With little in the way of top-tier economic data on tap and earnings season winding down, traders have turned their attention to today’s busy Fedspeak calendar.

None of the central bankers speaking today have “rocked the boat” when it comes to monetary policy…and that’s a very notable development in itself! It seems that both the FOMC’s doves and hawks are comfortable with interest rates where they are, leaving little impetus for the central bank to make any changes unless or until we see a sustained, substantial shift in underlying economic data:

- In his comments, St. Louis Fed President James Bullard (2019 voter) stated that it “makes sense” to wait and see how the economy reacts to recent interest rate cuts and emphasized a “measured” approach to monetary policy. He also downplayed his previous concerns over the inverted yield curve following the recent interest rate cuts.

- Dallas Fed President Robert Kaplan (2020 voter) noted that the US consumer was in good shape, that he didn’t believe inflation would run away from goals, and that he was concerned with growing debt levels (in other words, he equally cited both upside and downside risks to the economy, implying that current policy is roughly appropriate).

- New York Fed President John Williams (permanent voter) emphasized using monetary policy to anchor inflation expectations and looking ahead several years to evaluate the impact of decisions. He also noted that the US economy and monetary policy are in a good place for the moment.

- Fed Chairman Jerome Powell (permanent voter) concluded his semi-annual testimony to Congress today, and the overall takeaway is that he views economic growth as strong, but far from overheating. Coming on the back of his post-meeting comments last month, it’s clear that the chairman remains in wait-and-see mode and that there’s a high bar to changing monetary policy any time soon.

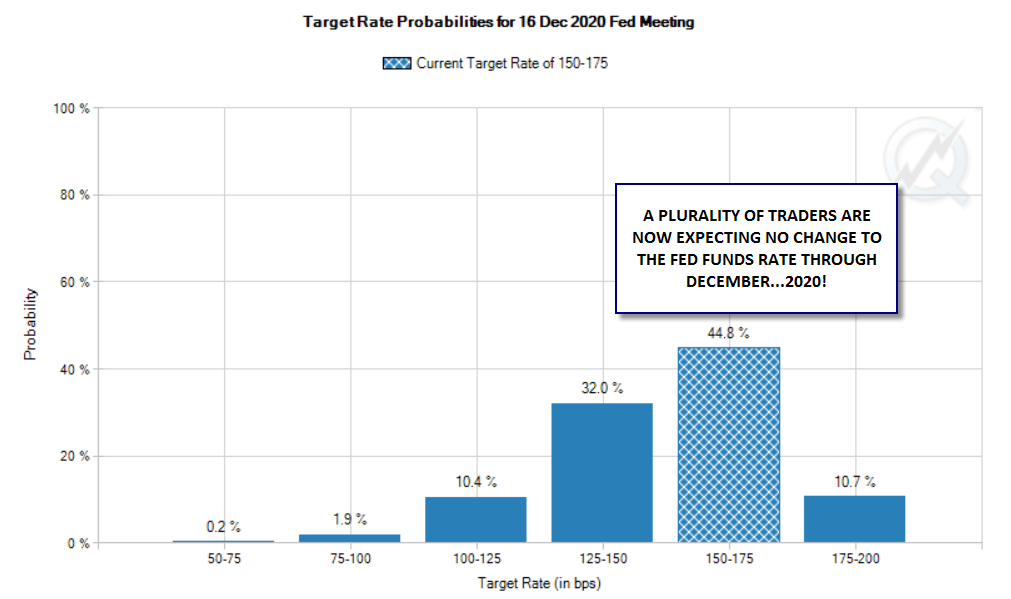

With all of today’s major Fed speakers singing from the same neutral hymn sheet, traders have essentially priced out the risk of any change in interest rates this year, with the CME’s FedWatch tool showing a 96% chance of no change to interest rates in the Fed’s December meeting (the remaining 4% implied odds are for a 25bps cut). Looking further out, traders are pricing in a 45% chance of interest rates remaining in the same 1.50-1.75% range at the end of 2020, with roughly 44% odds of at least one rate cut and 11% odds of a single rate hike by then. In other words, recent comments from the Fed have essentially “reset the table” to neutral, exactly where the central bank wants to be heading into an election year.

Source: CME FedWatch

Of course, there are enough unknowns between the election, trade policy, geopolitical developments, and economic data that the Fed will likely have to tweak policy over the next 13 months, but at this point, traders see the risks as balanced in both directions. We’ll be keeping a close eye on all of these developments as we flip the calendars to 2020, when Fed policy will once again be a major driver for markets.