FAANGs were clearly the winners from 2020 as the covid lockdowns accelerated a digital transformation that was already in place pre-pandemic. The stay at home orders and WFH set up has been a huge tailwind for tech stocks with the likes of Apple, Amazon, Alphabet, Facebook and Netflix picking up determinedly from mid-March weakness, ending 2020 with impressive gains across the year.

However, a closer look at the FAANGs reveals that their share price rally has lost momentum and the stocks have more recently moved sideways, with some even slipping lower.

Covid vaccine & rotation out of growth

Casting our minds back, early November was when vaccine news really picked up. Strong covid vaccine efficacy results and safety records meant that the end to the pandemic suddenly became a very real possibility. As the prospect of economies reopening has increased, stocks more closely tied to economic performance have become increasingly more in demand.

A rotation out of growth stocks and into value was clear with the Dow Jones index surging 11% across the month of November, whilst FAANGs gained a more subdued 5% on average.

Yet with the prospect of economies reopening and growth picking up, value stocks will look more attractive next to their big tech peers. The rally has started to broaden out with down beaten financials and energy stocks gaining the most since November whilst the FAANGs lagged. This trend is expected to continue.

Whilst many of aspects the digital transformation are likely to stay representing a permanent change, demand will naturally ease from its peak. That said the services businesses and subscriptions are unlikely to suddenly drop lower, customer often remained tied to the business ecosystem.Not all FAANGs are equal

It is also worth noting divergences that are appearing with the FAANG group and this will be a key theme to watch across the coming year.

In 2020 Apple’s share price and Amazon’s share price both rallied around 80% across the year. Netflix around 70% and Facebook and Alphabet gained 30% under-performing the Nasdaq which rallied 43%.

These figures show that advertising tech – those which make the majority of revenue through advertising didn’t perform so well.

Looking ahead the continued fracturing of the FAANGs group is likely, with the most bullish forecasts reserved for Apple and Amazon, whilst optimism surrounding Facebook is fading.

Learn more about trading equities.or trading with our thematic indices

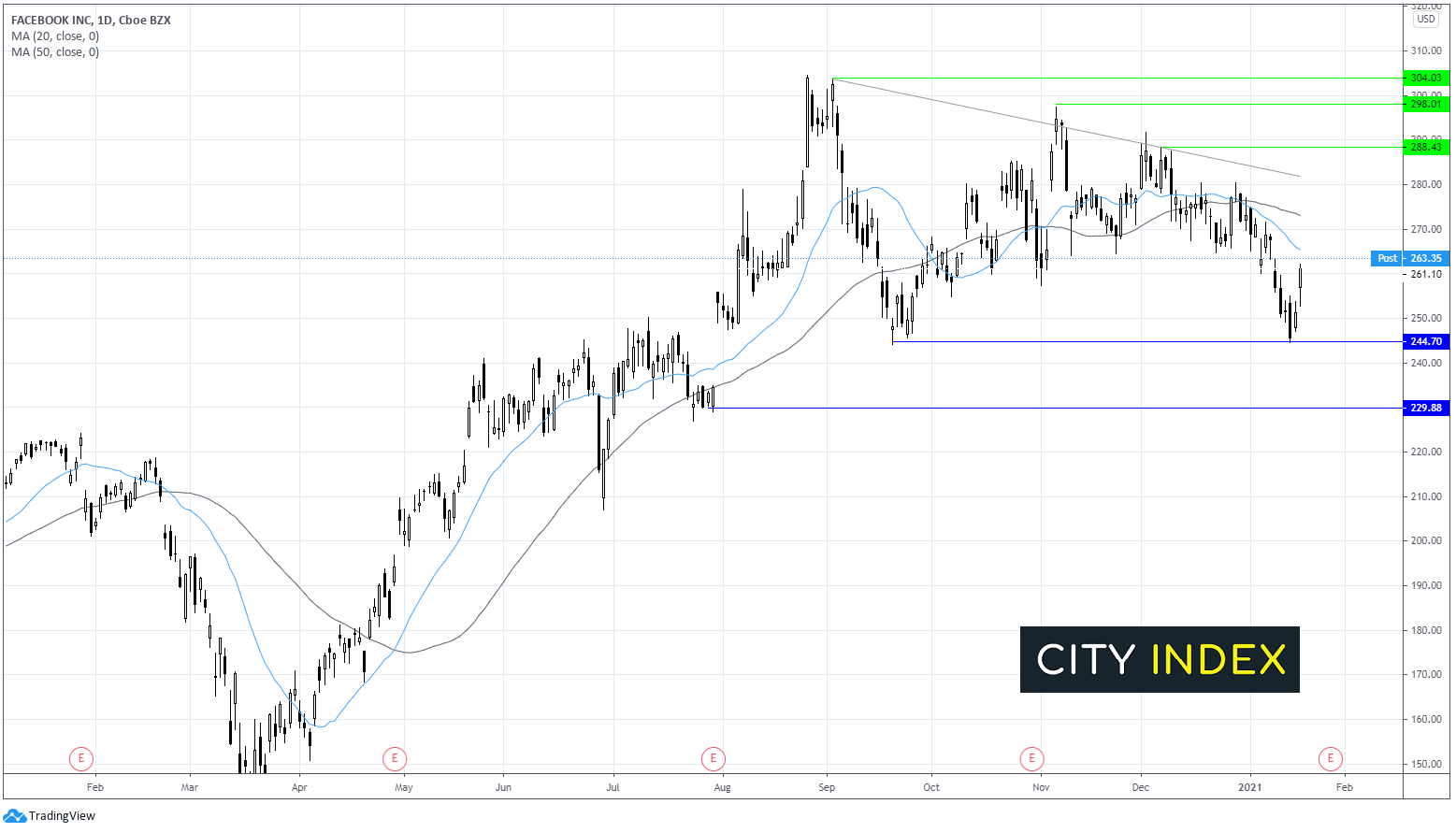

Facebook chart

Source:Tradingview Gain Capital