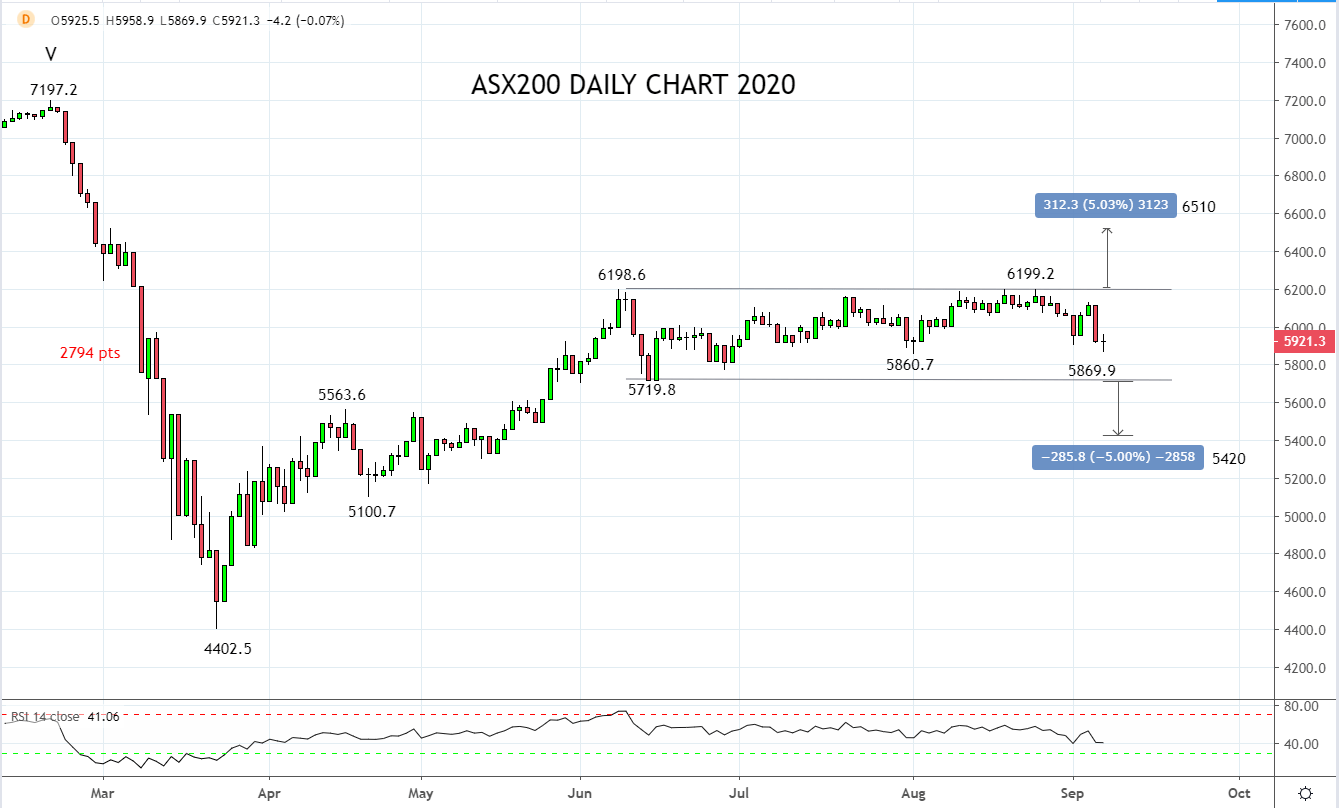

After falling another 0.95% in early trading this morning, a rally in bank and mining stocks has helped the ASX200 claw back into positive territory. Providing yet another example of the magnetic effect of the 6000 level and, prompting the question “for how much longer will the ASX200 rotate around 6000 for?”

As those who have been waiting for the ASX200 to play some catch up to the U.S equity market would know, 6200 has been an unbreakable wall of resistance. On the downside, dips towards 5800/5700 have been well supported - a pattern of range trading that has been in place since early June.

In over 25 years of watching the ASX200, I can only recall one other time the ASX200 was encapsulated within a range like this, back in 2017. Then like now, the range trading commenced in early June. The break out from the range did not come until Mid-October, 120 days later!

This particular period was behind our thinking in two articles we wrote in May here outlining expectations for consolidation in ASX200. As it turned out, the articles were written just a few weeks too early.

Using 2017 as a template the ASX200 can rotate either side of 6000 for another month. When the break does finally come the move is expected to be dynamic, somewhere in the vicinity of 5% reasonably quickly. In which direction, we are open minded.

Using this as a guideline, should the ASX200 make a sustained break above 6200, it would be considered as a buy signal, looking for a move towards 6500 as momentum/technical buyers step in. Alternatively, should the ASX200 see a sustained break below 5700, the downside projection is 5400.

Source Tradingview. The figures stated areas of the 7th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation