Already reflecting a high probability of default, the bond price bond of Evergrande has been trading at a significant discount in recent weeks. Should the situation fail to stabilise, RBC notes that authorities would likely step in to prevent contagion as they did in 2019 with Baoshang Bank.

Additionally, Evergrande does not have the considerable counterparty derivatives risk that Lehman had when it went under. Instead, a good chunk of the money Evergrande owes is to suppliers, construction companies, and buyers of uncompleted apartments, who are likely to be made good by a government bailout.

The return of some relative calm has allowed traders to take stock ahead of the first of this week’s developed markets central bank meetings, tomorrow’s Bank of Japan (BoJ) meeting.

Unfortunately, while the BoJ is the first cab off the rank, it will be one of the tamer events. The BoJ is expected to maintain the status quo across all monetary policy parameters, including asset purchase guidelines and forward guidance.

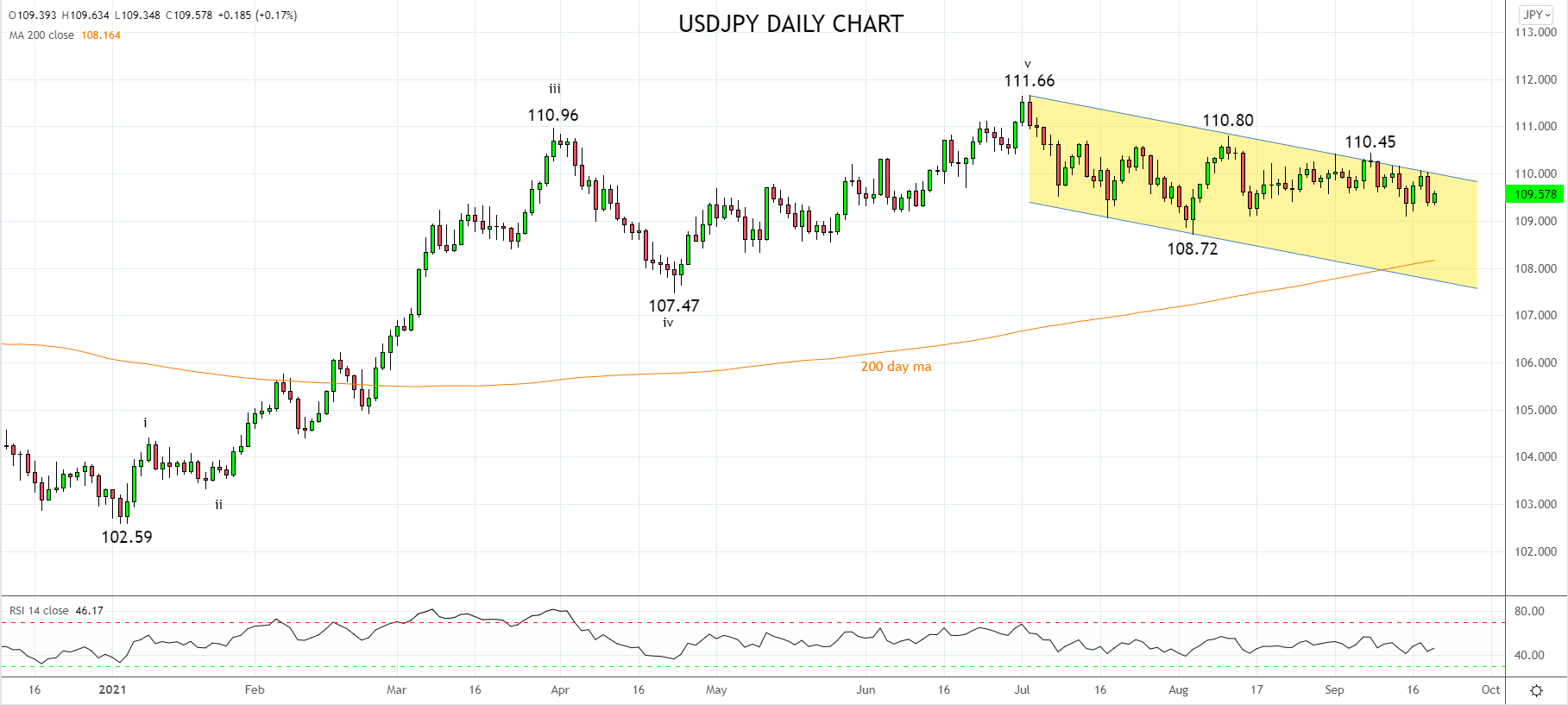

Turning to the charts after completing a 5-wave rally at the 111.66 high, USDJPY continues to trace out a corrective pullback within a well-established trend channel. A break and daily close above the top of the trend channel, (currently at 110.10) and above recent highs 110.40/50, ideally after Thursday's FOMC meeting, would indicate the correction is complete, and the uptrend has resumed, targeting a retest and break of the 111.66 high.

Aware that while USDJPY remains below resistance at 110.40/50, allow for a retest of the 108.72 low before the uptrend resumes.

Source Tradingview. The figures stated areas of September 21st, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation