Short-term technical outlook on CAD/JPY (Mon 08 Jul)

click to enlarge charts

Key elements

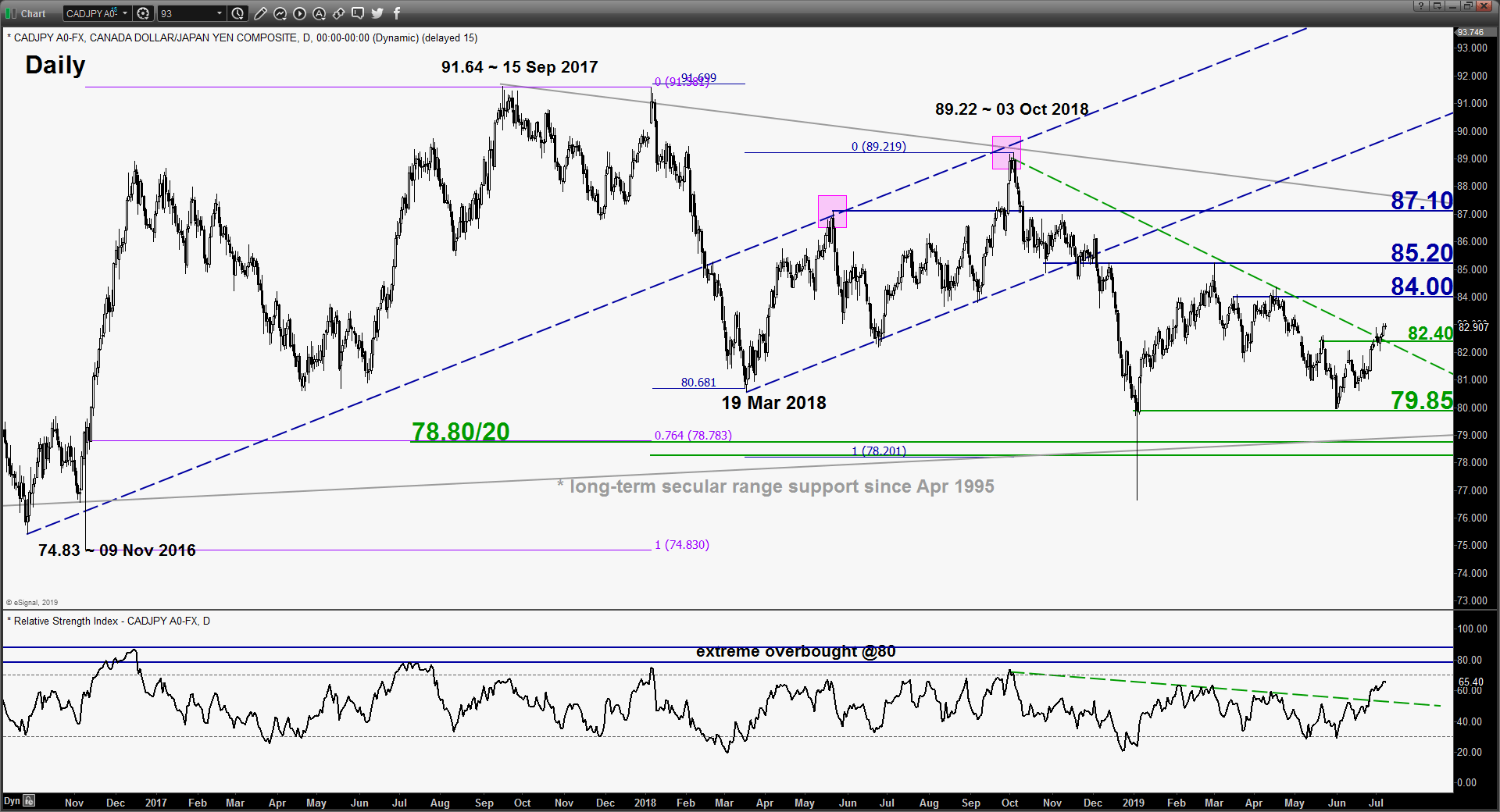

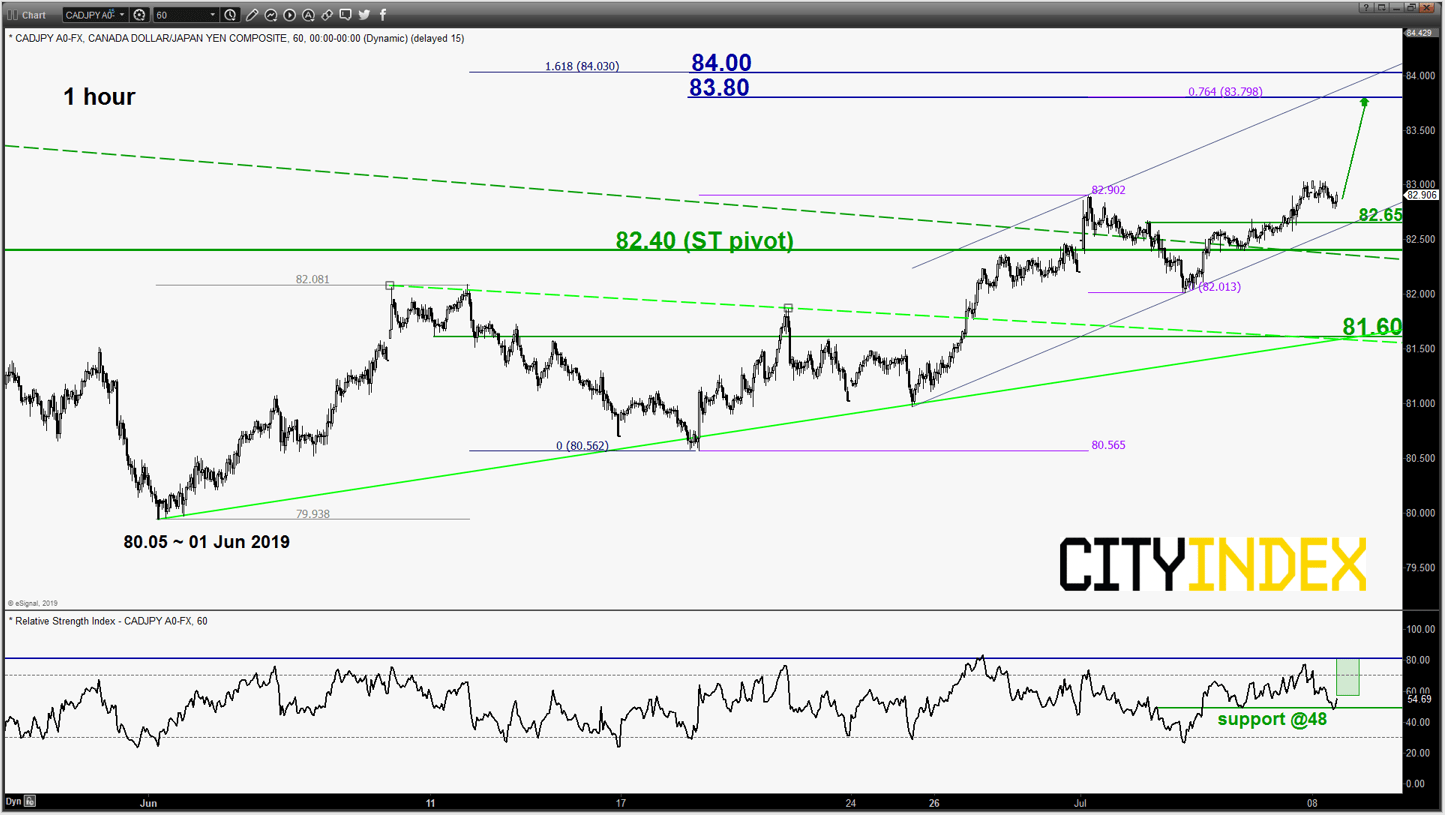

- Since its 31 May 2019 low of 79.94, the CAD/JPY cross pair has staged an up move of 270 pips and broke above a major descending trendline resistance in place since 03 Oct 2018 high on last Thurs, 04 Jul now turns pull-back support at 82.40.

- Medium to short-term momentum remains positive as indicated by the readings from both the daily and hourly RSI oscillators.

- The next significant intermediate resistance stands at the 83.80/84.00 zone which is defined by the range top from 15 Mar/17 Apr 2019, the upper boundary of the minor ascending channel from 01 Jun 2019 and a Fibonacci expansion cluster.

Key Levels (1 to 3 days)

Intermediate support: 82.65

Pivot (key support): 82.40

Resistance: 83.80/84.00

Next support: 81.60

Conclusion

If the 82.40 key short-term pivotal support holds, the CAD/JPY is likely to stage a further potential uppleg to target the 83.80/84.00 intermediate resistance zone in the first step.

However, a break with an hourly close below 82.40 negates the bullish tone for a deeper pull-back to test the medium-term support at 81.60 (also the ascending trendline from 01 Jun 2019 low).