal candles. The safety of the AUDUSD’s long-standing trend channel, currently at .6780ish remains out of reach as does the band of key resistance at .6825/35 which comes from the Jan 2016, .6826 low and the June 2019 .6832 low.

In summary, providing the AUDUSD remains below the resistance at .6825/35 the risk remains for the AUDUSD to trade lower towards the next layer of support at .6500c. This level comes from the congestion that occurred during the GFC in 2008 before the AUDUSD traded down to a low of .6007. A break/close below .6675 would provide some confirmation the next leg lower has commenced.

Source Tradingview. The figures stated are as of the 28th of August 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.