FOMC recap: Powell doesn’t rock the boat, key trends intact

As we noted in our FOMC preview report earlier this week, traders were split on what to expect from the central bank, with one subset expecting no immediate changes to policy, another group looking for a change to the maturity profile of asset purchases, and a small contingent even anticipating an outright expansion of the central bank’s quantitative easing program.

As it turns out, the first group was correct. The FOMC opted to leave its interest rates and all of its policies unchanged, though the group did vow to keep its asset purchases “until substantial further progress has been made toward the Committee's maximum employment and price stability goals.” Compared to the outright policy changes that (some) traders were expecting today, this vague, nonbinding restatement of an already-enacted policy was a disappointment to doves.

Turning our attention to the Fed’s Summary of Economic Projections (SEP), the central bank has seemingly grown more optimistic on the prospects for the US economy. Specifically, the median Fed member made the following changes to his/her economic projections:

- Raised real GDP forecasts by 0.2% for both 2021 (to 4.2%) and 2022 (to 3.2%)

- Lowered unemployment rate expectations for 2021 (to 5.0%), 2022 (4.2%), and 2023 (3.7%)

- Raised core PCE inflation projections for 2021 (1.8%) and 2022 (1.9%)

In other words, US central bankers see the US economy growing more quickly, with fewer unemployed citizens and marginally higher inflation, than they did three months ago. Nonetheless, the central bank’s infamous “dot plot” of interest rate expectations was essentially unchanged, meaning that the median Fed policymaker still expects interest rates to remain at 0.00% through at least 2023.

Combining these takeaways, it’s clear that the Fed has taken its “average inflation targeting” policy to heart; Jerome Powell and company will only remove current stimulus programs and consider raising interest rates once inflation starts to approach, if not meaningfully exceed, the central bank’s 2.0% target.

Market reaction

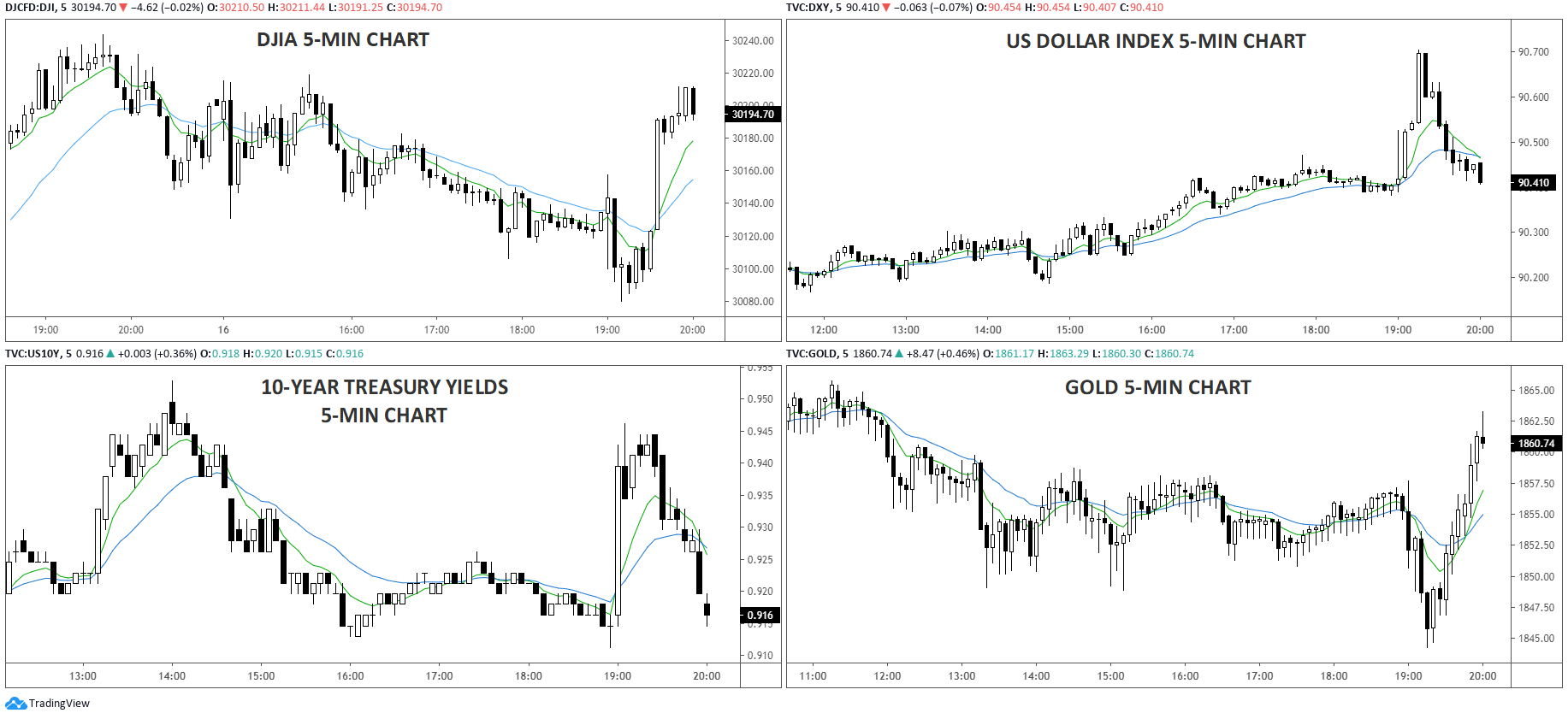

As anticipated, traders who were positioned for changes to the maturity profile of the Fed’s asset purchases were quick to close their trades once the central bank opted to stand pat. The kneejerk reaction was a 20-pip bounce in the US dollar against its major rivals, a quick 2bps spike in 10-year treasury yields to 0.94%, and a dip in major US indices.

However, as Fed Chairman Powell has taken the stage and indicated that any reduction in bond purchases is still a ways off, these initial moves have started to unwind. Most notably, US indices are now trading higher than they were before the Fed’s statement hit the wires, with all major indices now back in positive territory.

Source: GAIN Capital, TradingView

With the Fed doing little to rock the proverbial vote, the market’s well-established trends (stocks up, dollar down, gold and bitcoin up) are likely to reassert themselves in the coming days, so traders may want to consider fading any short-term counter-trend moves over the next week.