Short-term technical outlook on AUD/JPY (Tues, 04 Jun)

click to enlarge charts

Key elements

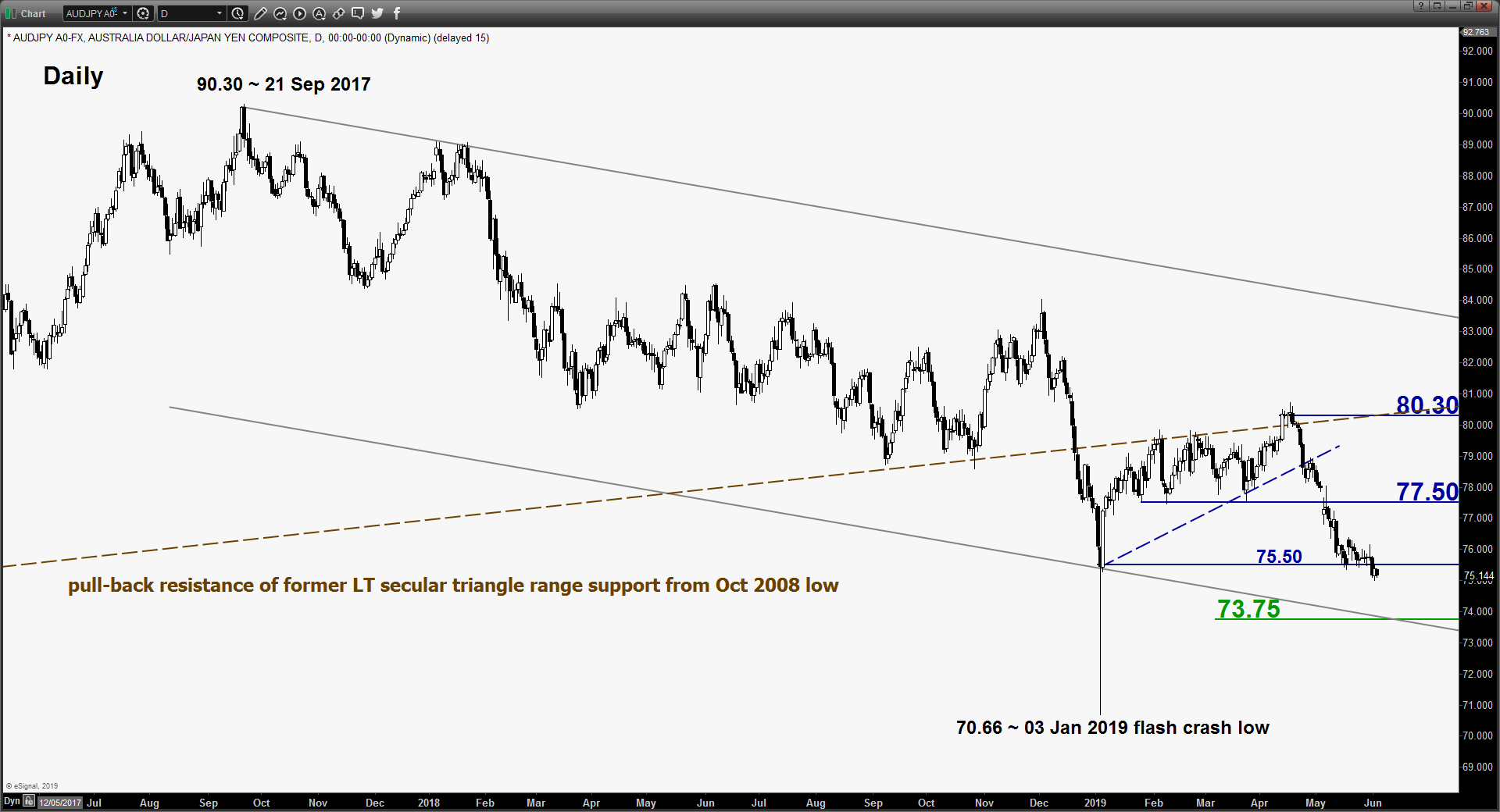

- Since 17 Apr 2019 high of 80.71, the AUD/JPY cross pair has been evolving within a medium-term downtrend within a descending channel on the backdrop of heightened risk aversion from trade tensions between U.S. and China (now spreading to other nations; Mexico & India) and the increasing odds of future interest rate cuts by Australian central bank, RBA.

- RBA monetary policy decision will be announced later today at 0430 GMT where markets have almost priced in fully a rate cut by 25bps to take the key policy cash rate down to 1.25%. The key will be the future guidance provided by RBA in its monetary policy statement on hints or economic grounds for further rate cuts down the road.

- In the shorter-term, the AUD/JPY has retested the minor pull-back of the former “Symmetrical Triangle” range support in yesterday, 03 Jun European session before it retreated in the U.S. session and a follow through in today, 04 Jun Asian session with a lower low (current intraday Asian session low at 75.08).

- Short-term momentum remains negative as indicated by the hourly RSI oscillator which still has further room to manoeuvre to the downside before it reaches an extreme oversold level at 16.

- The next significant supports rest at 74.30 (potential breakout exit target from the minor “Symmetrical Triangle” range) and 73.75/50 (the lower boundary of the major descending channel in place since 21 Sep 2017 and the 1.00 Fibonacci expansion of the down leg sequence from 17 Apr 2019 high to 25 Apr 2019 low projected from 30 May 2019 high)

- The key short-term resistance stands at 75.50/60 which is also the upper boundary of the medium-term descending channel from 17 Apr 2019 high.

Key Levels (1 to 3 days)

Pivot (key resistance): 75.60

Supports: 74.30 & 73.75/55

Next resistances: 76.40

Conclusion

If the 75.60 key short-term pivotal resistance is not surpassed, the AUD/JPY is likely to shape a further potential downleg to target the next supports at 74.30 and 73.75/55 next.

However, a break with an hourly close above 75.60 indicates a failure bearish breakdown from the “Symmetrical Triangle” range to see a squeeze up towards the next intermediate resistance at 76.40.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM