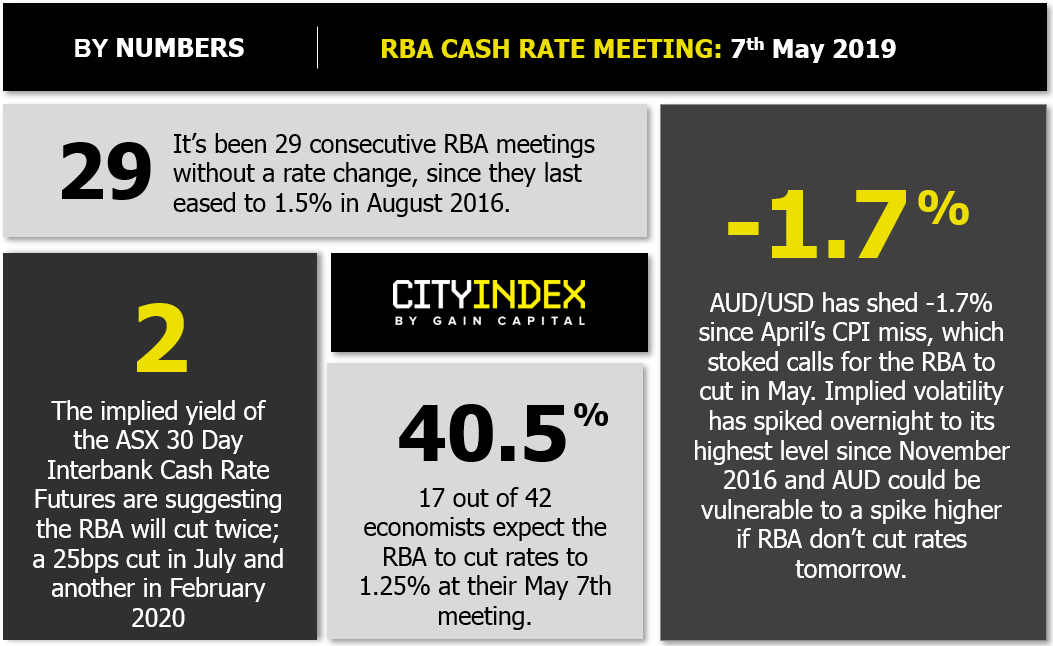

- The Australian central bank, RBA has held its key policy cash rate steady at 1.5% since its last cut in Aug 2016. On the back of the recent weak inflationary data where Q1 2019 CPI declined to 1.3% y/y, the weakest inflation growth since Jan 2017 and inflationary pressure in Australia has been continued to fall from its peak of 2.1% y/y seen in mid-2018.

- Given such lacklustre data, the financial markets have started to price in an imminent interest rate cut from the RBA where the ASX Cash Rate futures is projecting a 25bps cut in July and another cut in Feb 2020. Even a small majority of economists of 40.5% polled by Reuters are expecting a rate cut from RBA after its monetary policy meeting conclude at 0430 GMT.

- If RBA decides to put its cash rate hold tomorrow but offers a dovish guidance in its monetary policy statement to pave the way for at cut in the next July meeting, the AUD is likely to face downside pressure coupled with renewed trade tension between U.S and China after President Trump’s latest tweets on the intention to increase tariffs on Chinese imports this Friday.

Short-term technical outlook on AUD/NZD (Tues, 07 May)

click to enlarge charts

Key elements

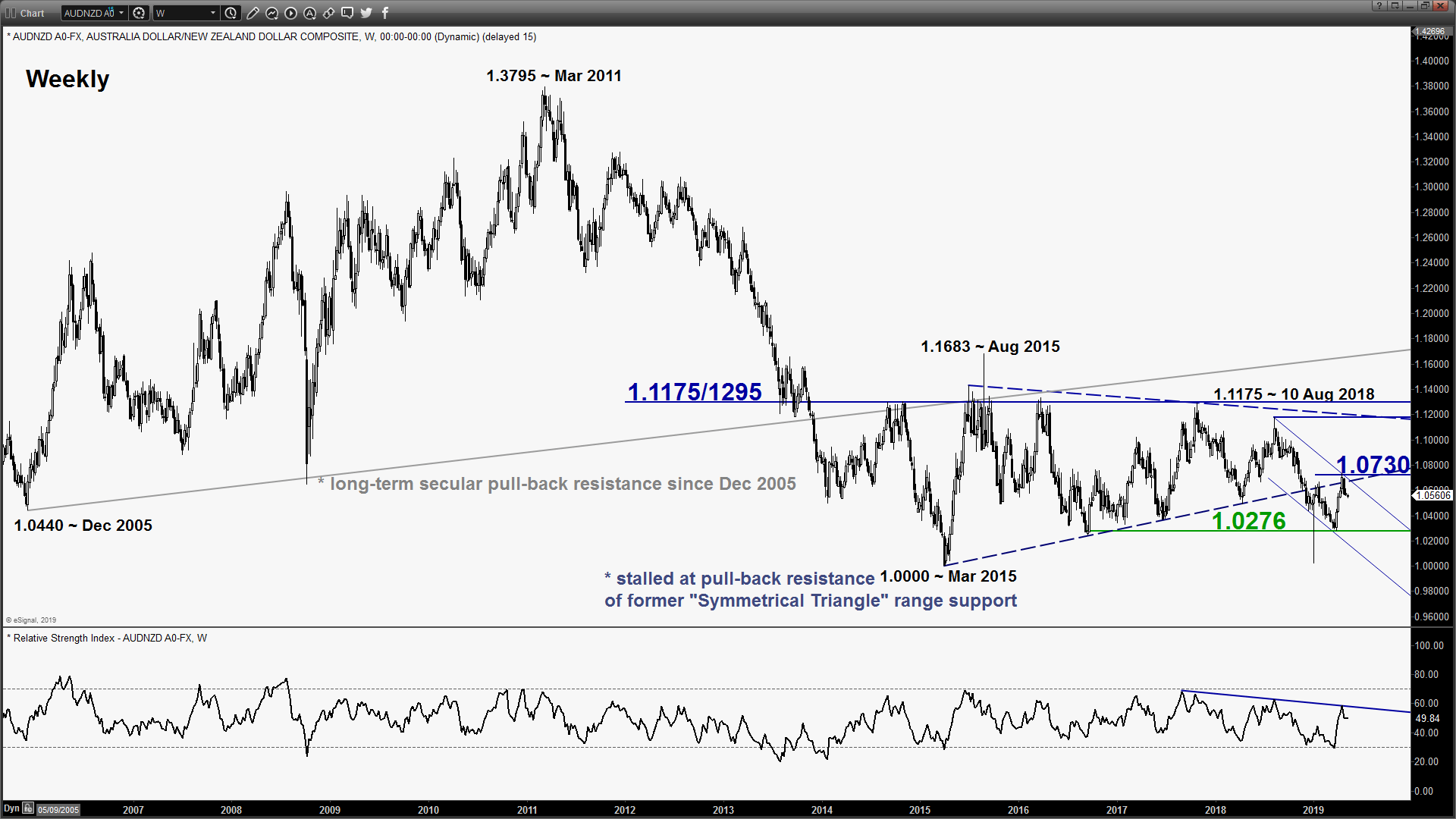

- The rebound from 25 Mar 2019 low of 1.0272 to 17 Apr 2019 high of 1.0732 has stalled at the pull-back resistance of a former major “Symmetrical Triangle” range support from Mar 2015 (see weekly chart).

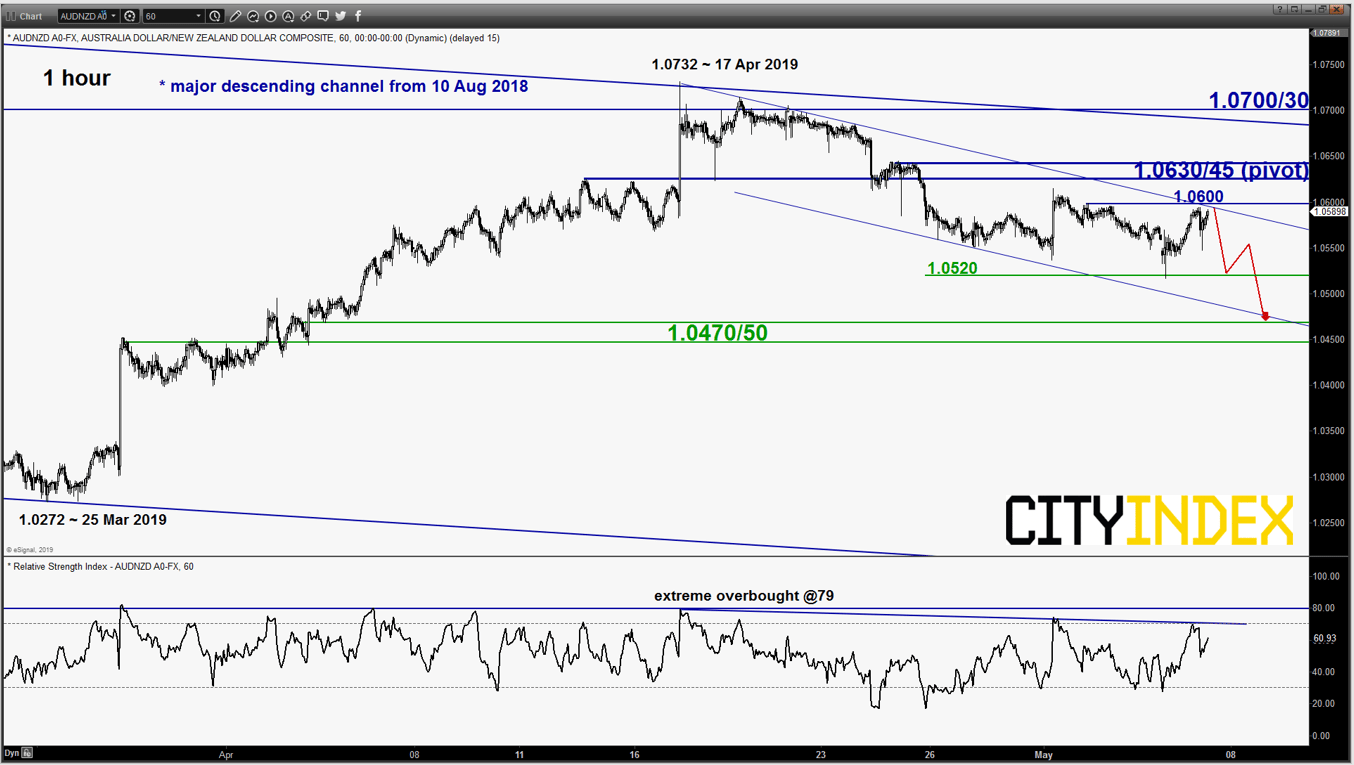

- The AUD/NZD has started to drift downwards from the 17 Apr 2019 high of 1.0732 has evolved within a minor descending channel with its upper boundary acting as an intermediate resistance at 1.0600 (see 1-hour chart).

- Hourly RSI oscillator is now coming close to its overbought region and a significant corresponding descending resistance at the 70 level. These observations suggest the price action of the cross pair shows the risk of a minor downside reversal after a rebound seen yesterday from 06 May 2019 swing low area of 1.0520.

- The next significant near-term supports at 1.0470/50 which is defined by the lower boundary of the minor descending channel and the 61.8% Fibonacci retracement of the rebound from 25 Mar 2019 low to 17 Apr 2019 high.

Key Levels (1 to 3 days)

Intermediate resistance: 1.0600

Pivot (key resistance): 1.0630/45

Supports: 1.0520 & 1.0470/50

Next resistance: 1.0700/30 (medium-term pivot)

Conclusion

If the 1.0630/45 short-term pivotal resistance is not surpassed, the AUD/NZD cross pair is likely to see another potential minor downleg to retest 1.0520 before targeting to the next support at 1.0470/50.

On the other hand, a clearance above 1.0645 invalidates the bearish scenario for a squeeze up towards 1.0700/30 key medium-term pivotal resistance (also the upper boundary of a major descending channel from 10 Aug 2018 high).

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM