Fed Slams The Dollar | AUD/USD, USD/JPY

Dovish comments from Fed officials has put a 50bps cut in July back onto the table for markets, and markets were quick to respond.

- Fed’s William’s said current estimates of the US neutral interest rates are around 0.5% and, if inflation gets stuck below goal, people’s expectations may push inflation lower, “reducing the Fed’s ability to be effective”.

- Richard Clarinda, who was mostly ‘centrist’ at the June meeting, said during a live TV interview that “you don’t want to wait until data turns decisively” and “it’s important to act pre-emptively.

That these comments were said on Donald Trump’s favourite Fox News program, ‘Fox and Friends’ is also worth noting, given the Fed have been accused of bowing to the President’s pressure and therefor, not as independent as they claim. Still, what’s said is said and markets reacted accordingly.

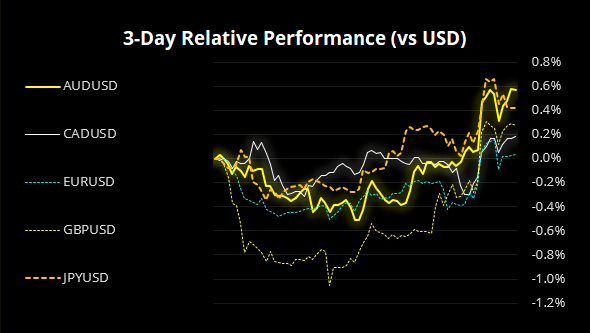

- USD index closed to a 2-week low amid its most bearish session in 1-month

- Gold broke to a fresh, 6-year high (nice call Fawad)

- AUD/USD hit a 3-month high

- US2yr fell to 1.76%, a 9-day low and now far from its YTD lows

- OIS markets are now pricing in a 76% chance of a 50bps cut this month, whilst CME’s FedWatch tool suggests a relatively modest 44.2%.

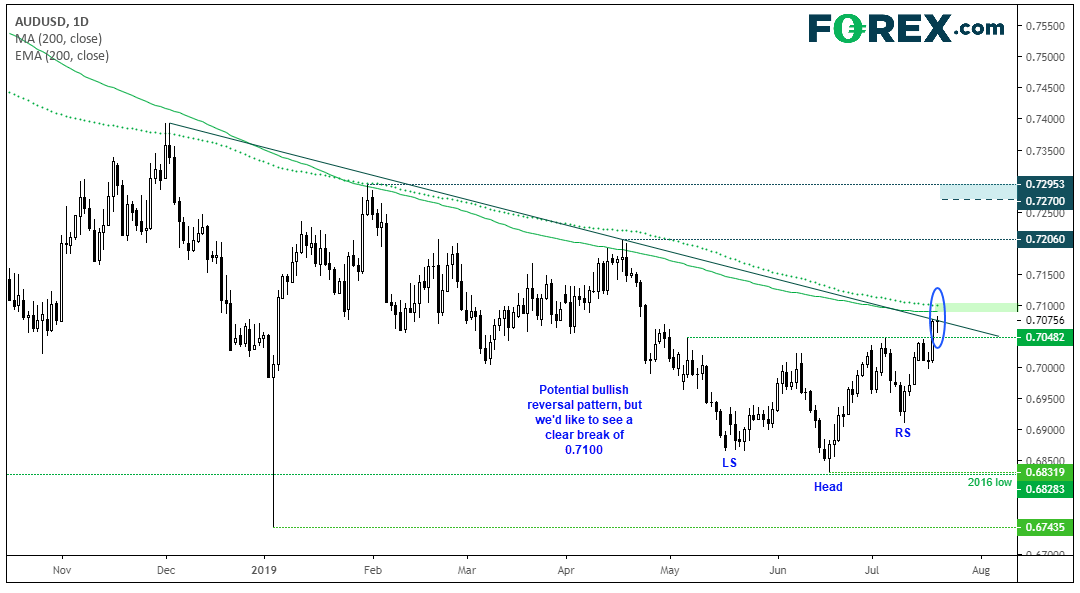

Starting with AUD/USD, it’s most bullish day since late January closed right on the December ’18 bearish trendline.

- A higher high and low has materialised since the 2016 low, which could be part of an inverted head and shoulders pattern.

- If successful, the pattern projects an approximate target around 0.727, although the 0.7200 area makes a logical interim target

- However, the 200-day MA and eMA are nearby, so we’d want to see a clear break above 0.7100 before assuming a bullish reversal

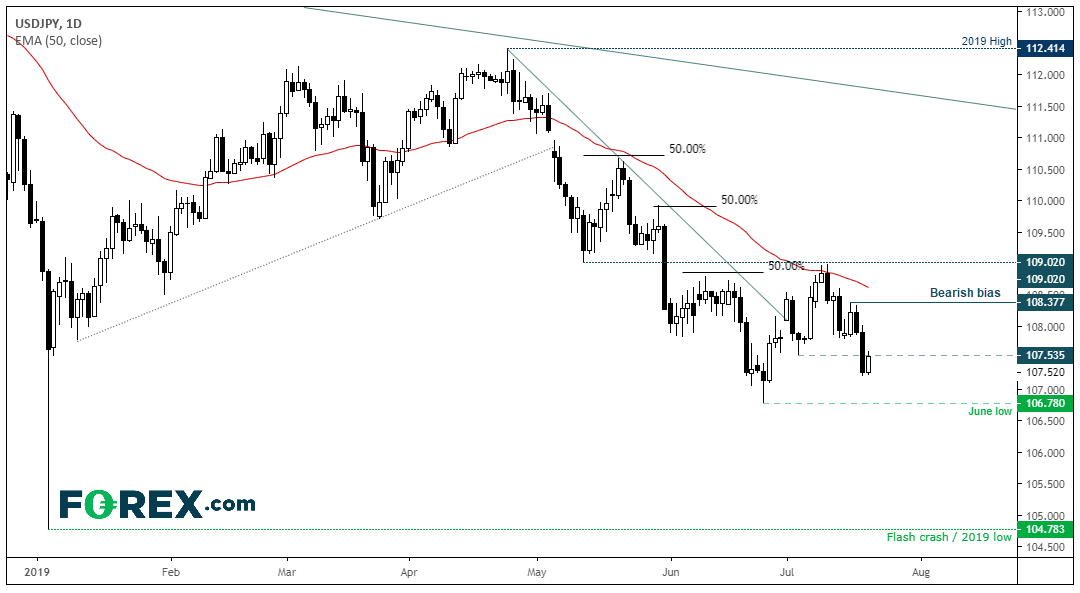

USD/JPY looks set to re-test its lows and potentially extend its bearish trend now bearish momentum has returned.

- The 109.02 resistance level previously highlighted has continued to be a good level to fade into, with the 50-day eMA capping as resistance

- Intraday traders could look for shorts below the 107.54 area (but expect some noise around this level heading into the weekend)

- The daily structure remains bearish below 109.02, but we could consider fading into moves on the daily chart below 108.38

- Next target is 106.78 but the bias is for a break to new lows

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM