Short-term technical outlook on EUR/GBP (Thurs 20 Jun)

click to enlarge charts

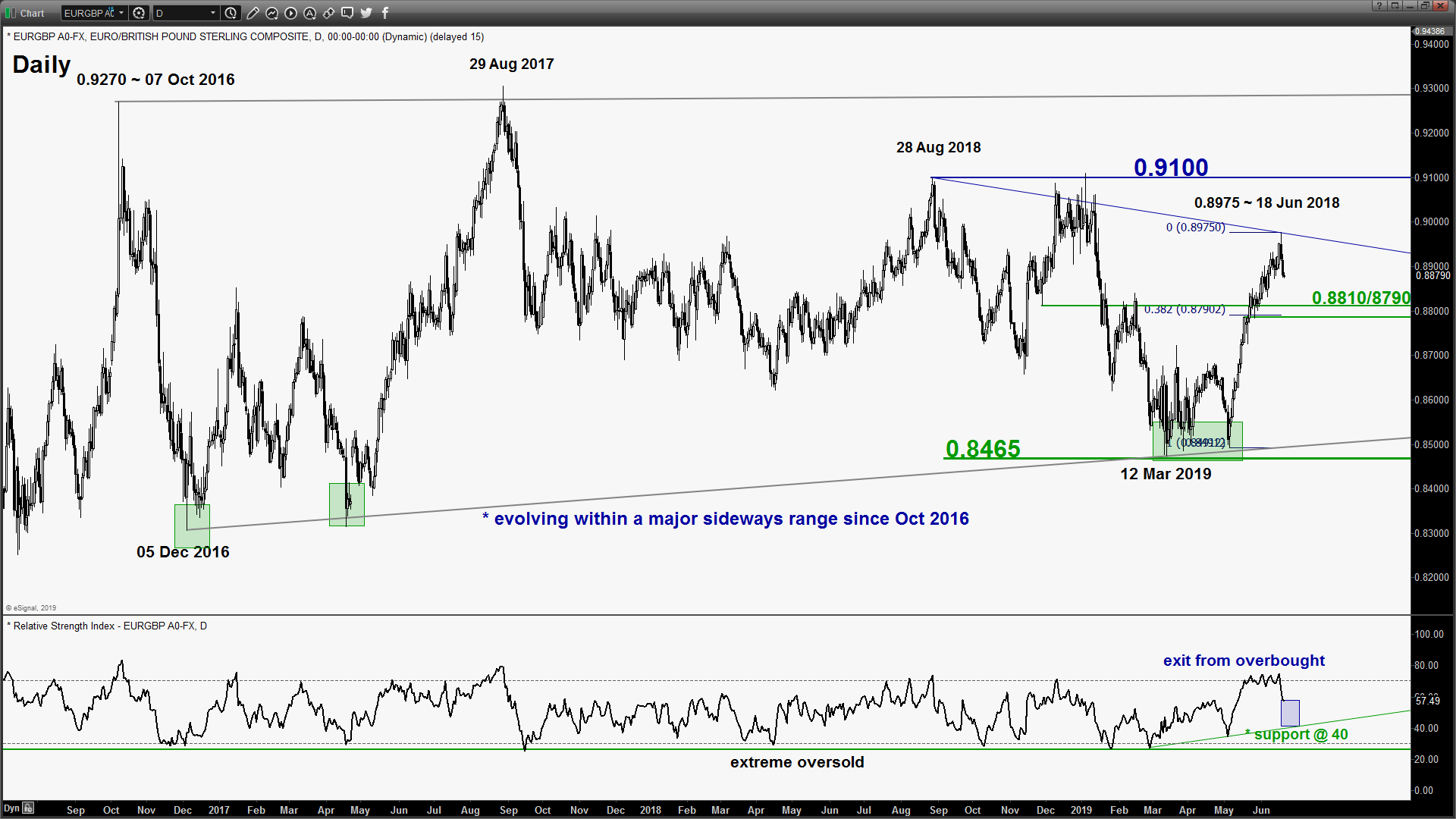

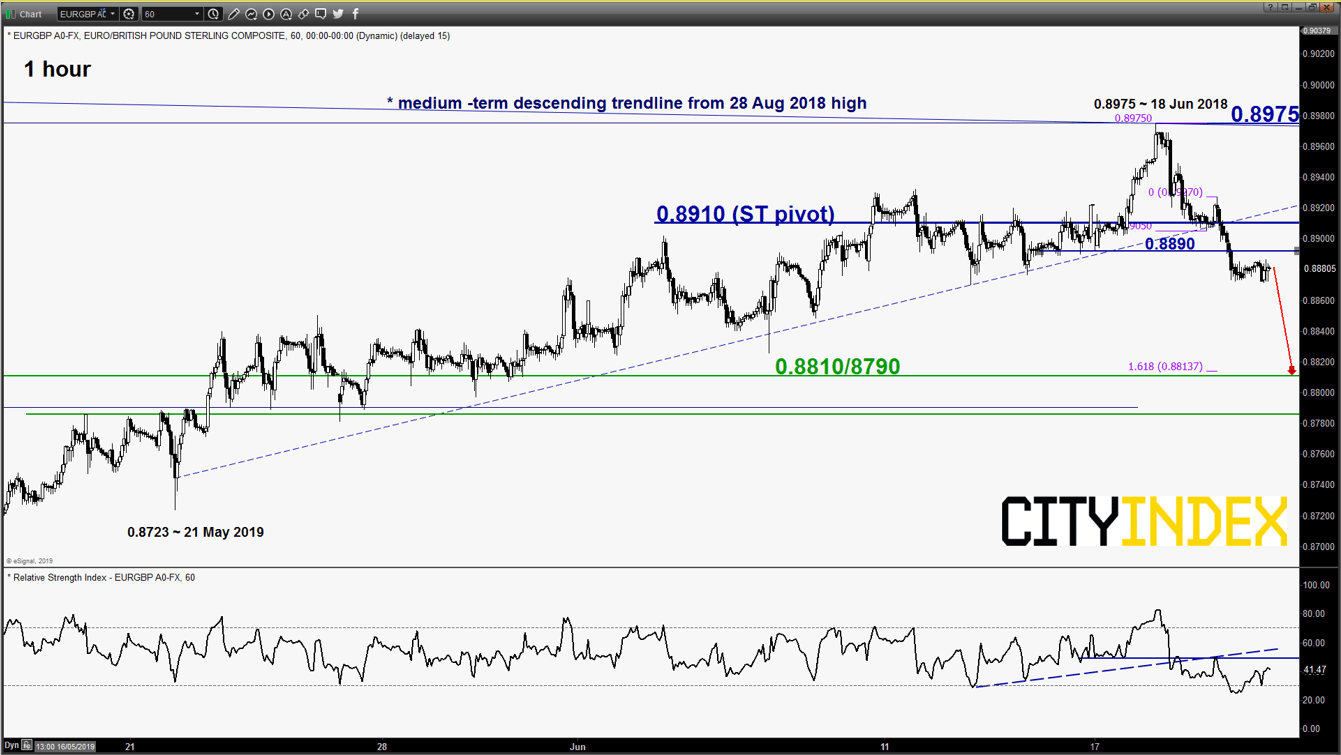

- The recent 7-weeks of rally from 06 May 2019 low of 0.8491 has stalled at a recent high of 0.8975 printed on 18 Jun 2019 which also coincides with a medium-term descending trendline resistance from 28 Aug 2018 high.

- The cross pair has retreated by 107 pips and broken below a minor ascending trendline support from 21 May 2018 swing low to print a current intraday low of 0.8871.

- Momentum remains negative as indicated by both the daily and hourly RSI oscillators.

- The key short-term resistance stands at 0.8910.

- The significant near-term support rests at the 0.8810/8790 zone which is defined by the former swing high areas of 04/14 Feb 2019 and a Fibonacci retracement/expansion cluster.

Key Levels (1 to 3 days)

Intermediate resistance: 0.8890

Pivot (key resistance): 0.8910

Supports: 0.8810/8790

Next resistance: 0.8975

Conclusion

If the 0.8910 key short-term pivotal resistance is not surpassed, the EUR/GBP may see another minor downleg to target the next support at 0.8810/8790.

However, a clearance with an hourly close above 0.8910 invalidates the bearish scenario for a squeeze up to retest 0.8975.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM