Fed Goes “All In”

The US Fed has provided unprecedented stimulus to the US markets so far, include slashing interest rates to 0%-25%, QE4, extending credit lines, and participating in the overnight commercial paper markets. Today, the Fed has announced TALF, or Term Asset-Backed Securities Loan Facility. TALF allows the Fed to buy UNLIMITED amounts of Treasuries and Mortgage Backed Securities. In addition, the Fed established PMCCF, or Primary Market Corporate Credit Facility , and SMCCF, or Secondary Market Corporate Credit Facility. These programs allow the Fed to buy corporate and investment grade bonds in the secondary markets and some ETFs. These special purpose vehicles will allow the Fed to continue to ease corporate credit conditions. The vote was unanimous at the emergency meeting.

By the way, don’t forget that congress in trying to put together a fiscal package worth $2 trillion to help individuals, including providing cash directly to eligible individuals. There have been several votes so far, however none have passed both houses of congress. There may be another vote later today.

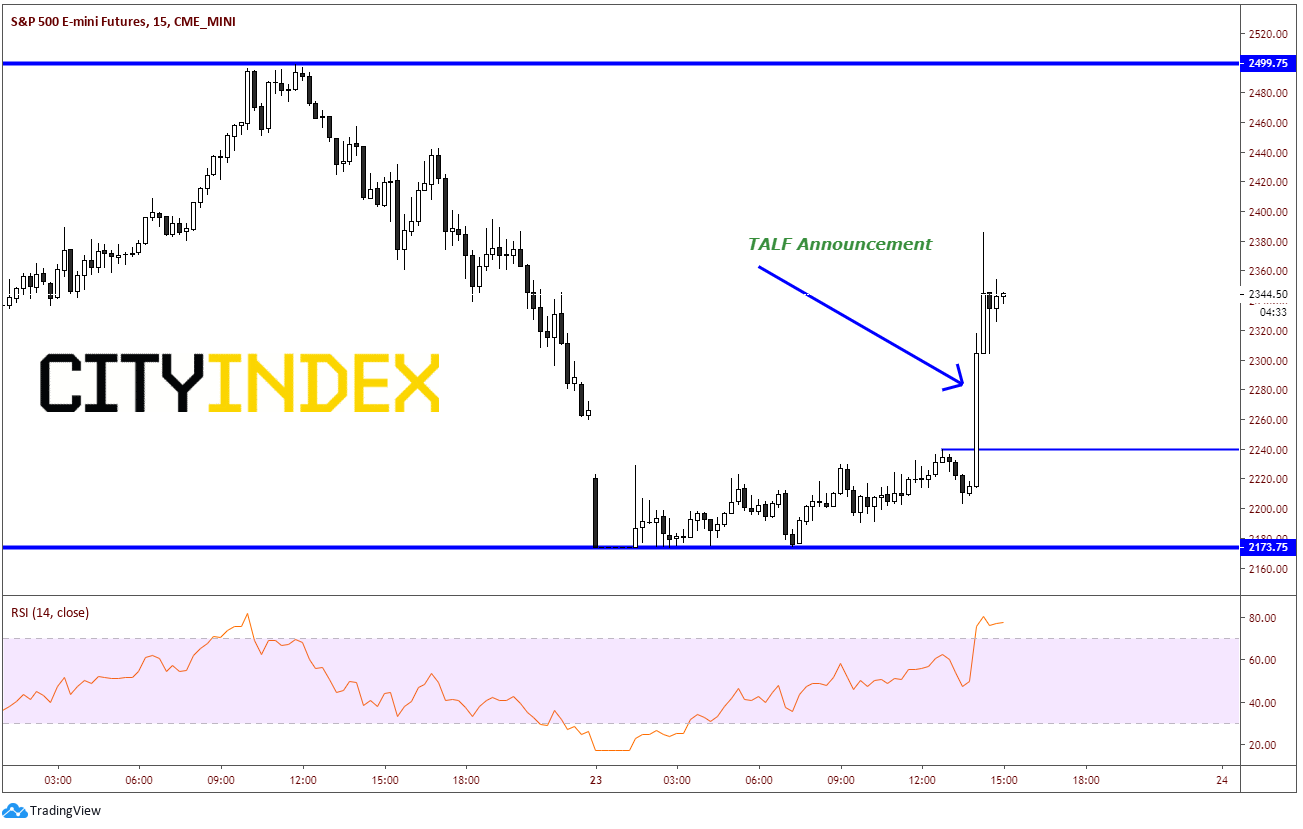

Stocks shot higher after the TALF announcement, as markets are taking this effort by the Fed as the ultimate backstop for the economy. S&P 500 futures shot up from 2214 to 2386, 172 HANDLES! If price breaks these highs, there is horizontal resistance near 2420 and then Friday’s highs near 2500. Overnight support at 2239.50 and the overnight lows near 2174.

Source: Tradingview, CME, City Index

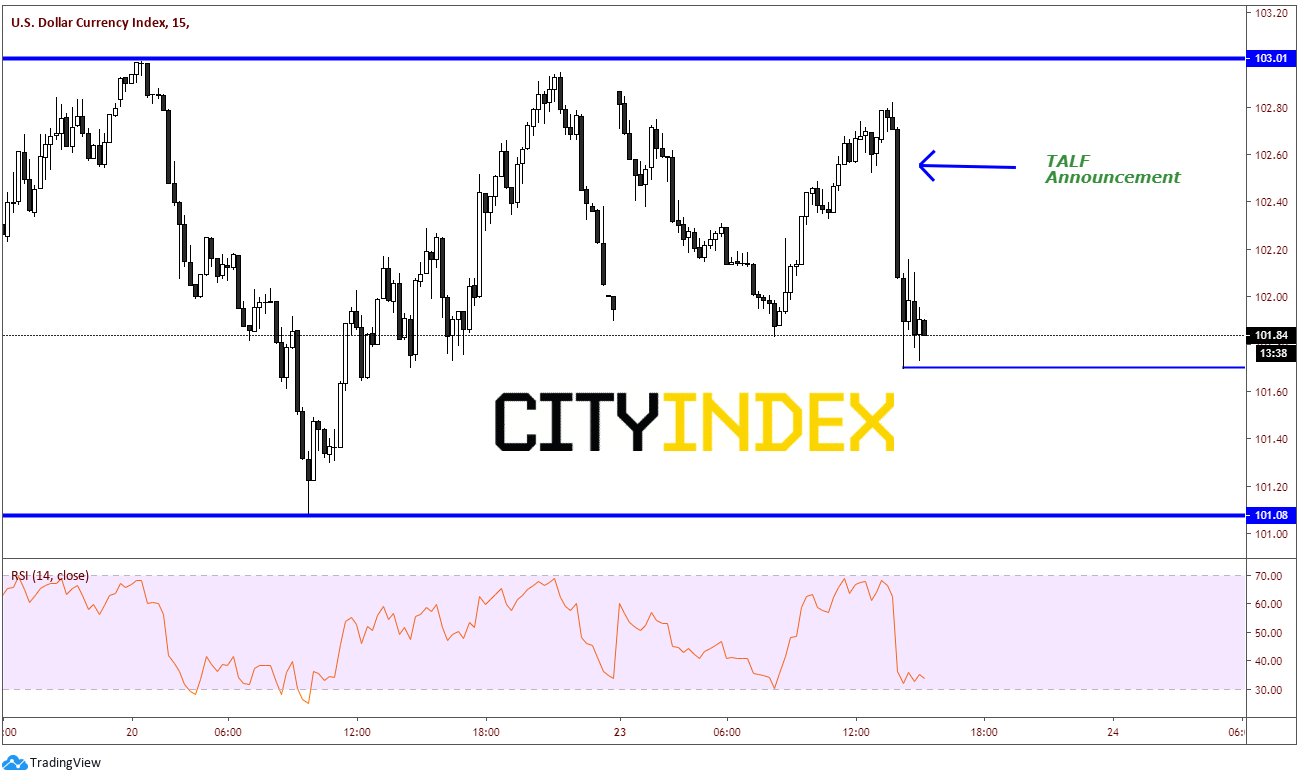

Watch the DXY! The Fed is flooding system with US dollars. Theoretically, more supply of US Dollars should push the price of the DXY lower. Since the announcement, the DXY has moved from 102. 71 to 101.70. If the DXY does move higher, this will signal that the demand for US Dollars is overwhelming the supply and the aggressive Fed measures may not be enough. There really isn’t any resistance until Friday’s highs near 103. First support is at today’s lows near 101.70. Support below that at Fridays lows of 101.09.

Source: Tradingview, City Index

As governments continue to provide more and more stimulus to global economies it will be important to watch the reaction in the markets. The main question will be: Is it enough?