A common thread in our notes this week has been a discussion of fiscal stimulus and its imminent arrival. Timely, as another fiscal stimulus domino fell after the Japanese Prime Minister Shinzo Abe announced yesterday an economic stimulus package worth about 13 trillion yen ($119bn).

Japan has been experimenting with ultra-low low-interest rates for decades. Despite experiencing mixed success, it appeared committed to this course of action until GDP data released last month showed that in the third quarter the annualised growth rate of the Japanese economy slumped to 0.2% from a rate of 1.8% in the second quarter.

The cause of the slump, a tax hike in October, a sharp fall in Japanese exports due to the U.S. – China trade war and a devastating typhoon. Adding to downside risks a drop in activity is expected after the completion of stadiums and other venues ahead of the 2020 Tokyo Olympics.

Faced with the possibility that the Japanese economy might slip back into recession and with the lost decade of economic stagnation still recent enough to bring back painful memories, the Japanese government has turned to fiscal policy.

The fiscal package was met with only mild enthusiasm as the details confirmed leaks from earlier in the week. Nevertheless, fiscal stimulus is in theory supportive of the currency of that country and therefore should be viewed as JPY supportive. This aligns with the current technical setup in USDJPY outlined below.

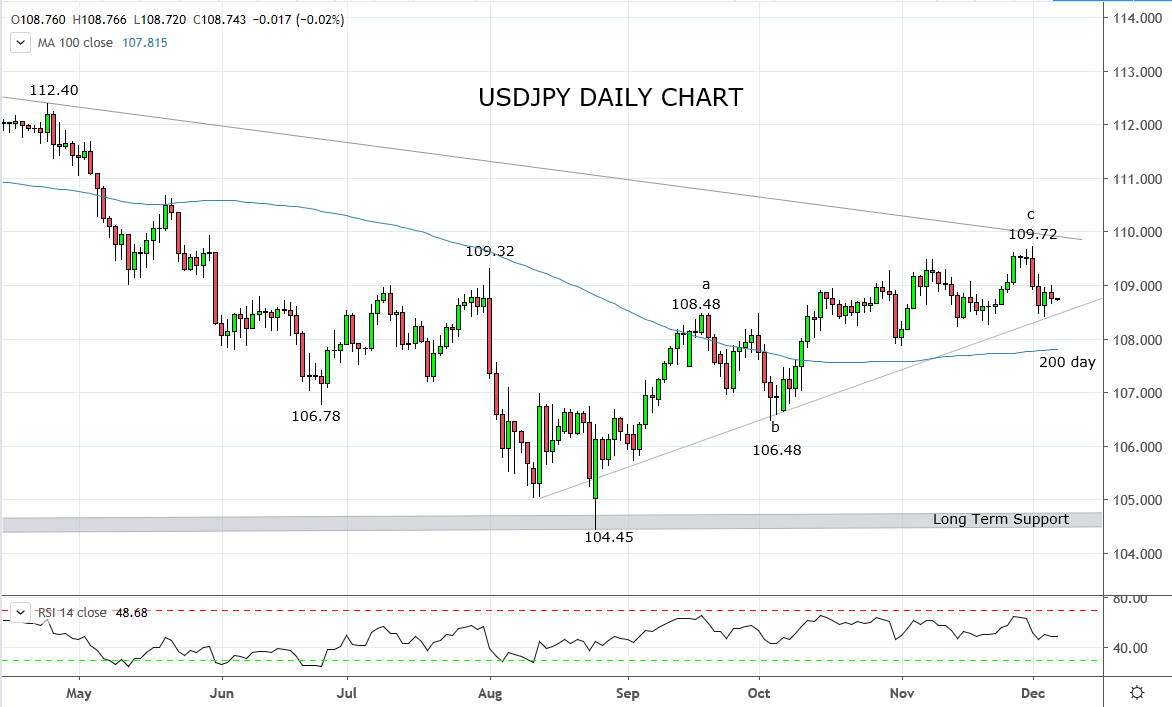

The rally from the 104.45 low is viewed as a correction that suggests a move lower in USDJPY will occur in due course, including a test of the 104.45 low. The bearish reversal candle that formed earlier this week from ahead of the trendline resistance at 110.00, goes some way to suggesting the move lower has already commenced. However, more downside confirmation is required, including a break of trendline support and recent lows 108.20 area. Until this occurs, a rally back to 109.30/50 is possible.

As such, my preference is to sell rallies in USDJPY back towards 109.30/50 ideally pending the formation of a bearish reversal type candle, with a stop loss placed above 110.25.

Source Tradingview. The figures stated areas of the 6th of December 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation