FOMC Minutes Show Return to Taper on Taper off Mode

2014 FOMC Hawkish-Dovish Balance The release of the minutes of the December FOMC reveals little more than what was shown in the policy statement. But […]

2014 FOMC Hawkish-Dovish Balance The release of the minutes of the December FOMC reveals little more than what was shown in the policy statement. But […]

2014 FOMC Hawkish-Dovish Balance

The release of the minutes of the December FOMC reveals little more than what was shown in the policy statement. But it’s important to put it all in perspective considering the new guard at the 2014 FOMC.

The annual rotation of district Fed presidents to the FOMC marks the return of two well-known hawks to the FOMC voting panel; Richard Fisher of the Dallas Fed and Charles Plosser of the Philadelphia Fed. Departing Fed members from the voting committee are hawk Esther George of the Kansas Fed (who was the lone dissenter against no tapering last year), James Bullard of St Louis and the two known doves Eric Rosengren of Boston (dissenting against December’s taper) and Charles Evans of Chicago. The net balance from the 2014 could mean that on paper the FOMC will have one additional hawkish member, thereby implying general discussions in upcoming meetings to lean towards a continued tapering of asset purchases.

Lowering unemployment thresholds not ruled out

But if we learned once lesson from the last 5 years is the Federal Reserve has never pre-committed to a single forecast. The December minutes stated that “Members also stressed the need to underscore that the pace of asset purchases was not on a preset course and would remain contingent on the Committee’s outlook for the labor market and inflation as well as its assessment of the efficacy and costs of purchases.”

Although the Fed’s unemployment threshold that is most likely to accompany a tightening stands at 6.5%, several members have shown concern that the declining jobless rate, currently at 7.0%, has accelerated bond trader’s expectations for higher rates and lifted bond yields towards 3% faster than the Fed would have liked. Indeed, the minutes revealed that some members mentioned lowering the unemployment threshold to 6.0%, which “could effectively convey” the intention to keep the federal funds low for an extended period. Instead, the Fed chose to balance its tapering decision with dovish language about inflation. This was expressed by indicating that rates may have to be kept low “well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal”

Inflation will be Fed’s priority in 2014

As labour markets stabilized and the unemployment rate fell to 7.0% in November from 7.9% in January, it was not enough for the Fed. Nor it was worth risking a spike in bond yields via a taper. That was especially the case as the labour force participation rate hit 35-year lows at 62.8%.

With 10-year yields standing at 2-1/2 year highs and inflation drifting at 2-year lows, the Fed quickly realized that any tapering would provoke an unwanted tightening of market conditions. Hence, the Fed’s shifted towards highlighting the importance of price stability as inflation further deviated away from its 2.0% threshold.

If inflation fails to move up alongside rising yields (or moves opposite from yields), then Chairman Yellen may highlight disinflation risks by enforcing a minimum inflation target, which would serve as a more effective tool in capping bond yields than another downward revision of the unemployment threshold, or further prolonging exceptionally low rates.

And so even though the balance of the FOMC has moved a notch towards the hawkish side and US GDP is nearing the 3% handle, the Fed doves (led by Chairman Yellen) have ample ground in supressing yield’s climb past the 3.30% resistance. The use of other labour market indicators such as referring to a preferred minimum in the employment participation rate as well as possibly setting a minimum inflation target is expected to be seen in 2014. Such will be the stark reality-check to USD bulls anticipating persistent hawkishness.

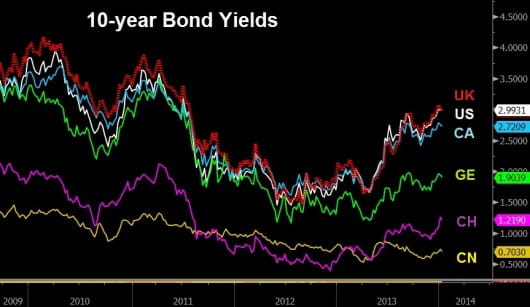

And let us not forget that “taper/no-taper” speculation shall return to each FOMC meeting as the Fed has stated that tapering will NOT be on “a preset course”. The chart below indicates the general uptrend in 10-year global bond yields, currently led by the UK, followed by the US, Canada, Germany, Switzerland and Japan. I’ve argued the GBPUSD implications thoroughly in this column, and I will intend to do so this year again.