Four Big Bullish Factors Boosting Bitcoin…And Why the Euphoria May Still Be Excessive

After a year-long slumber, Bitcoin bulls began to stir from their hibernation in early April…but for those who missed the early signs, there’s no denying that the animal spirits have awoken by now!

The world’s oldest cryptoasset traded as low as $3100 in mid-December and was still trading near $4100 at the start of April. In the last three months, Bitcoin has surged more than 230% to peak near $13900 yesterday. In the midst of a potential “blow off top,” the digital asset has gained nearly 50% in the previous six days alone!

So what factors have driven Bitcoin’s incredible surge? It’s impossible to pinpoint every dynamic at play, but the follow four reasons have played a major role:

1) Libra: Corporate America’s Implicit Endorsement of Crypto

As my colleague Fiona Cincotta noted yesterday, “[b]y launching their own cryptocurrency, Facebook are giving legitimacy to crypto’s across the board. When a tech giant like Facebook jumps behind cryptocurrencies, mainstream acceptance is much more probable, boosting future demand expectations. This is being interpreted as a massive vote of confidence from a hugely important player.” It’s also worth noting that Facebook has signed on multiple industry-leading firms as partners in its new venture, including Visa, Mastercard, eBay, Paypal, Uber, Lyft, Coinbase, and Spotify.

While there is little in common between the two cryptocurrencies, the widespread corporate endorsement of Libra suggests that the industry is here to stay, and Facebook’s entry into the market could eventually familiarize billions of people (literally) with digital wallets and non-sovereign virtual currencies.

2) Institutional Involvement on the Rise

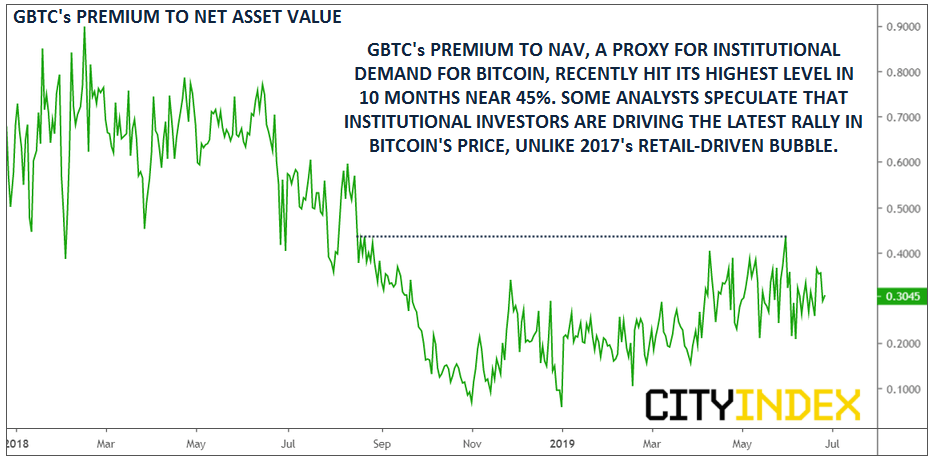

While proxies for retail demand, such as Google searches for “bitcoin”, remain at a fraction of 2017’s bubble peak, there are signs that institutional investors are entering the space in droves.

For example, Grayscale’s Bitcoin Trust (GBTC), which is seen as a “safer,” more regulated way for large institutions to get exposure to crypto markets in the absence of an ETF, recently saw its premium over net asset value rise to a 10-month high. Likewise, the CME’s futures contracts have seen a surge in popularity, with open interest recently hit a record high of 26,555 BTC, or roughly $350 million at current prices. After a long wait, it looks like institutional investors are finally starting to dip their toes into Bitcoin and other cryptoassets.

Source: TradingView, Forex.com. Please note this product may not be available to trade in all regions.

3) “Safe Haven” Demand

Bitcoin bugs’ favorite explanation for the recent rally is that the cryptocurrency is operating… exactly as intended. Bitcoin’s censorship resistance and mathematically-fixed supply is increasingly valuable as nuclear-armed countries engage in protectionism, trade wars, high-stakes military exercises, and rampant stimulative measures.

With global geopolitical tensions and unprecedented economic experimentation becoming increasingly common, traders may be seeing Bitcoin as a compelling, potentially uncorrelated hedge to more traditional investments.

4) Bitcoin’s Fundamentals Are as Strong as Ever

While we hesitate to fully endorse “fundamental drivers” for such a nascent asset, the evidence suggests that the Bitcoin network continues to grow in popularity.

The network’s “hash rate,” a measure of the amount of computing power supporting and protecting Bitcoin, recently hit a record high above 65 million TH/s*. Likewise, confirmed transactions per day are approaching the late 2017 highs, “block size” (essentially the amount of information in each 10-minute batch of transactions) is hitting a record high, and perhaps most importantly, transaction fees are holding at a relatively low level due to recent advancement’s in Bitcoin’s code such as SegWit and the Lightning Network.

* All data in this section courtesy of Blockchain.com

…So the Rally Will Continue, Right?

Despite these compelling bullish dynamics (even your humble author is feeling more bullish than he was before writing this piece!), readers should still put the recent move into context.

Ask yourself: Is Bitcoin truly 50% more valuable than it was two weeks ago?

Even if you believe it was fully 40% undervalued in mid-June, it’s price may still have gotten ahead of the “fundamentals.” As we’ve seen over the last 16 hours, Bitcoin is a highly volatile asset that’s prone to sharp swings in both directions.

Most of the factors we highlighted will play out over the coming years (Facebook’s Libra is not expected to launch until 2020 at the earliest, for example), so even after today’s pullback, it may be prudent for bullish swing traders and investors to wait for the present euphoria to wear off and join the uptrend at a better value. While its impossible to say how far Bitcoin could run if another bubble forms in earnest, patient traders usually come out ahead during parabolic moves.

Related Analysis:

Can the Bitcoin rally last this time?

Bitcoin: Do Volatile Bullish Sessions Lead To Further Gains?