Why is dollar still king?

So why is the dollar advancing even as the market is pricing in a great probability of a rate cut? Basically, the dollar continues to be the best of a bad bunch. The pound is under pressure from Brexit, the euro from weak growth across the eurozone. The Aussie and the Kiwi are both out of favour owing to the trade war and lower interest rate expectations. The yen’s appeal has been lifted thanks to its safe haven status, although is limited thanks to its ultra-low interest rate.

One of the narratives impacting the other currencies needs to change in order for the dollar to change its course.

Levels to watch

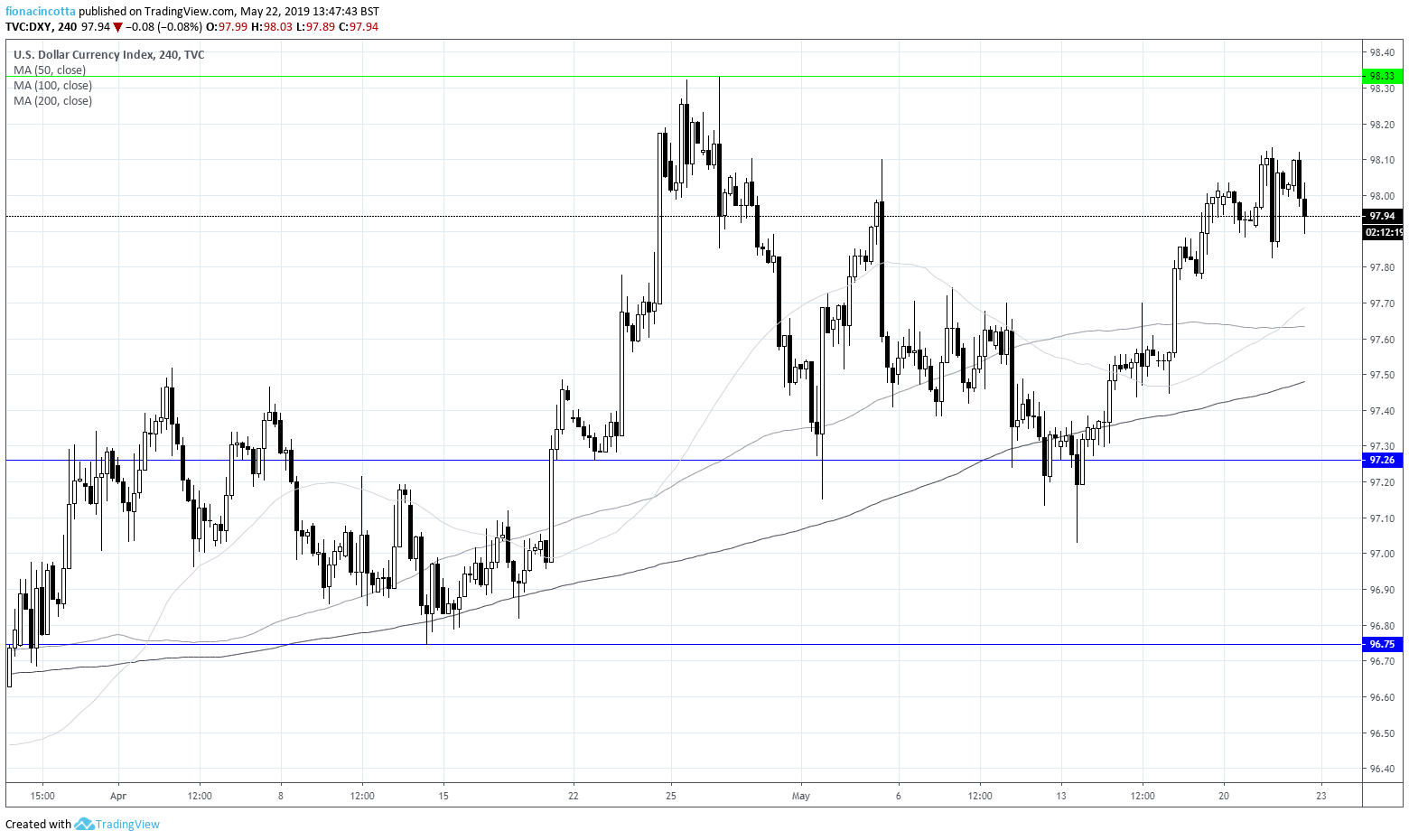

The dollar index is currently trading at the higher end of its recent range and around the key 98.00 level. A meaningful move above this level could see the dollar test resistance at 98.33. On the downside support can be seen at 97.26 before 96.75.