Short-term technical outlook on Nasdaq 100/US Tech 100 (Tues 18 Jun)

click to enlarge charts

Key technical elements

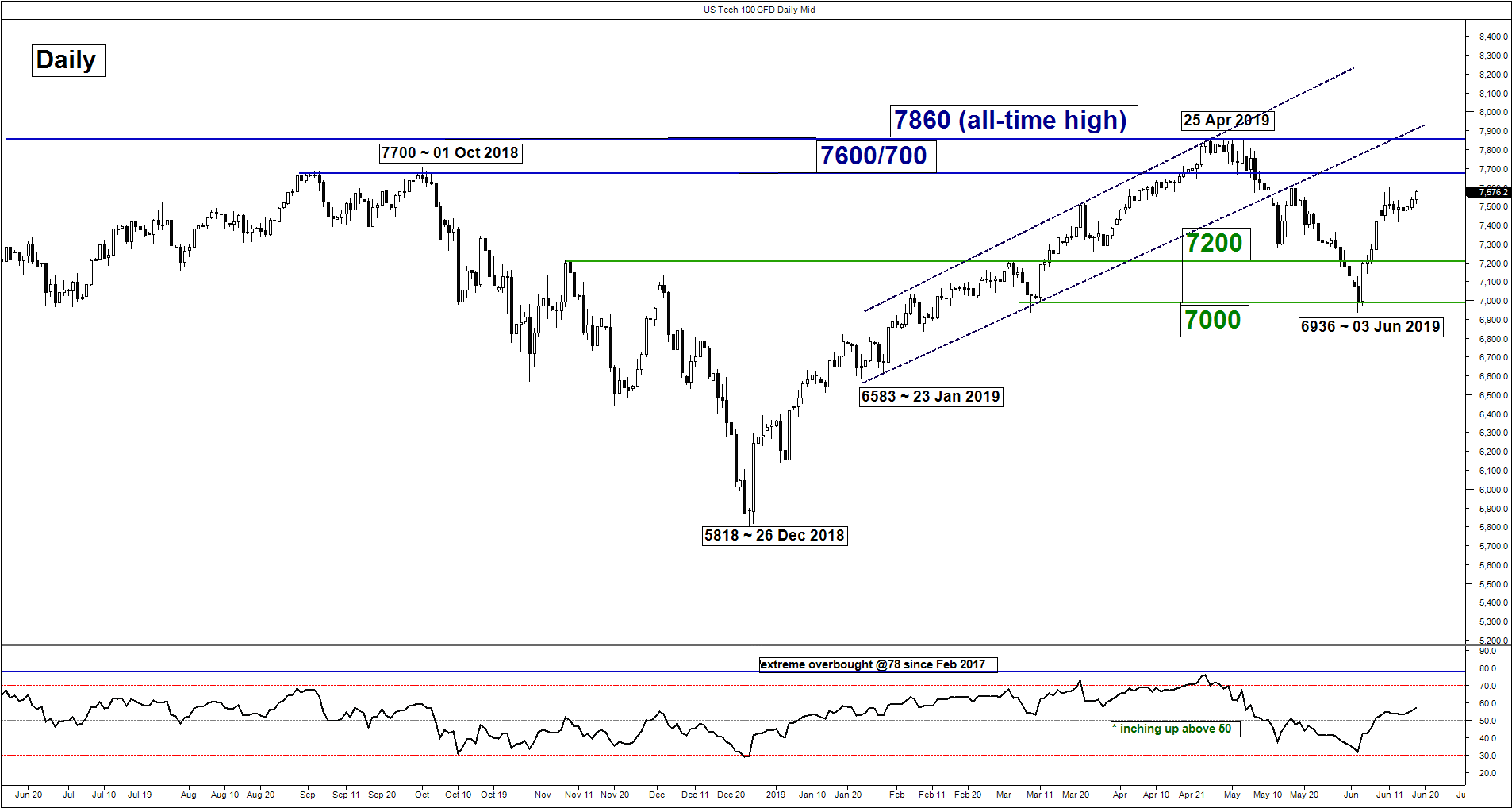

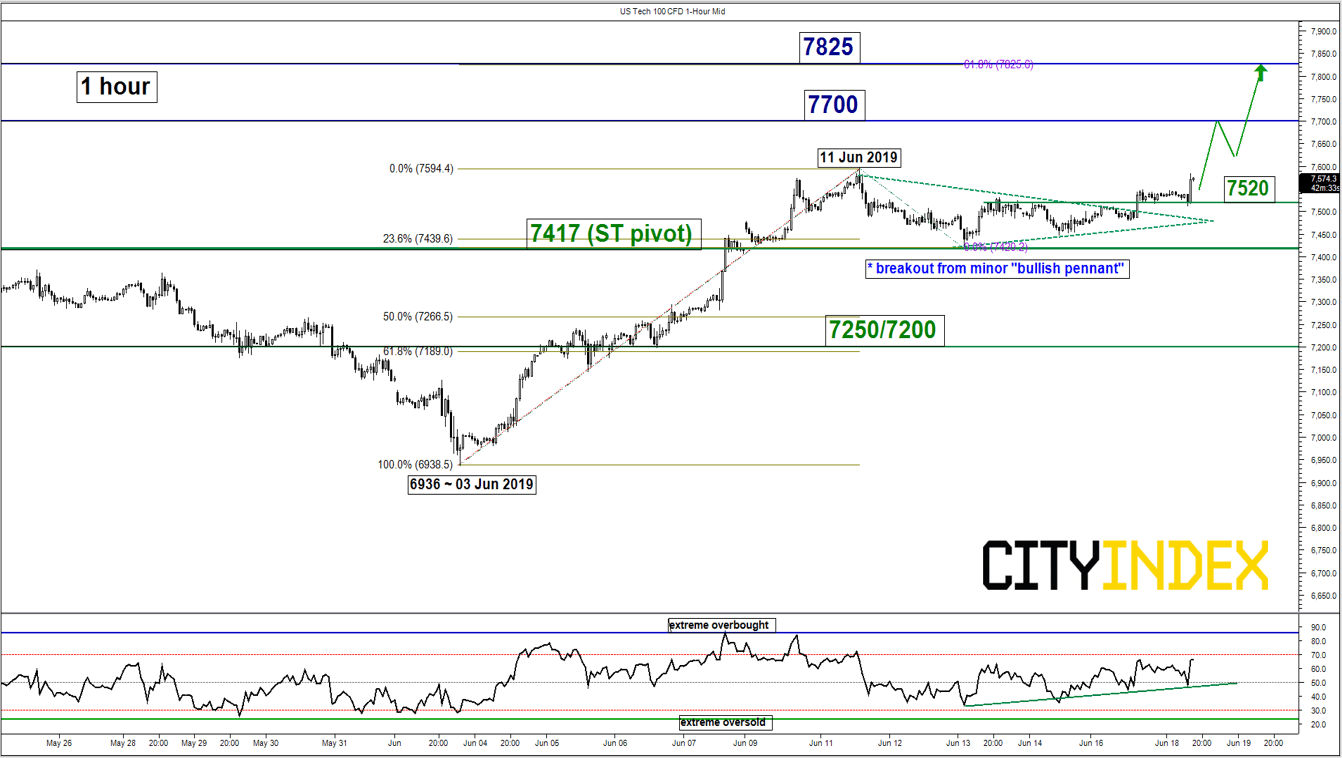

- Since our previous “Featured Trade” report published on the US Tech 100 Index (proxy for the Nasdaq 100 futures) on last Tues, 12 Jun, the Index has staged the expected minor corrective pull-back/decline to print a low of 7417 on 13 June but fell short of our target/support of 7350. Click here for a recap.

- Momentum from short to medium-term has turned positive as indicated by both the daily and hourly RSI oscillators.

- In today’s European session, the Index has shaped a breakout from its minor “bullish pennant” contracting range configuration which has been reinforced by a dovish speech from ECB President Draghi in an ECB forum in Portugal. Draghi has emphasised that ECB has the available tools and the willingness to cut interest rates again or provide another round of QE if inflation does not reach ECB’s intended target.

- Thus, it is likely that the Index has ended the minor corrective pull-back and it is shaping another potential impulsive upleg sequence within its medium-term uptrend in place since 03 Jun 2019 low of 6936.

Key Levels (1 to 3 days)

Intermediate support: 7250

Pivot (key support): 7417

Resistances: 7700 & 7825 (Fibonacci expansion)

Next support: 7250/7200

Conclusion

If the 7250 key short-term medium-term pivotal support holds, the Index is likely to shape another potential upleg to target the next resistances at 7700 (30 Aug/01 Oct 2018 swing highs) and 7825 next in the first step.

On the other hand, a break with an hourly close below 7417 invalidates the bullish scenario for an extension of the minor corrective pull-back towards the key medium-term pivotal support zone of 7250/7200 (also the 50%/61.8% Fibonacci retracement of the recent rally from 03 Jun 2019 low to 11 Jun 2019 high).

Charts are from City Index Advantage TraderPro