Short-term technical outlook on AUD/JPY (Tues 30 Apr)

click to enlarge charts

Key elements

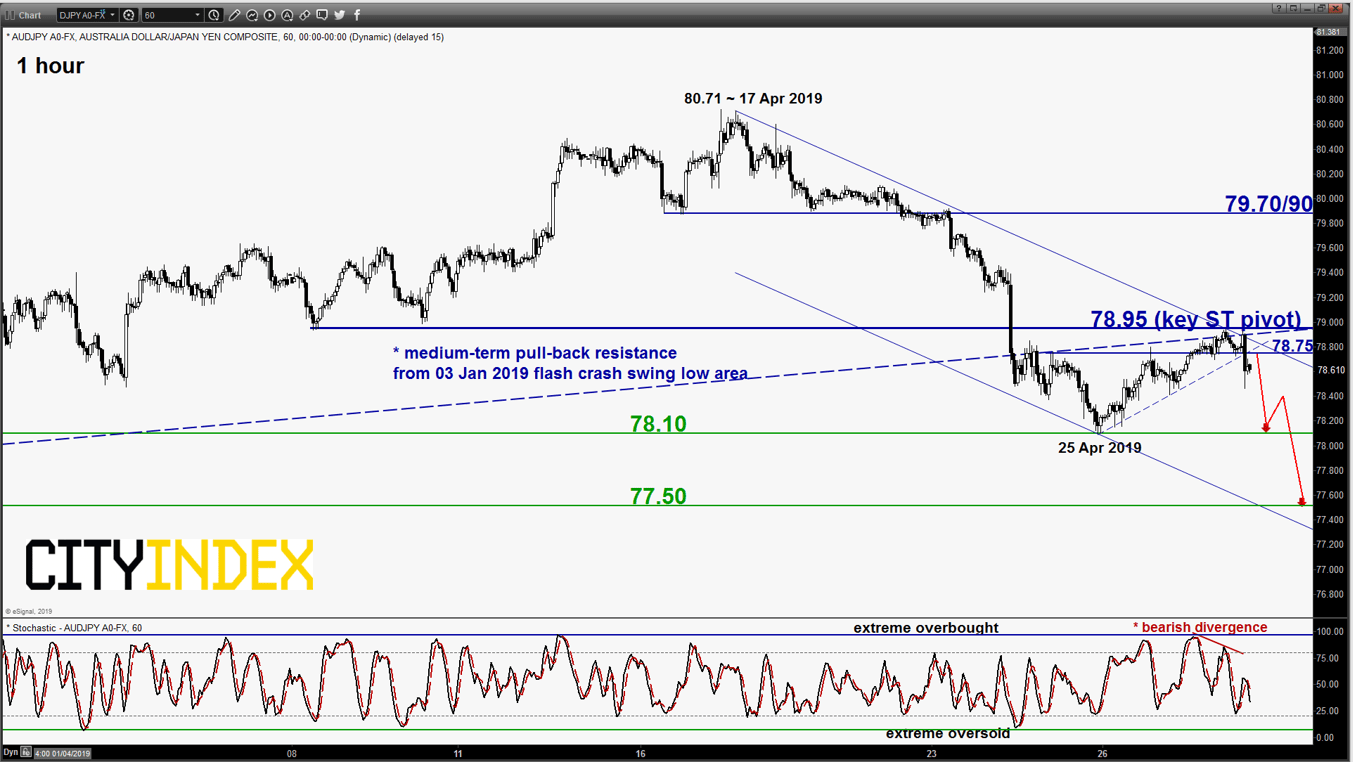

- The recent rebound seen in the AUD/JPY cross pair from its 25 Apr 2019 swing low of 78.10 has stalled and reversed down from a key short-term resistance at 78.95 (also the former medium-term ascending support from the 03 Jan 2019 flash crash swing low area).

- In addition, today’s Asian session price action of the AUD/JPY has staged a bearish breakdown below the minor ascending support from 25 Apr 2019 low now turns pull-back resistance at 78.75 on the backdrop of a lower China PMI manufacturing data for Apr; both official & Caixin (official 50.1 vs 50.5 in Mar & Caixin 50.2 vs 50.8 in Mar).

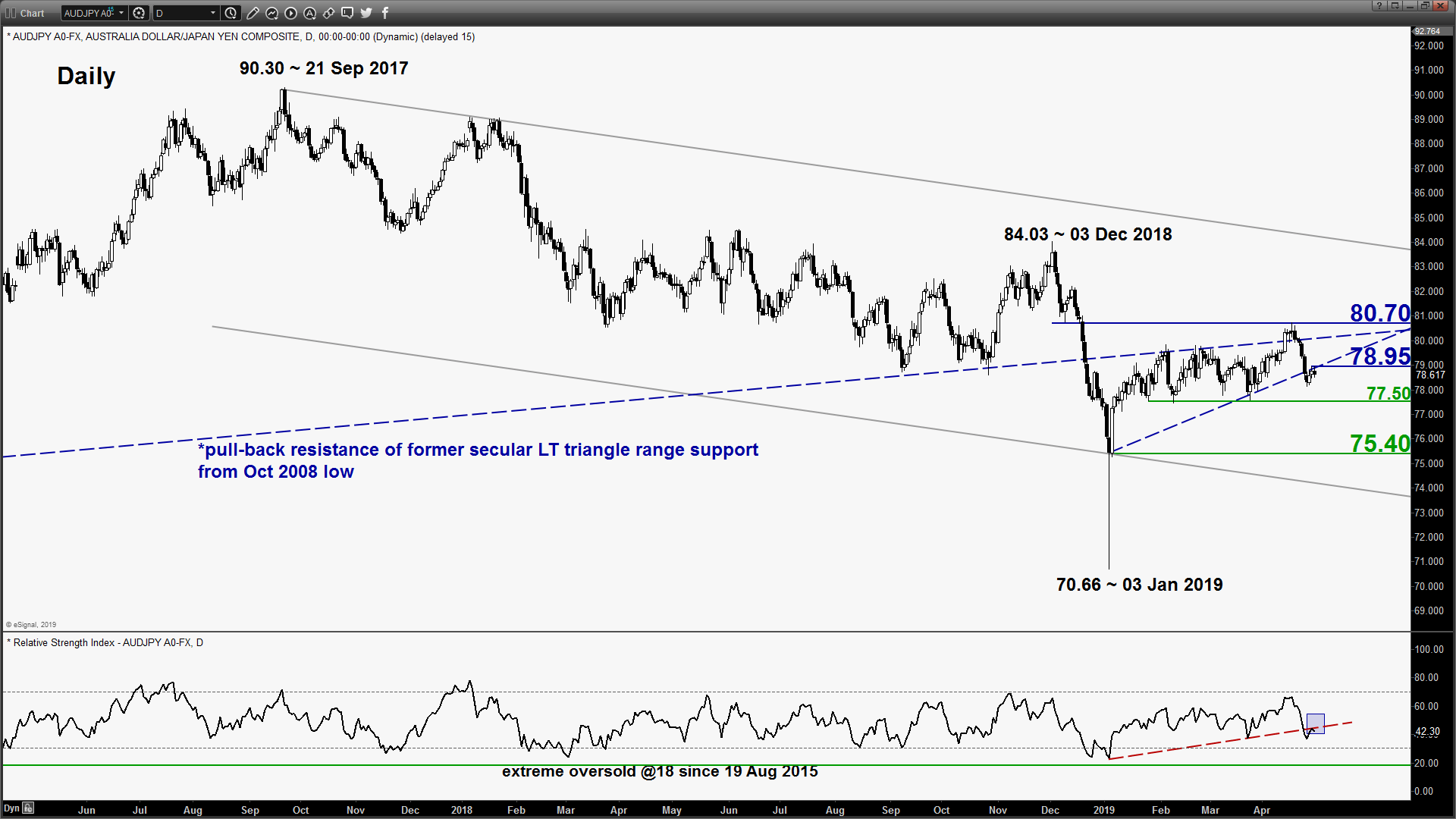

- Momentum has turned negative where the daily RSI oscillator has broken below a significant corresponding ascending support in parallel with the 03 Jan 2019 flash crash swing low and the shorter-term hourly Stochastic oscillator has flashed a bearish divergence signal at its overbought region.

- The next significant near-term supports rests at 78.10 follow by 77.50 (range support in place since 24 Jan 2019 & close to the lower boundary of the minor descending channel from 17 Apr 2019 high).

Key Levels (1 to 3 days)

Intermediate resistance: 78.75

Pivot (key resistance): 78.95

Supports: 78.10 & 77.50

Next resistance: 79.70/90

Conclusion

If the 78.95 key short-term pivotal resistance is now surpassed, the AUD/JPY is likely to see a further potential minor downleg to retest 78.10 before targeting 77.50.

On the other hand, an hourly close above 78.95 invalidates the bearish tone for an extension to the corrective rebound towards the next intermediate resistance at 79.70/90 (former minor range support of 16/18 Apr 2019 & 61.8% Fibonacci retracement of the entire slide from 17 Apr 2019 high to 25 Apr 2019 low).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM