Ultra-low interest rates and a laissez fair approach to the regulation of financial firms under the watch of former Chairman of the Federal Reserve, Alan Greenspan, are frequently cited as one of the leading causes of the dotcom bubble and the Global Financial Crisis (GFC).

Greenspan is also known for his mystical style of Fed-Speak, designed to obscure his message and to prevent markets from unintentionally tumbling or rallying on each word he spoke.

“I guess I should warn you, if I turn out to be particularly clear, you’ve probably misunderstood what I said.” Alan Greenspan

In some ways, current Federal Reserve Chairman Powell attempted to do similar today. While markets expectations for today’s meeting were met in the form of a 25bp reduction in the Feds Fund target range to 2.00-2.25% and an end to the balance sheet reduction program (QT), the subsequent press conference created the type of volatility that Greenspan so keenly sought to avoid.

The upshot being that today’s cut is being viewed as a hawkish cut, a “mid-cycle adjustment” rather than the beginning of an extended easing cycle. Perhaps it was, but was there a sensible alternative?

If the Fed had confirmed the dovish trajectory that the interest rate market had priced, it risked denting the confidence channel when the opposite was needed. With an eye on the better data in recent weeks the Fed has saved policy bullets for when they might truly be needed. In doing so it has reserved itself some optionality around the future path of monetary policy.

What does this mean for the U.S. dollar?

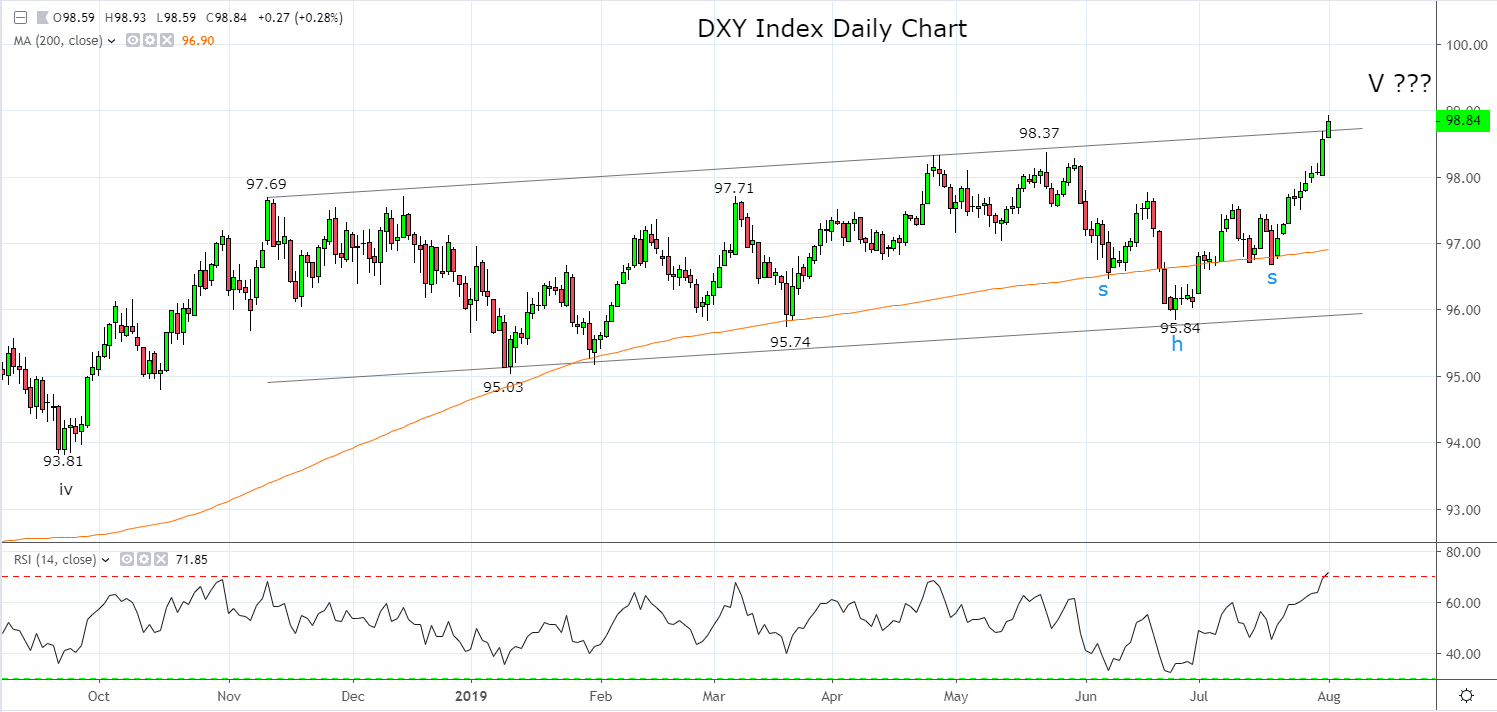

The U.S. dollar index, the DXY has broken above its recent highs, 98.30/40 area as well as trend channel resistance 98.70. That said I am yet to be convinced this is the DXY has commenced its next leg higher. Based on the high number of false breaks in the U.S. dollar during 2019, there is a possibility that the DXY index closes today’s session back below trend channel resistance and then rotates lower towards 97.00.

As such and given the risk-reward potentially available, I am biased to be a seller of the DXY, should a daily bearish reversal candle form in the next 24/48 hours combined with a daily close back below 98.70. Conversely, if the DXY closes above 98.70/80 allow the rally to extend towards 99.70/00.

Source Tradingview. The figures stated are as of the 1st of August 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.