Flight to Safety - Canceled

Today has been an interesting day, to say the least. The S&P 500 moved from “Limit up” overnight to briefly negative for the day, and finally closed up over 4.8% on the day. This was primarily due to comments from US Government officials regarding the coronavirus. Investors were hopeful overnight before the US stock markets opened that the President would introduce a payroll tax cut, to give some relief to corporations who are dealing with the fallout of the coronavirus. At a press conference this morning, the President said they were not ready to announce any kind of economic relief. There were concerns by Democrats that payroll tax relief would not reach all workers who might need help. Markets gave back all their gains and briefly turned negative. However, later in the afternoon Treasury Secretary Steve Mnuchin met with House Democratic leader Nancy Pelosi and he said that there is a ‘BIPARTISAN” urgency to pass a coronavirus economic relief package. As a result, stocks roared higher as markets hoped something will get done!

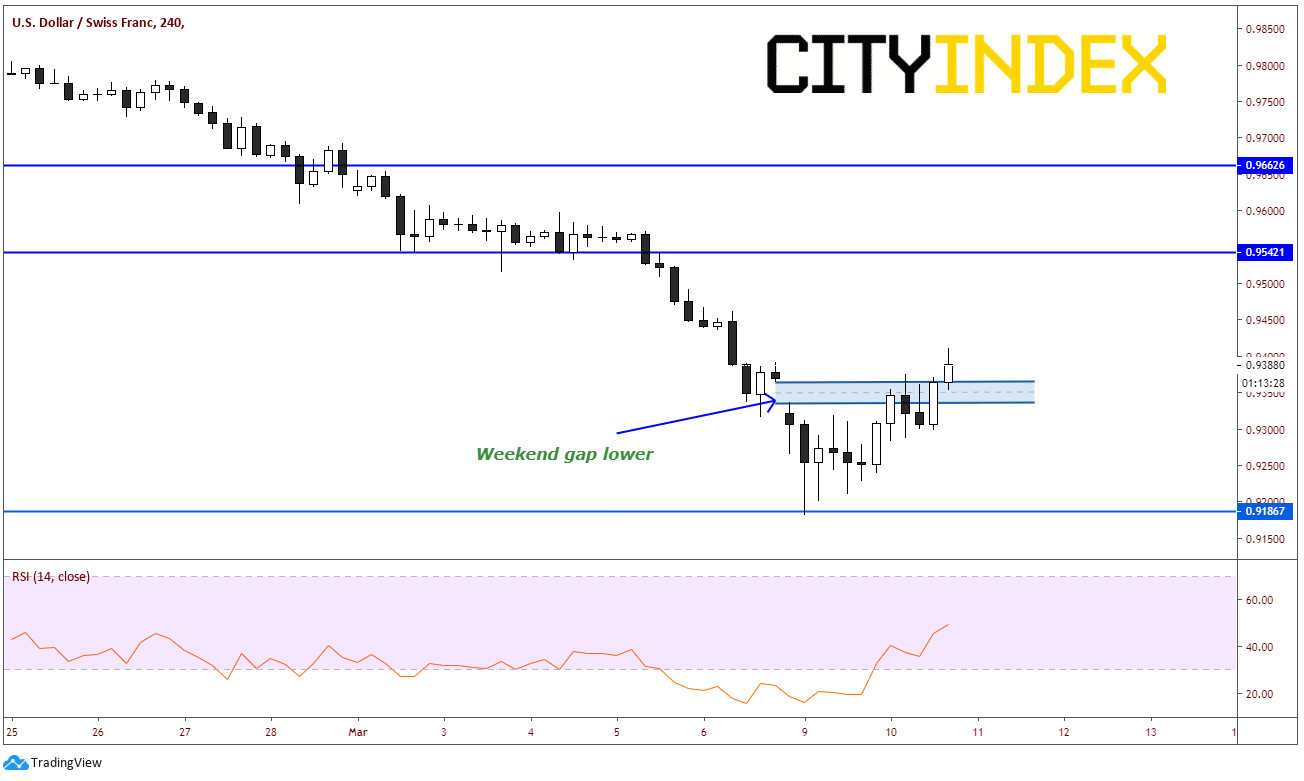

As a result of the moves in stock markets, the flight to safety trade was unwound a bit. On a 240-minute timeframe, USD/CHF has moved from a low on Sunday night of .9182 to today’s highs of .9411, completely filling the gap from over the weekend. (The low Sunday night was also horizontal support from the February 2018 lows.)

Source: Tradingview, City Index

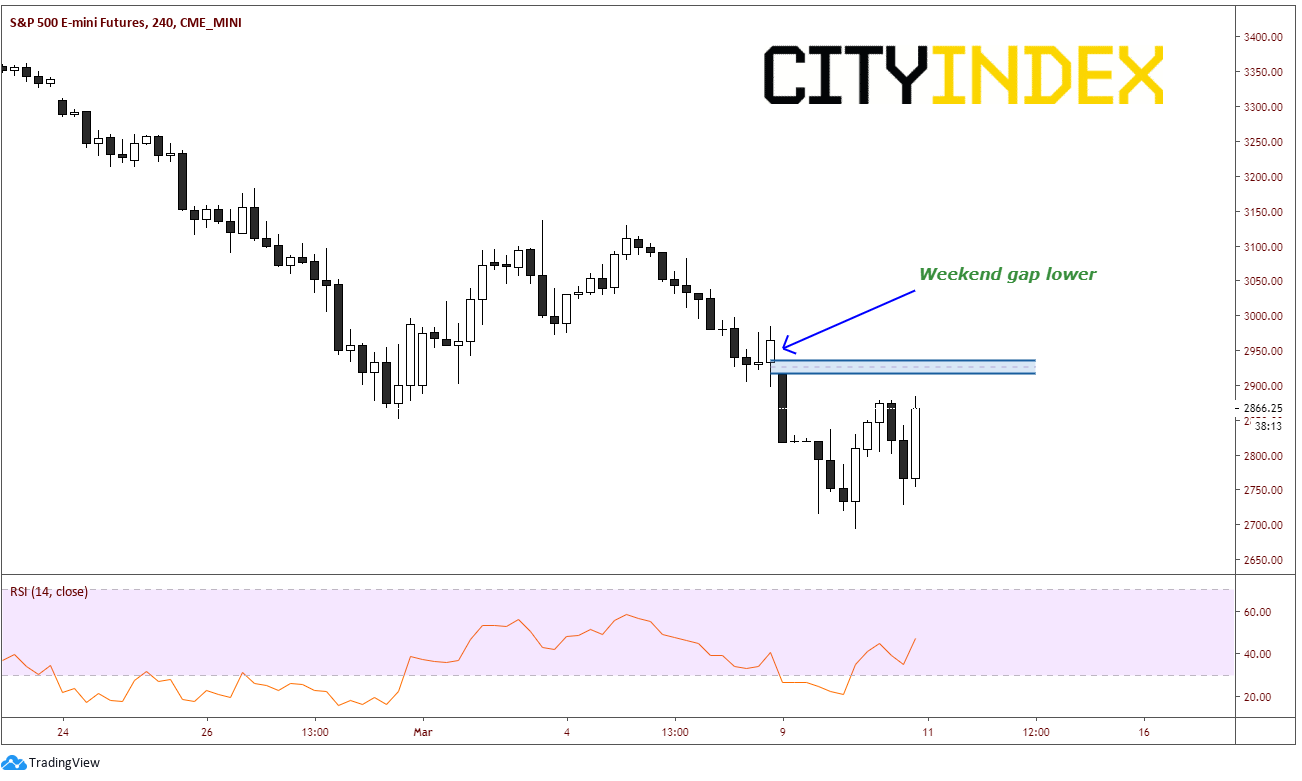

All is right in the world once again! Right? Not quite. Although S&Ps closed up over 4.8% on the day, they could not fill the gap from Sunday night at 2916. The actual gap fill is Friday’s close at 2984.25. Price is still over 100 handles away from that point. The first resistance is 2916 (the gap open) and the second resistance is 2984.25 (the gap fill).

Source: Tradingview, CME, City Index

What does this mean? The coronavirus is still out there. A fiscal stimulus package is helpful, but as Powell said regarding the 50bps interest rate cut last week, stimulus will not stop the coronavirus. It will just help those who are affected by it. This means that although US government officials are finally moving in the right direction, stocks can still move lower. Because stocks did not fill the gap from Sunday night, there is still a lot of work to be done if they want to move higher. USD/CHF bears are still watching the “flight to safety” trade. They are hunting the trade in which stocks turn lower and they can jump in again and look to take out the February 2018 lows.

The markets will continue to be volatile over the next few weeks. If stocks move lower, watch for USD/CHF to move lower as well.