FOMC Recap: Dollar Rallies, Stocks Unenthused as Powell Holds the Line

Traders enamored with the minute by minute fluctuations in so-called meme stocks like Gamestop (GME) and AMC Entertainment (AMC) may not have noticed, but we just saw a far more longer-term and macroeconomically-significant news item land: The Federal Reserve’s January monetary policy meeting.

As we outlined in yesterday’s FOMC Preview report, the central bank was never going to make any immediate changes at today’s meeting, but the markets would still key in on any changes the central bank made around the margins of its statement and in Jerome Powell’s press conference.

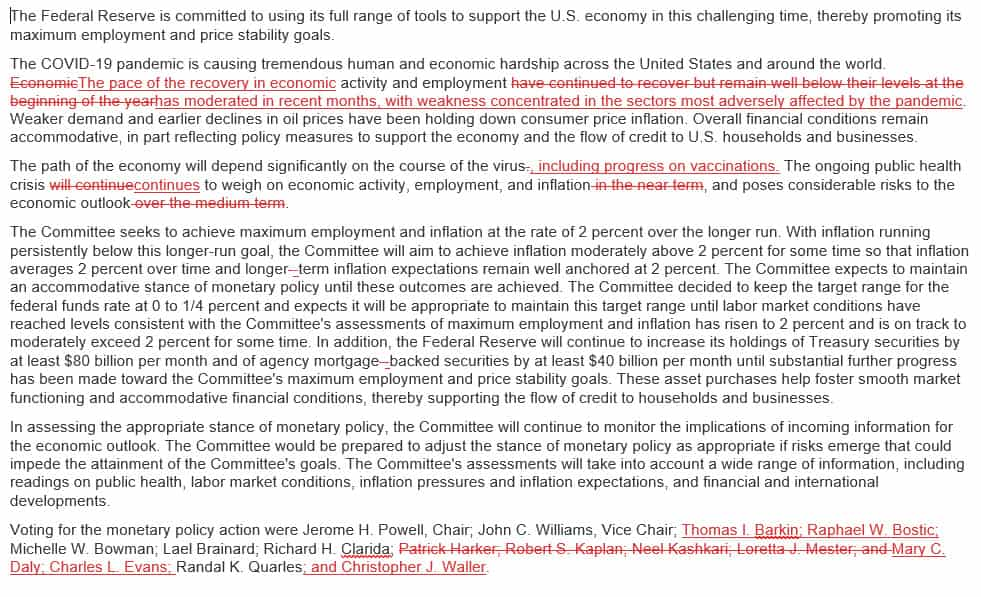

When it comes to the statement, the Fed made relatively few changes, as the below “red line” shows:

Source: Federal Reserve, GAIN Capital

The biggest takeaways from the central bank’s statement are that the pace of the recovery has slowed and that the Fed will be closely monitoring the progress of vaccinations as the first step toward normalizing monetary policy. The statement continues to emphasize that the FOMC needs to see inflation run above 2% for some time before removing the current accommodative policy stance. Put simply, there were no signs in the statement that the central bank has changed its outlook on the US economy and monetary policy.

As we go to press, Fed Chairman Powell is winding down his press conference and has generally stressed the importance of remaining accommodative and flexible until inflation actually starts to pick up. Highlighted comments from the presser follow (emphasis ours):

- PATH OF THE ECONOMY CONTINUES TO DEPEND SIGNIFICANTLY ON THE VIRUS

- REAL UNEMPLOYMENT RATE CLOSER TO 10%

- VERY UNLIKELY THAT WE’LL SEE TROUBLING INFLATION

- SEVERAL DEVELOPMENTS HAVE SIGNALLED A BETTER OUTLOOK LATER IN 2021

- MONETARY POLICY IS PLAYING A KEY ROLE IN SUPPORTING ECONOMY

- LIKELY TO TAKE SOME TIME FOR SUBSTANTIAL FURTHER PROGRESS TO BE ACHIEVED

- POLICY TO REMAIN ACCOMMODATIVE UNTIL GOALS REACHED

- TOO EARLY TO BE TALKING ABOUT DATES ON TAPERING

- PATH AHEAD REMAINS HIGHY UNCERTAIN

- POWELL, ASKED ABOUT GAMESTOP, DECLINES TO COMMENT (you know we had to sneak that one in here!)

Market reaction

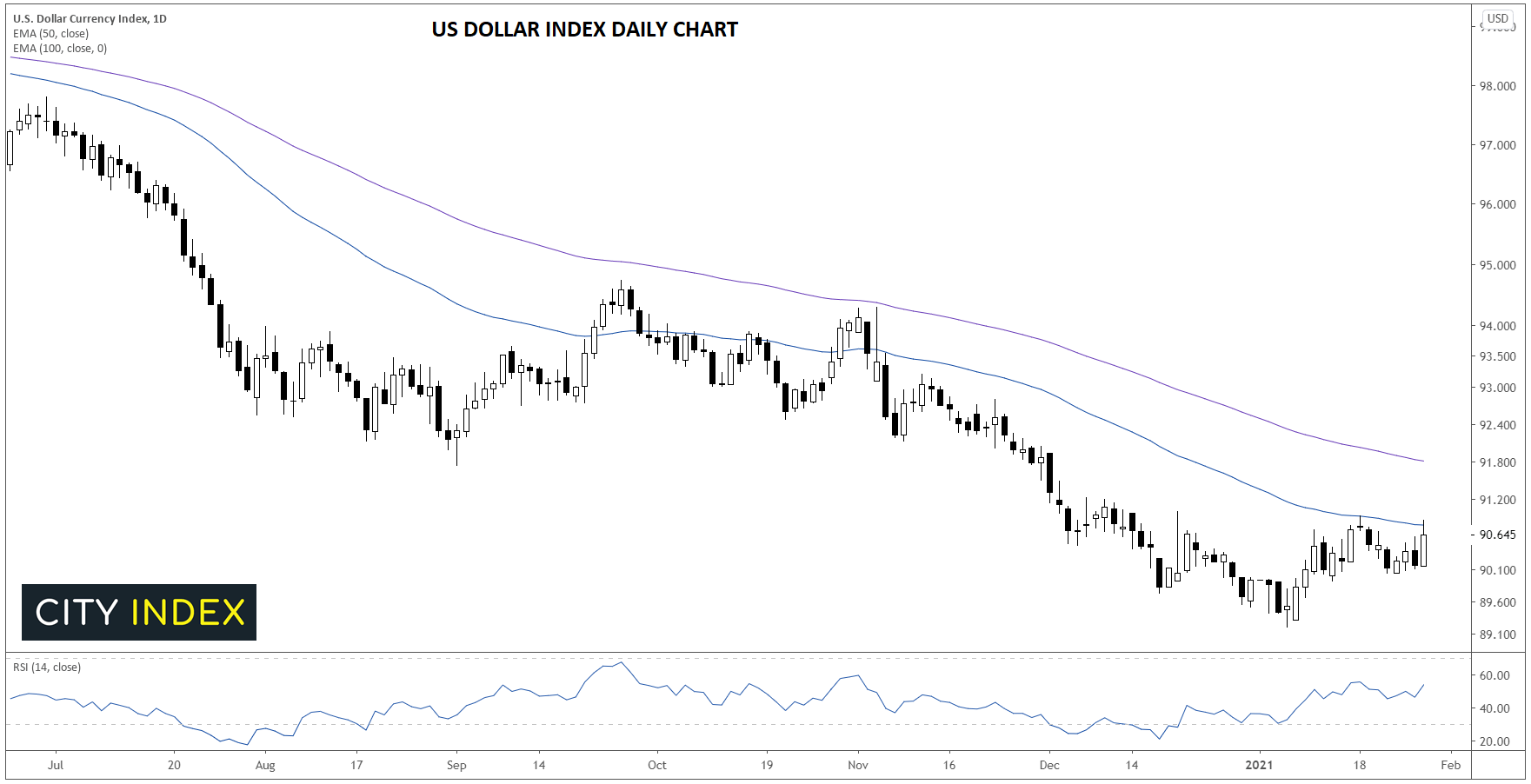

Despite the Fed’s generally dovish, steady-as-she-goes tone, US indices have deepened their selloff, with major indices trading lower by 2-3% ahead of the close. Both gold and oil are also ticking lower along with the yield on the benchmark 10-year treasury bond (-2bps to 1.02%). In FX, the US dollar has recovered off its midday lows to resume the uptrend from today’s Asian and European sessions. With little in the way of new information from Powell and Company, traders may look at this near-term rally in the greenback as a selling opportunity until the longer-term 50- and 100-day EMAs start to turn.

Source: TradingView, GAIN Capital

Learn more about forex trading opportunities.