Freeport-McMoRan Earnings Release

On Friday, before market, Freeport-McMoRan (FCX) is anticipated to report first quarter loss per share of $0.17 compared to an EPS of $0.50 a year ago on revenue of appx. $2.9B vs. $3.8B last year. On April 16th the company was upgraded to "overweight" from "equal-weight" at Barclays.

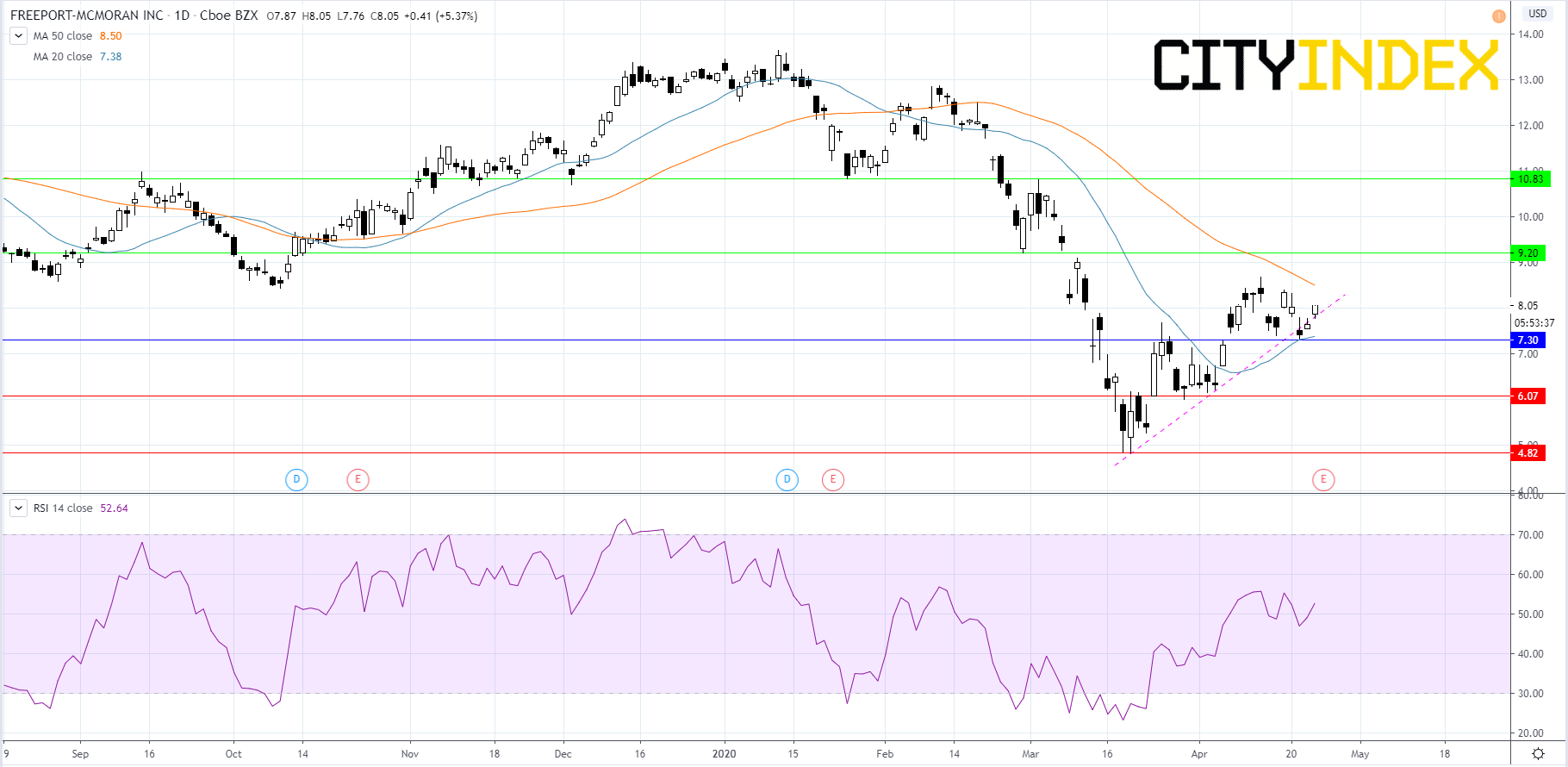

From a technical point of view, the RSI is above its neutrality area of 50. Freeport-McMoRan's stock price is holding above a rising trend line that began at the March low. Price briefly slipped under the trend line to find support at the 20 day moving average, where it bounced back above the trend line. If Freeport-McMoRan can remain above trend line support and break above its 50 day moving average we may see an acceleration towards $9.20.

From a technical point of view, the RSI is above its neutrality area of 50. Freeport-McMoRan's stock price is holding above a rising trend line that began at the March low. Price briefly slipped under the trend line to find support at the 20 day moving average, where it bounced back above the trend line. If Freeport-McMoRan can remain above trend line support and break above its 50 day moving average we may see an acceleration towards $9.20.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM