FOMC Preview: Powell Likely to Stay on Hold, Open the Door to a July Cut

Oh, what a difference six months makes!

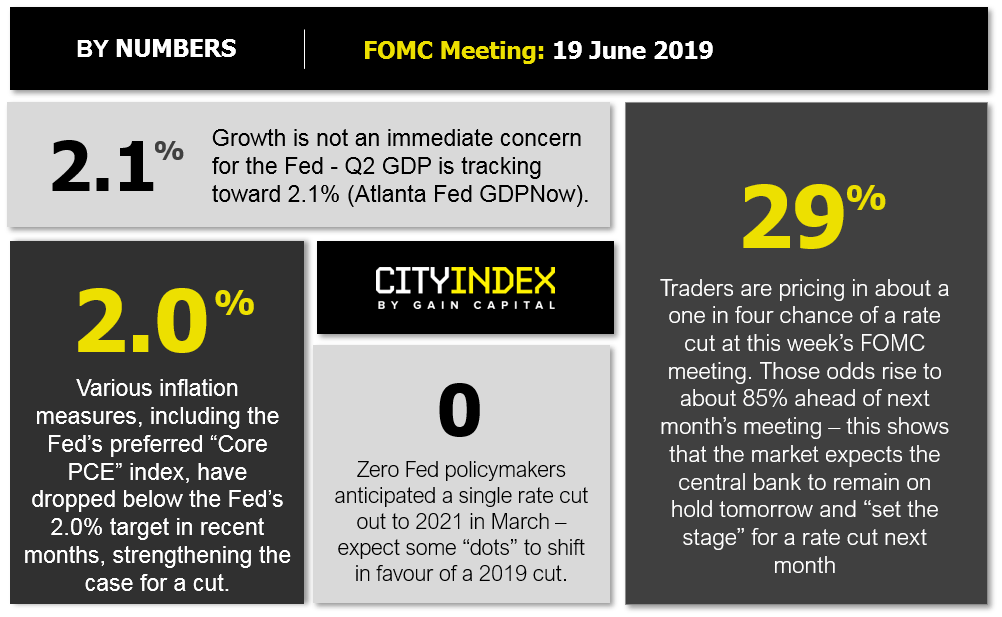

Back in mid-December, the Federal Reserve raised interest rates for the ninth time this cycle and hinted that policymakers were looking to at a couple more hikes over the course of 2019. Now, after a major escalation in the trade war between the planet’s two largest economies and a sustained drop in inflationary measures, the Fed is considering multiple interest rate cuts by the end of the year:

Source: City Index

As the above graphic shows, growth is not a particularly urgent concern for the central bank, but the coordinated deterioration in a variety of inflation indicators certainly is. Back in March, zero members were expecting a rate cut at any point in the next three years, and with data generally holding steady (albeit at low levels), there’s no urgency for an immediate rate cut tomorrow in our view. Instead, Powell and Company may use Wednesday’s release to set the stage for a potential rate cut next month.

What to Expect

- The central bank may replace the wording in its statement to say that the committee “will act as appropriate” to sustain the economic expansion (instead of “be patient” when setting policy).

- “Housekeeping” updates to the statement (e.g. labor market gains “have moderated,” increased downside risks from trade, etc)

- Policymakers may also revise down their Core PCE inflation forecasts for the rest of this year (1.8%) and 2020 (2.0%).

- Most “dots” to shift to expecting one rate cut by the end of the year.

Such a shift would still leave a dramatic difference between what traders are expecting and the Fed’s forecast; regardless of what happens this week, the gap between Fed forecasts and market pricing for interest rates will be a major dynamic to watch for the rest of the year.

Possible Market Reaction

With the market discounting a (slight) chance of a rate cut tomorrow, we could see a minor bounce in the buck and dip in US stocks if the Fed stands pat. That said, the more important reaction will depend on what the statement, economic forecasts, and Chairman Powell’s press conference suggest for the rest of 2019.

Looking ahead, traders have discounted about three rate cuts by the end of the year. Even in the most dovish of no-rate-cut scenarios, it would be difficult for the Fed to deliver a dovish surprise relative to those expectations. In other words, the dollar could see a short-term dip if the Fed takes a dovish tone, but we wouldn’t be surprised to see the greenback recover in the latter half of the week as traders reevaluate the meeting in the context of the rest of the year.

Related Analysis:

USD/JPY Resistance Zone Holds Ahead Of Key FOMC Meeting