FOMC meeting preview: Threading a needle

As we kick off the final full trading week of 2020, traders will be focused on a busy calendar of economic data, as well as major central bank meetings including from the Federal Reserve.

As my colleague Joe Perry noted in his Week Ahead report, the economic calendar gets off to a slow start before kicking into high gear midweek (see a full list of market-moving events on our economic calendar):

Wednesday

- Eurozone, UK, and US PMI surveys

- US Retail Sales

- * FOMC Monetary Policy Meeting and Press Conference *

Thursday

- AU Employment report

- BOE Monetary Policy Meeting and Press Conference

Friday

- BOJ Monetary Policy Meeting and Press Conference

- UK Retail Sales

While the PMI surveys on broad economic activity and retail sales reports will be noteworthy, the most important scheduled events for traders to watch this week will be Wednesday’s Federal Reserve

When it comes to the Federal Reserve, Chairman Jerome Powell and Company will have to thread a tight needle: the economic recovery is stalling as COVID resurges across the northern hemisphere, but the prospects for a strong recovery in 2021 is growing as vaccines roll out. Muddying the waters further, the prospects for near-term fiscal stimulus remain up in the air with Congress and the White House still at odds over the details of such a program.

Speaking generally, the Fed’s most likely proactive move would be to extend the average maturity of its asset purchases. Currently, the central bank is buying $80B of Treasury bonds and $40B of agency MBS per month if (and it’s a big “if”) the central bank feels that it must act this week, officials may opt to buy more longer-term Treasury bonds in an effort to keep a lid on future inflation expectations.

While an increase in asset purchases cannot be ruled out, the central bank is more likely to “look through” the temporary economic disruptions like a COVID-driven slowdown this winter, especially as most of the Fed’s tools impact the economy only after 3-6 months anyway. Alternatively, the central bank could simply deem its current programs sufficient for now and make no immediate changes to policy.

Potential market implications

Regardless of what the Fed decides, markets are likely to be volatile as traders seek to profit on the last major scheduled economic event of the year. The base expectation is the that the Fed will tweak the maturities of its asset purchases, so Powell and Company take that path, market moves will likely be limited with perhaps a dash of US dollar weakness and support for US indices.

The more interesting trading scenarios emerge if the US central bank refrains from making any changes (a decision that would likely push the greenback higher and US indices lower) or increases asset purchases (which would likely extend the buck’s recent downtrend and boost US indices to record highs).

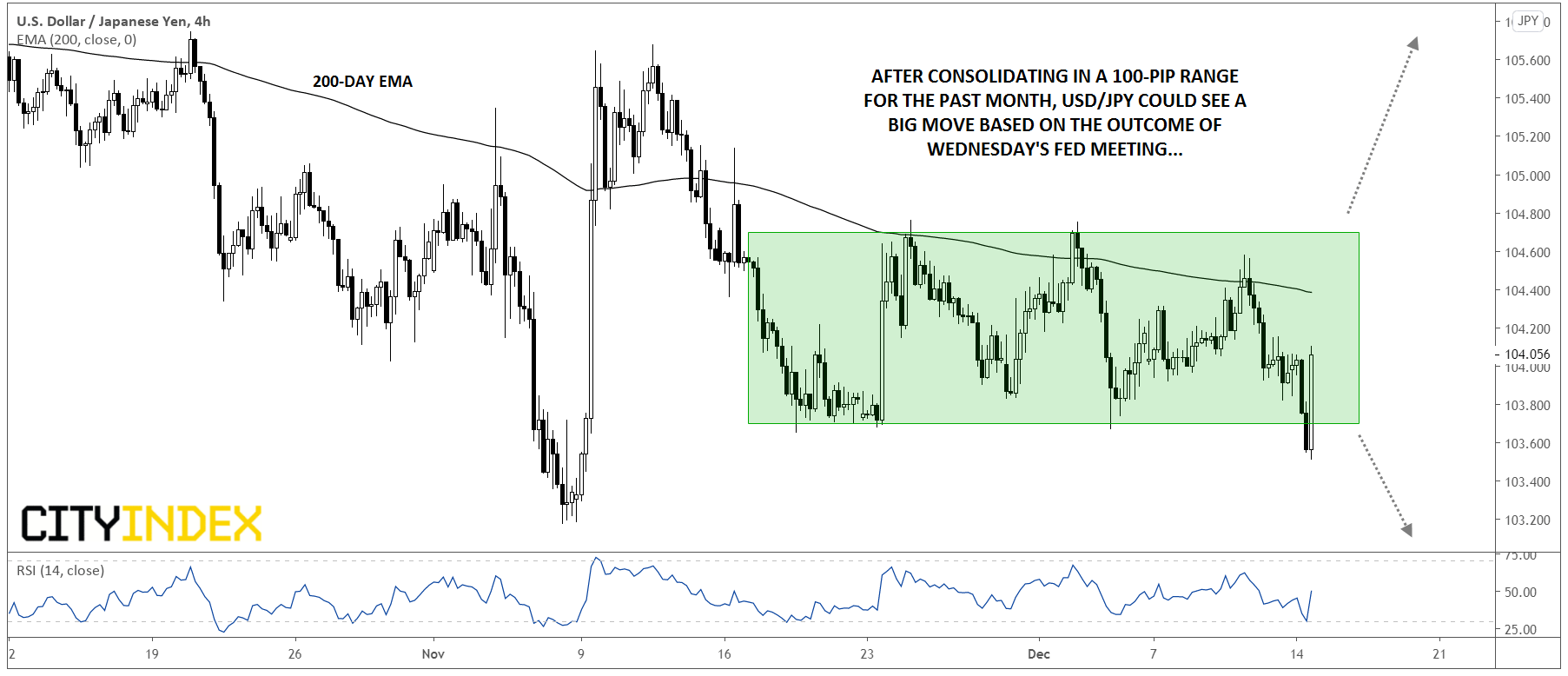

USD/JPY in particular looks coiled for a big move if the Fed surprises traders. The pair has spent the last month consolidating in a 100-pip range between 103.70 and 104.70, despite the US dollar’s continued weakness against other rivals. If the Fed opts to stand pat, USD/JPY could see an upside breakout and move toward 106.00, while an expansion to the central bank’s asset purchases could take USD/JPY down through 103.00 to test the lowest levels since the initial COVID swoon in March:

Source: TradingView, GAIN Capital

Learn more about forex trading opportunities.