In an update this afternoon, Prime Minister Jacinda Ardern and Director-General of Health Dr. Ashley Bloomfield confirmed that the current level four lockdown, originally scheduled to end at 11.59 pm Tuesday, would be extended until Midnight Friday night. The decision will be reviewed on Friday, and an update will be given in the afternoon.

The news of the lockdown extension will go some way towards reducing the impact of the release of what is expected to be a firm Q2 retail sales number tomorrow at 8.45 am Sydney time.

Despite the strong inflationary pressures in the quarter, real sales volumes are expected to rise a solid +2.5% in Q2, following a 2.5% rise in the first quarter of 2021.

A second consecutive strong print will confirm that the economy was on a strong footing before the lockdown and undoubtedly strengthen the RBNZ’s resolve to lift rates, presuming the outbreak is contained relatively quickly.

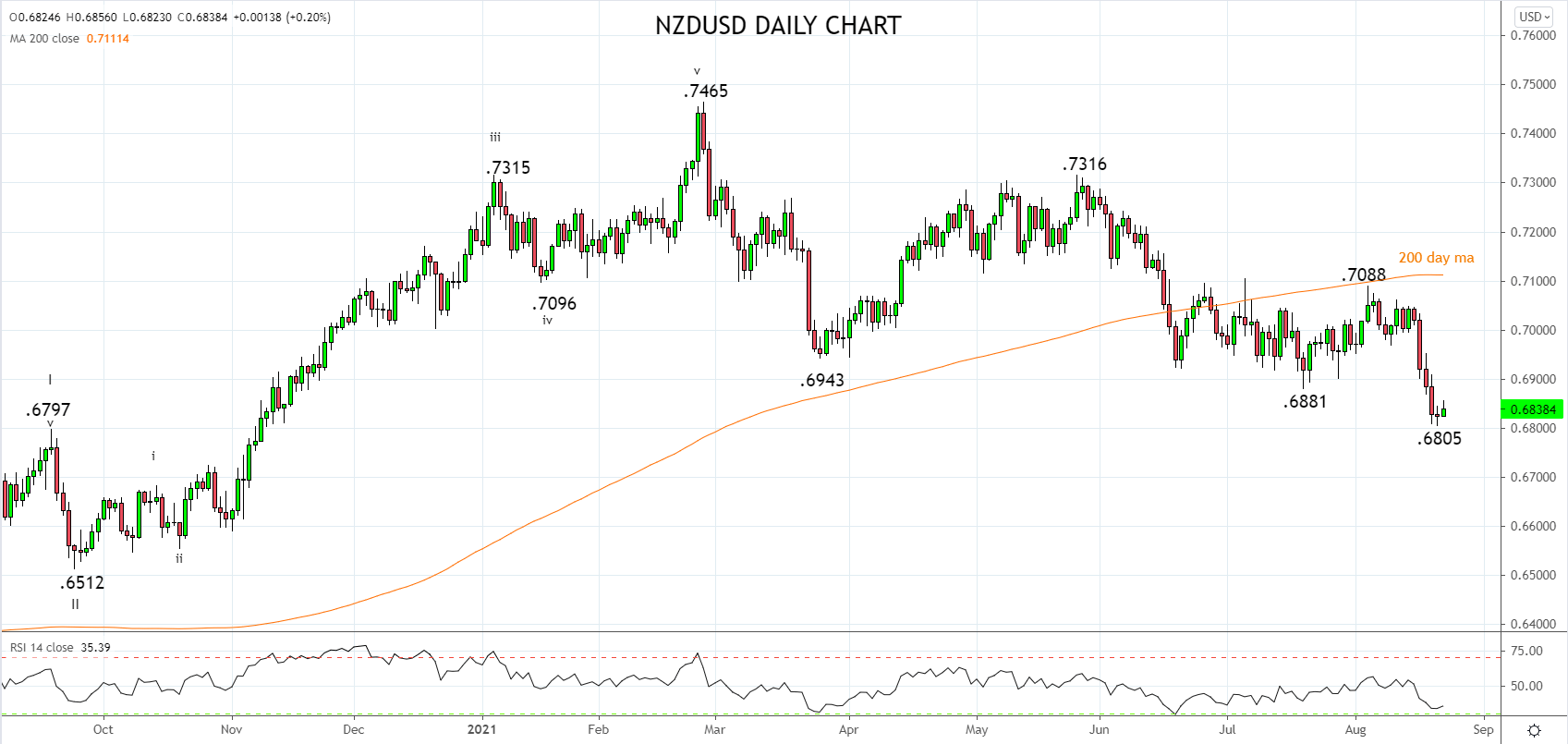

After a four-day 250 pip fall that included fresh cycle lows on Friday near .6800c, the NZDUSD reached oversold levels. In the short term, a bounce-back towards resistance near .6880/00 would not surprise before the next leg lower towards .6720/00 begins.

Aware that a break and close back above resistance at .6920ish is required to put the NZDUSD back on more solid footing and avert the near-term downside risks.

Source Tradingview. The figures stated areas of August 23rd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation