Short-term technical outlook on Hang Seng Index/Hong Kong 50 (Wed 10 Jul)

click to enlarge charts

Key technical elements

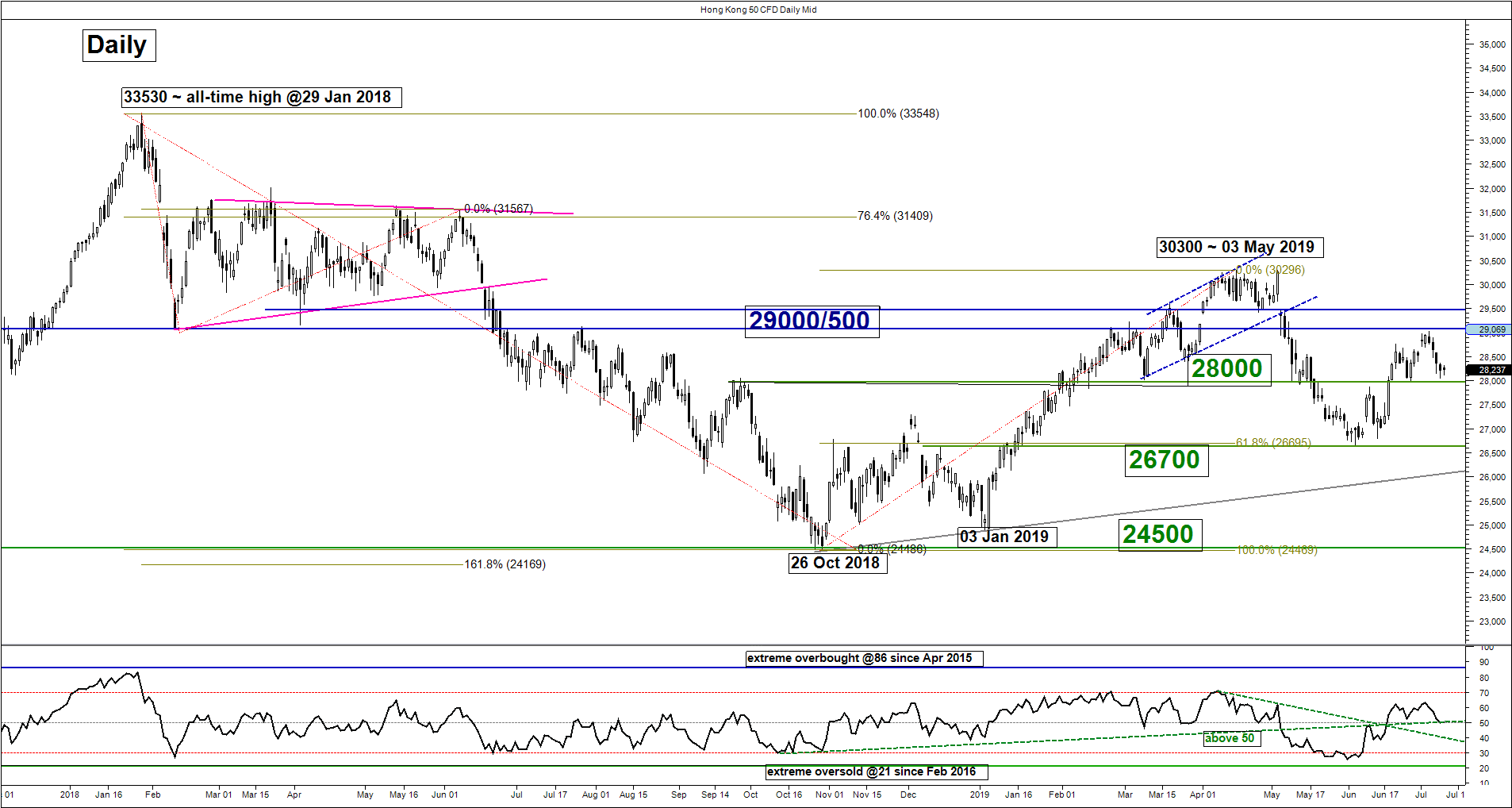

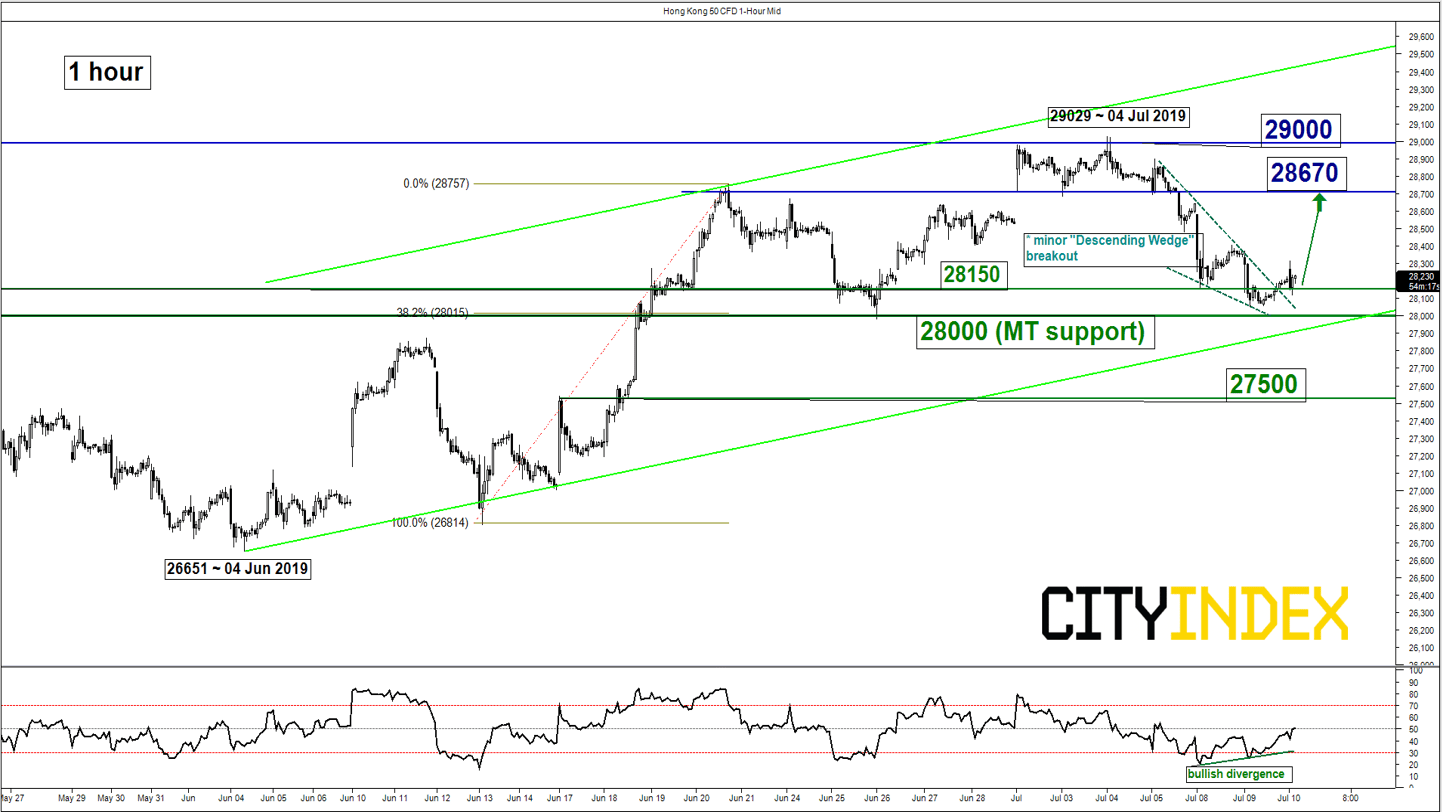

- The recent 3-days of consecutive decline from the 04 Jul high of 29029 by a magnitude of 3.3% on the Hong Kong 50 Index (proxy for the Hang Seng Index futures) has almost reached the predefined key medium-term pivotal support of 28000 (click here for a recap on our latest weekly outlook report).

- Bullish elements have been surfaced at this juncture where the Index has just staged a bullish breakout from a minor “Descending Wedge” range configuration coupled with a bullish divergence signal seen in the hourly RSI oscillator at its oversold region.

- The significant intermediate resistance stands at 28670.

Key Levels (1 to 3 days)

Intermediate support: 28150

Pivot (key support): 28000

Resistances: 28670 & 29000

Next support: 27500

Conclusion

Therefore, the Hong Kong 50 Index is likely to stage a potential bullish reversal to kickstart another round of impulsive upleg sequence. If the 28000 key medium-term pivotal support continues to hold, the Index may see a further push up to target the 28670 intermediate resistance in the first step.

However, a break with daily close below 28000 invalidates the recovery scenario to see the continuation of the down move towards the next support at 27500 (61.8% Fibonacci retracement of the previous up move from 04 Jun low to 04 Jul 2019 high).

Charts are from City Index Advantage TraderPro