Short-term technical outlook on Nikkei 225/Japan 225 (Tues 28 May)

click to enlarge chart

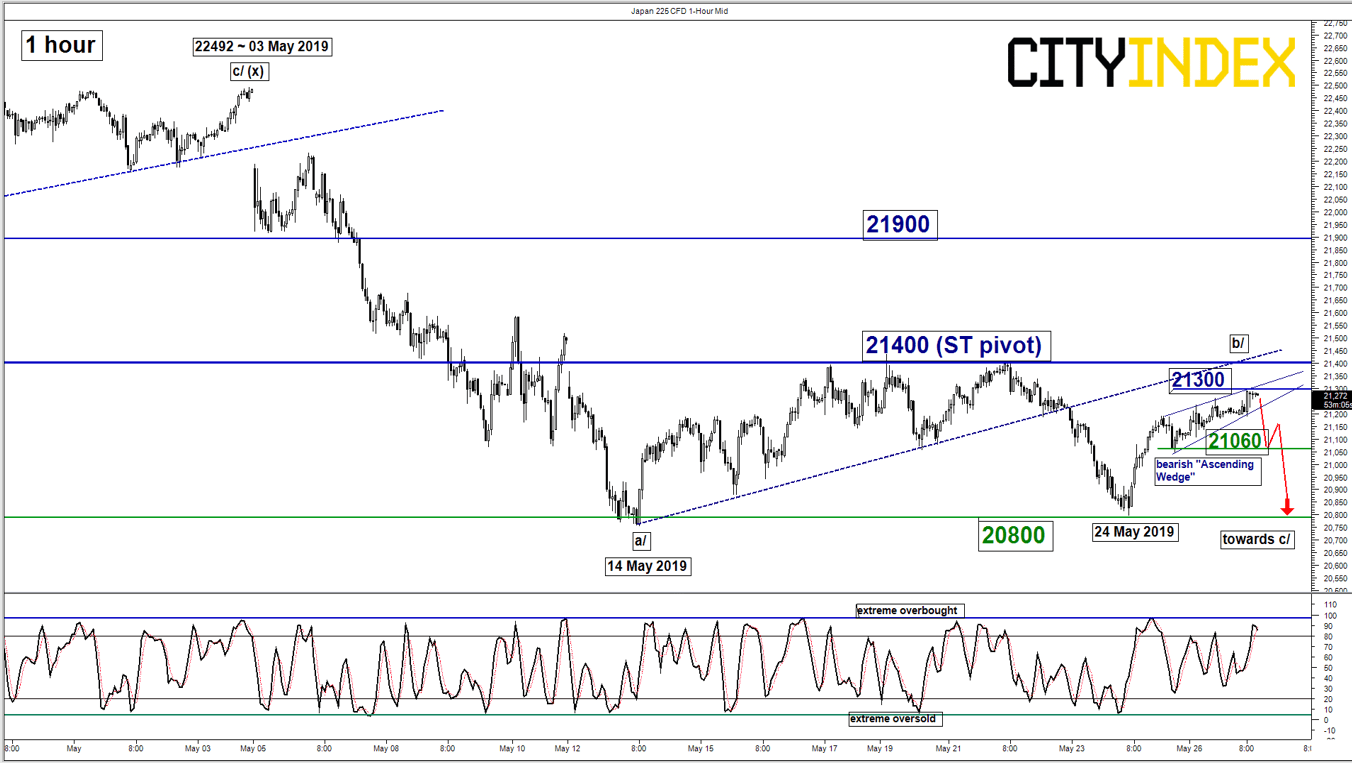

Key technical elements

- The on-going rebound of 2.4% seen in the Japan 225 Index (proxy for the Nikkei 225 futures) from last Fri, 24 May Asian session low of 20797 has almost reached its minor range resistance of 21400.

- Interestingly, it has started to exhibit bullish exhaustion signals as price action has formed a minor bearish “Ascending Wedge” configuration in place since 24 May 2019, U.S. session low of 21047 with an extreme overbought reading seen in the hourly Stochastic oscillator.

- The significant near-term support to watch will be at 20800 as defined by the minor range bottom in place since 14 May 2019.

Key Levels (1 to 3 days)

Intermediate resistance: 21300

Pivot (key resistance): 21400

Supports: 21060 & 20800

Next resistance: 21900 (key medium-term pivot)

Conclusion

If the 21400 key short-term pivotal resistance is not surpassed, the Index may see a further potential push down to target 21060 follow by the minor range support at 20800 in the first step.

On the other hand, a clearance with an hourly close above 21400 sees an extension of the corrective rebound towards the 21900 key medium-term pivotal resistance as per highlighted in our latest weekly technical outlook report (click here for a recap).

Charts are from City Index Advantage TraderPro