Short-term technical outlook on GBP/JPY (Tues 11 Jun)

click to enlarge charts

Key elements

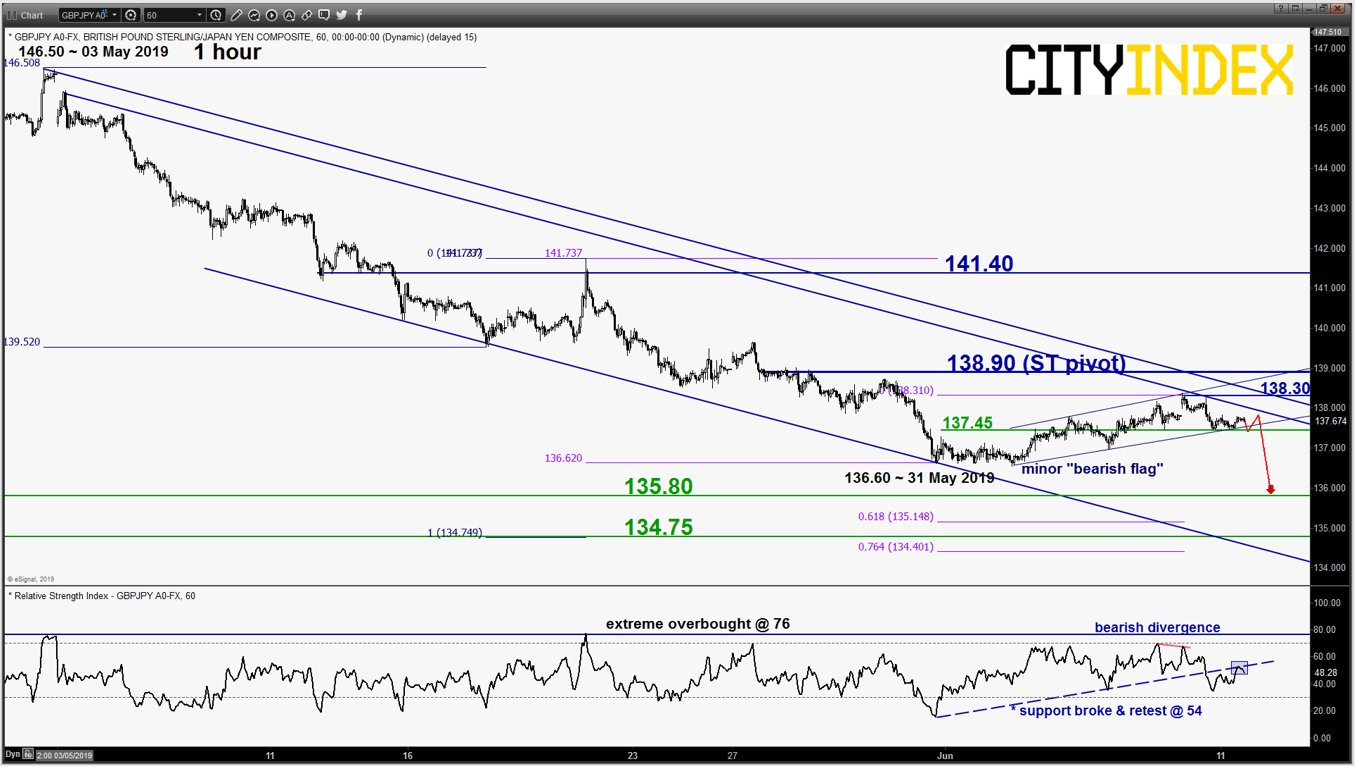

- Since its 31 May 2019 low of 136.60, the GBP/JPY cross pair has been evolving in a minor “bearish flag” ascending range configuration within a medium-term descending channel in place since 03 May 2019 high of 146.50.

- Short-term momentum has turned negative as the hourly RSI oscillator has shaped a prior bearish divergence signal at its overbought region and staged a break below a significant corresponding support (similar parallel support with the “bearish flag” support).

- Key short-term resistance stands at 138.90 which is defined by the upper boundary of the medium-term descending channel and a Fibonacci retracement/expansion cluster.

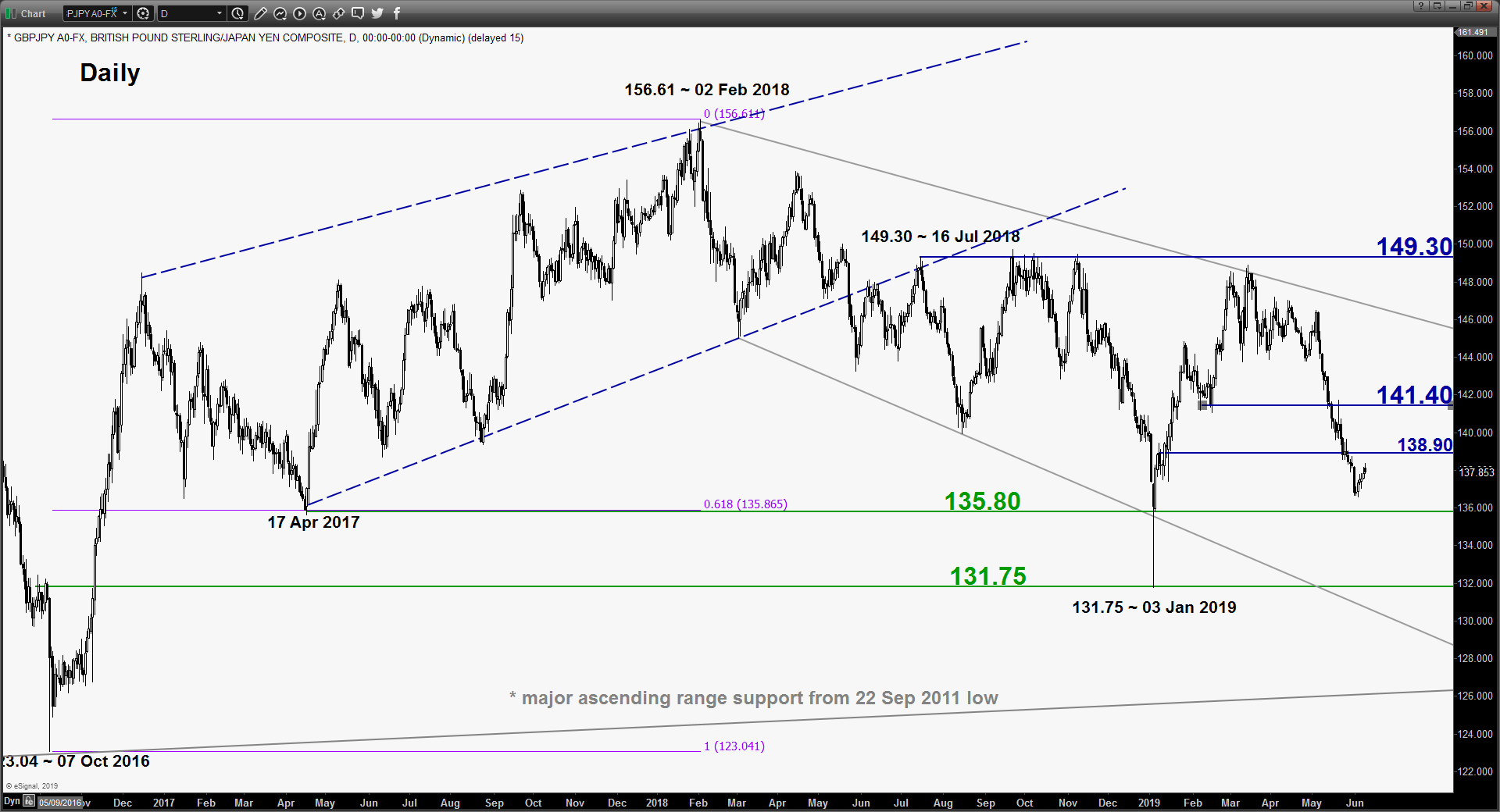

- The key support to watch will at 135.80; the major swing low areas of 17 Apr 2017 and 03 Jan 2019 flash crash low.

Key Levels (1 to 3 days)

Pivot (key resistance): 138.90

Supports: 137.45 & 135.80

Next resistance: 141.40

Conclusion

If the 138.90 key short-term pivotal resistance is not surpassed and a break below 137.45 is likely to see a further potential drop for the GBP/JPY to test its major support at 135.80.

On the other hand, an hourly close above 137.45 negates the bearish tone for a squeeze up towards the medium-term resistance at 141.40 (former swing low areas of 07/15 Feb 2019 & 50% Fibonacci retracement of the decline from 03 May 2019 high to 03 Jun 2019 low).

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM