In addition, FLT’s global corporate travel management network, FCM Travel Solutions, extends to about 90 other countries through strategic licensing agreements with independent local operators. FLT is scheduled to report its half-year numbers on Thursday, February 24th.

The travel industry was decimated by the impact of the COVID-19 pandemic as borders slammed shut around the world and travelers cancelled or postponed trips. FLT saw an 80% decline in its share price from its 2019 $44.24 high to the $8.69 low and cancelled its previously announced dividend.

In April 2020, it launched an emergency equity raising of $700m and tapped the Bank of England’s emergency debt facility to assist its UK operations. Thousands of staff were stood down or made redundant, and hundreds of stores targeting leisure travelers were closed across its global network.

Underscoring this period, FLT recorded a $507.1million underlying loss before tax during FY21, in line with the prior year result and market guidance. As highlighted in the company’s Annual General Meeting (AGM) in October 2021, its healthy liquidity position helped it weather the various Covid challenges.

During the AGM, the company also noted that trading conditions were expected to improve, supported by travel restrictions being relaxed/lifted in key markets and vaccination programs gaining momentum globally. However given the ongoing uncertainty, declined to provide FY 2022 guidance.

“Timing is uncertain and remains largely in government hands, given that revenue generation opportunities are intrinsically linked to borders re-opening and staying open and international travel resuming in a more meaningful way globally.”

One of the key uncertainties was removed yesterday on news that Australia will re-open its borders to vaccinated tourists from February 21st, providing a massive boost for Australia’s $60 billion tourist industry.

After two years of losing money, the prospect of a return to profitability, most likely in the second half of 2022, has buoyed travel stocks, including FLT, currently trading at $19.55.

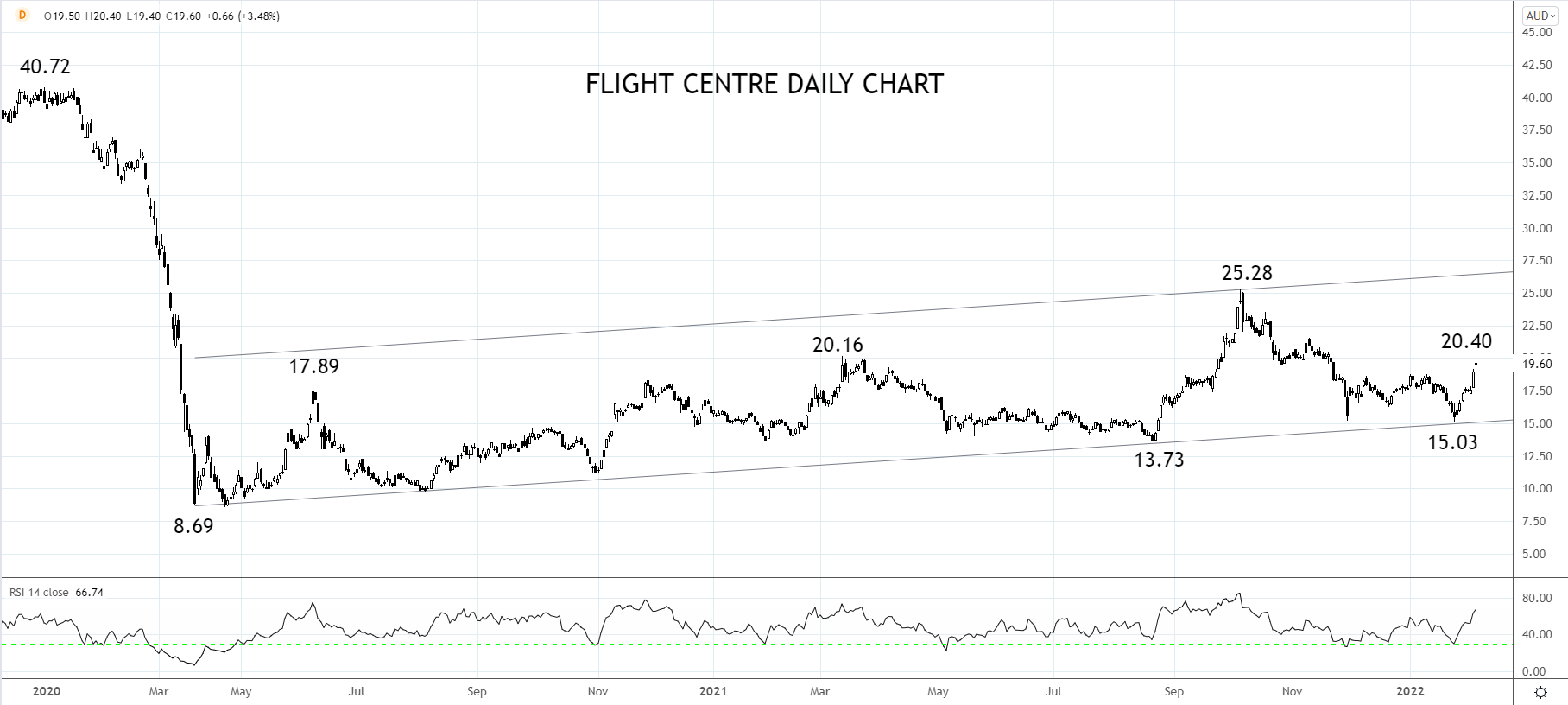

FLT Daily Chart

Following the drop from the $40.72 high to the April $8.56 low, the share price of FLT has been content to grind higher within a trend channel for the better part of 12 months now.

If the share price can break above horizontal resistance at $20.20/40, there is scope for a test of the October $25.58 high before trend channel resistance at $26.50.

On the downside, trend channel support viewed ahead of $15.00 will provide support should another Covid challenge emerge in 2022.

Source Tradingview. The figures stated areas of February 8th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade