Short-term technical outlook on Nasdaq 100/US Tech 100 (Tues 21 May)

click to enlarge charts

Key technical elements

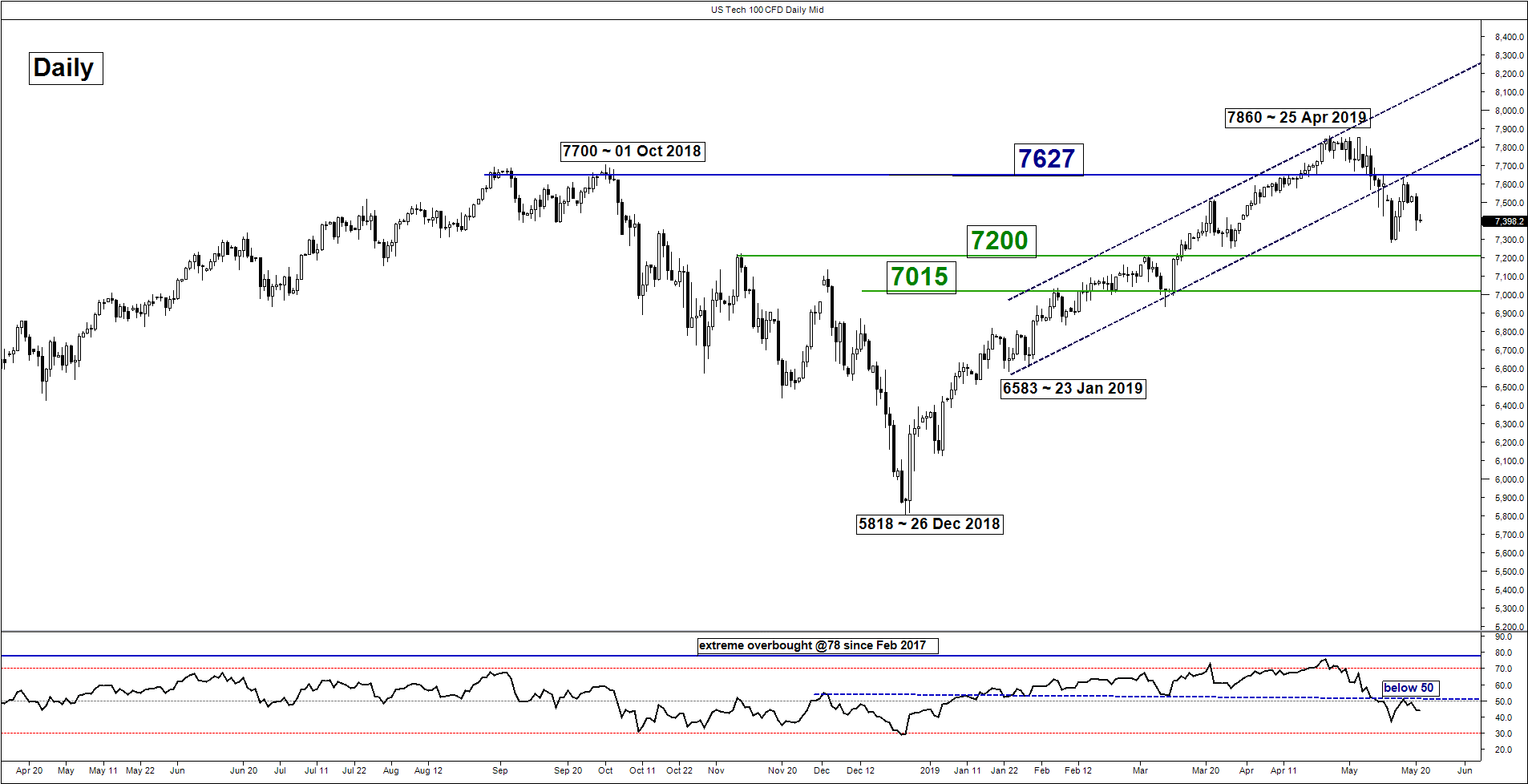

- The prior 3-day rally of 4.7% of the US Tech 100 Index (proxy for the Nasdaq 100 futures) from its 14 May 2019 swing low area of 7300 has stalled right at a medium-term resistance of 7627 on last Thurs, 16 May which is the former ascending channel support from 23 Jan 2019 low.

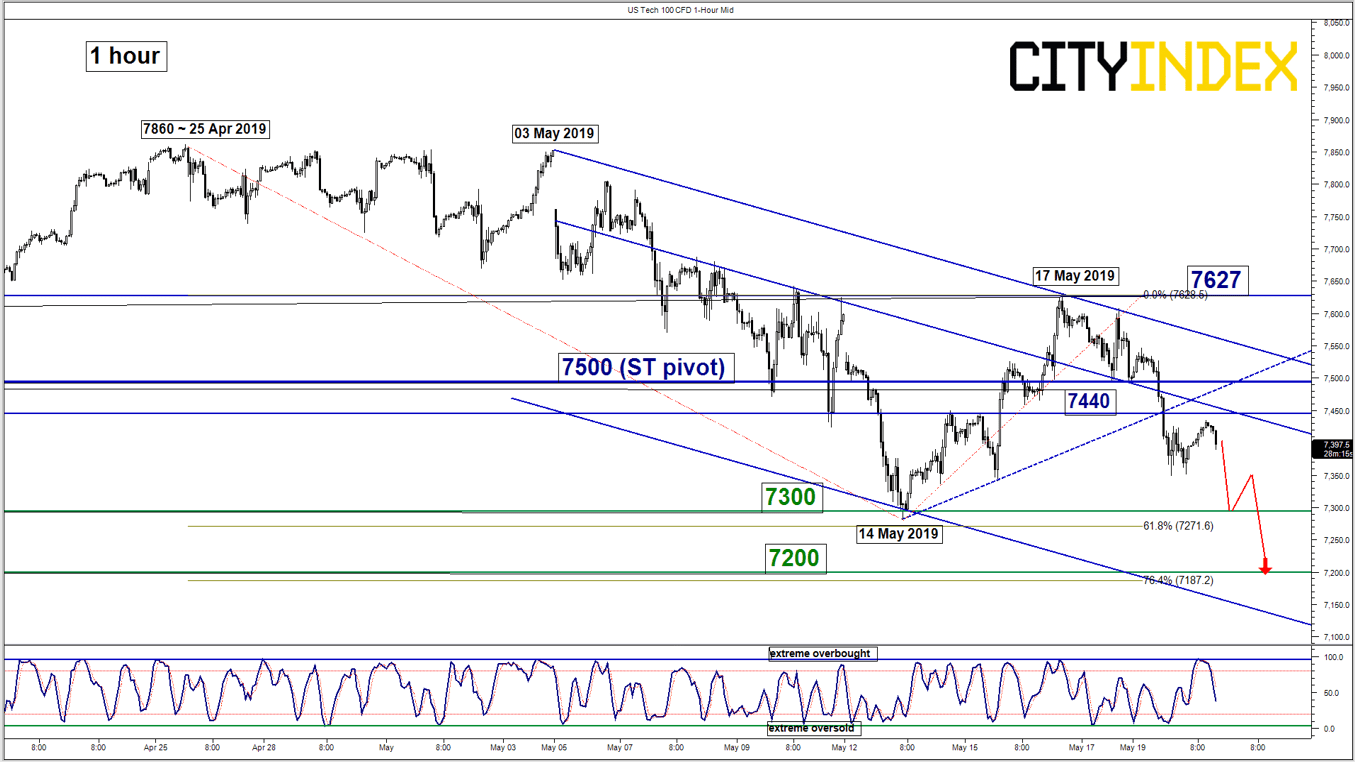

- Since its last Fri, 18 May, the Index has staged a decline of 3.6% to print a low of 7349 in yesterday, 20 May U.S. session before a rebound of 1.15% has materialised in today’s Asian session to print a current intraday high of 7434.

- Momentum remains negative as the daily RSI has tested and inched down from a corresponding significant resistance at the 50 level. In addition, the shorter-term hourly Stochastic oscillator has exited from its overbought region.

- Key short-term resistance stands at 7500 which is defined the former minor ascending support from 14 May 2019 low and the 50% Fibonacci retracement of the recent decline form 17 May high to 20 May 2019 low.

- The next significant near-term support rests at 7200 which is defined by the former medium-term swing high of 08 Nov 2018 and 0.764 Fibonacci expansion of the down move from its current all-time high level printed on 25 Apr 2019 to 14 May 2019 low projected from 17 May 2019 high.

Key Levels (1 to 3 days)

Intermediate resistance: 7440

Pivot (key resistance): 7500

Supports: 7300 & 7200

Next resistance: 7627 (medium-term pivot)

Conclusion

If the 7500 key short-term pivotal resistance is not surpassed, the US Tech 100 is likely to shape another potential impulsive downleg to retest 7300 before targeting the next support at 7200.

On the other hand, a break with an hourly close above 7500 invalidates the bearish scenario for a corrective rebound to test 7627 medium-term pivotal resistance again.

Charts are from City Index Advantage TraderPro

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM