Short-term technical outlook on CAD/JPY (Mon 17 Jun)

click to enlarge charts

Key elements

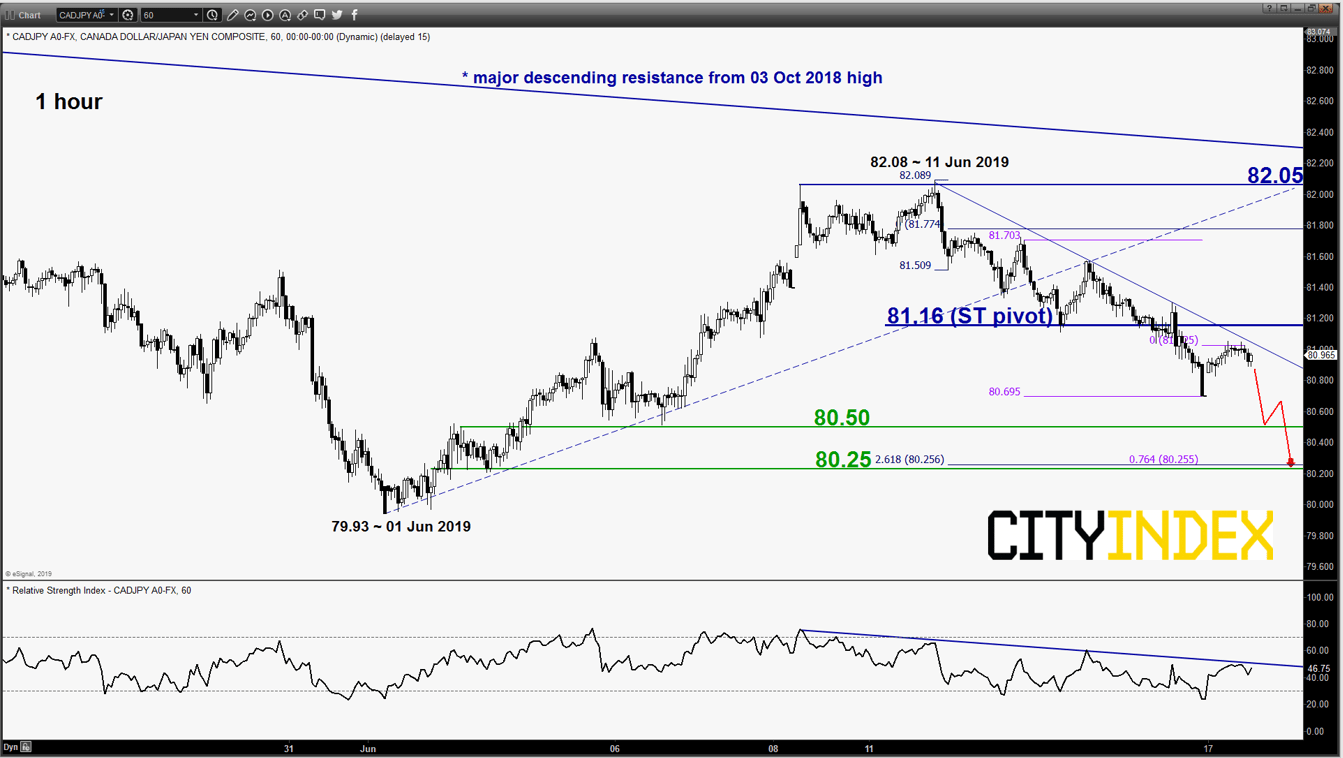

- The minor corrective up move from 01 Jun 2019 low of 79.93 has been damaged through the bearish break below its former ascending support on 12 Jun 2019.

- Momentum remains negative as indicated by the daily and 1-hour RSI oscillators.

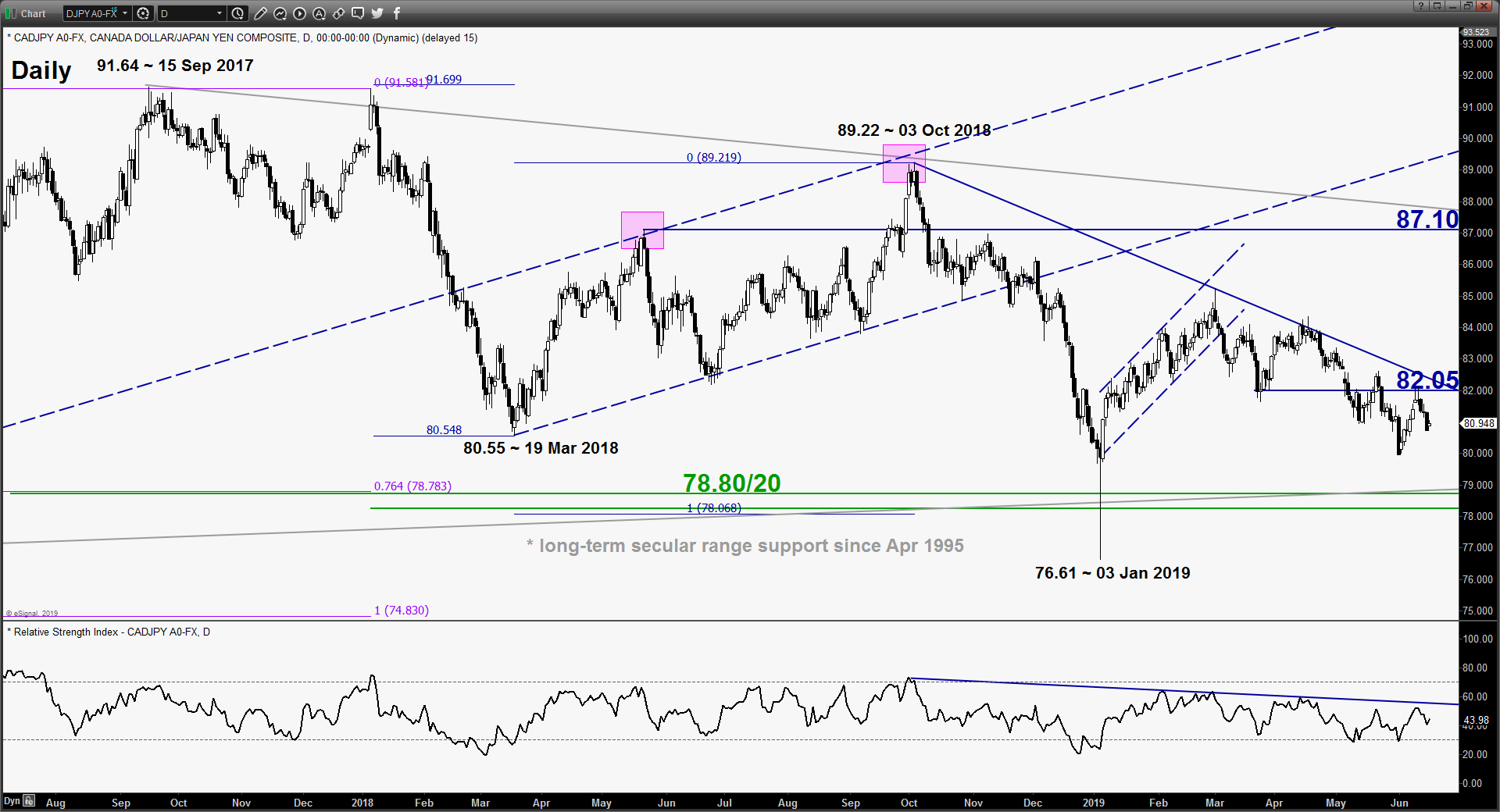

- It is likely that the CAD/JPY is now likely undergoing another minor bearish downleg within a medium-term down move sequence in place since 01 Mar 2019 high of 84.60.

- Key short-term resistance stands at 81.16 which is defined by the minor descending resistance in place since 11 Jun 2019 high and the 23.6% Fibonacci retracement of the recent decline from 11 Jun high to last Fri, 14 Jun U.S. session low of 80.86.

- The significant near-term supports rest at 80.50 and 80.25 (also a Fibonacci expansion cluster).

Key Levels (1 to 3 days)

Pivot (key resistance): 81.16

Supports: 80.50 & 80.25

Next resistance: 82.05

Conclusion

If the 81.16 key short-term pivotal resistance is not surpassed, the CAD/JPY is likely to shape another potential downleg to target the next near-term supports at 80.50 and 80.25 in the first step.

However, an hourly close above 81.16 invalidates the bearish scenario for an extension of the corrective rebound to retest the key medium-term resistance at 82.05.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM