The FOMC increased that pace of their bond purchases from $15 billion per month to $30 billion per month as the economy no longer needs rising amount of support, according to the FOMC. The QE program will now end in March 2022 instead of June 2022, as was announced at the November meeting. The $30 billion reduction in bond purchases will consist of $20 billion in treasuries and $10 billion in MBS.

Fed Chairman Powell said that inflation “will run above our 2% goal well into next year”. In the Summary of Economic projections, dot plots showed that FOMC members expect inflation for 2021 to be 5.3%, 2.6% for 2022, and 2.3% for 2023. Recall that the Fed targets 2% inflation! The rise on inflation has mainly been due to supply bottlenecks from the pandemic; however, price increases are now broader.

See our 2022 inflation outlook!

The FOMC also expect to reach full employment to be reached by the end of next year, however the labor participation may take longer.

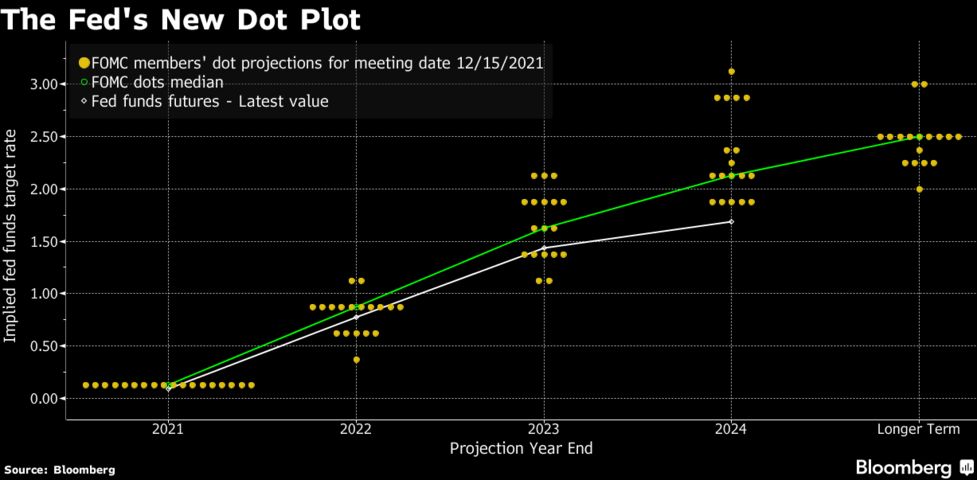

In addition, the Dot Plot shows that FOMC members expect 3 rate hikes in 2022 and 3 rate hikes in 2023.

Source: Bloomberg

Fed funds immediately priced in a 75% chance of a rate hike at the April meeting and a 100% chance of a rate hike at the May meeting. At the time of this publication, these percentages have risen even further.

Powell recently testified in front of the Senate and Banking Committee and noted that it was time to retire the word “transitory” due to the elevated inflation. The most recent headline CPI was 6.8% for November.

Learn more about forex trading opportunities.