FOMC Meeting Recap: Powell’s Punch Bowl Party Persists

In our FOMC Preview report, we highlighted three major themes to watch: the central bank’s economic projections, the potential for a yield curve control (YCC) program, and any hints about reining in easing measures. To address each of those issues briefly, today’s statement and press conference offered the following answers: (temporarily?) downbeat, not officially, and not anytime soon.

As widely expected, the US central bank left its benchmark interest rate unchanged in the 0.00-0.25% range, with no changes to the interest on excess reserves (IOER) rate of 0.10% either. In a dovish development, the Fed also suggested that it will continue to buy Treasuries and MBS at “at least the current pace.” This works out to about $80B/month in Quantitative Easing (QE), or more than double the $40B/mo pace of QE3.

Turning to the central bank’s first economic projections in six months, Jerome Powell and Company clearly acknowledged the current economic difficulties while remaining stubbornly optimistic about the long run outlook:

- The median central banker expects the economy to contract -6.5% in 2020, but recover to grow by 5.0% and 3.5% in 2021 and 2022.

- Unemployment is projected at 9.3% at the end of the year, recovering to 6.5% by the end of 2021 and 5.5% by the conclusion of 2022.

- PCE inflation is expected to run at below-target rates of 0.8%, 1.6%, and 1.7% over 2020, 2021, and 2022 respectively.

- Finally, and most importantly, essentially all central bankers expect interest rates to remain at the 0% lower bound through 2022, with just two hawks (out of 16 potential voters) seeing an uptick in 2022.

In other words, even though the Fed hasn’t explicitly introduced a yield curve control program, it certainly hasn’t hinted at reining in monetary stimulus anytime soon. Chairman Powell has started his press conference as we go to press and is reiterating the accommodative message from the statement and economic projections so far.

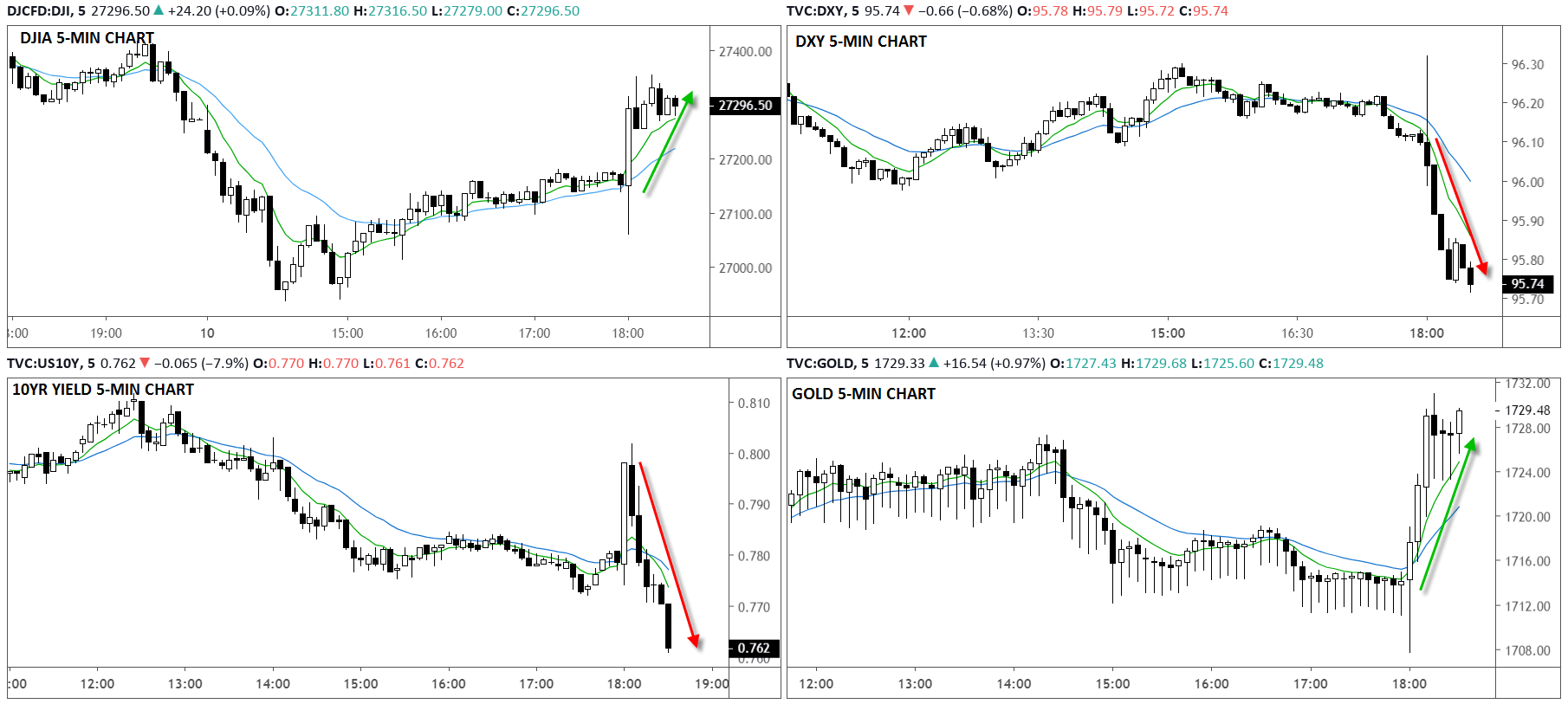

Initial Market Reaction

So far, the global markets are reacting to the dovish-tinged announcement as expected: The US dollar is dropping by about 30 pips against its major rivals, US stock indices have bounced back to positive territory on the day, and the benchmark 10-year treasury yield is off by 1bp. Meanwhile, gold is rallying to gain nearly 1% on the day. With the Fed suggesting that its “emergency” stimulus measures and 0% interest rates are here to stay, these trends could extend further through the rest of the week.

Source: TradingView, GAIN Capital