Data released earlier showed that factory orders for Germany were 3.5% MoM vs 2.1% MoM expected and a higher revised October print to -5.8% MoM. Euro Zone PPI for November was 23.7% YoY vs 22.9% YoY expected and 21.9% YoY in October. Germany’s preliminary Harmonized CPI for December was 5.7% YoY vs 5.7% YoY expected and 6.0% YoY in November. Strong manufacturing data and volatile inflation data should point to a volatile EUR/USD. In addition, the US Fed is pointing towards hiking rates sooner rather than later, while the ECB is pointing towards bond buying through September. One would think this would also cause more movement in the pair.

Central Banks: Liftoff in Focus?

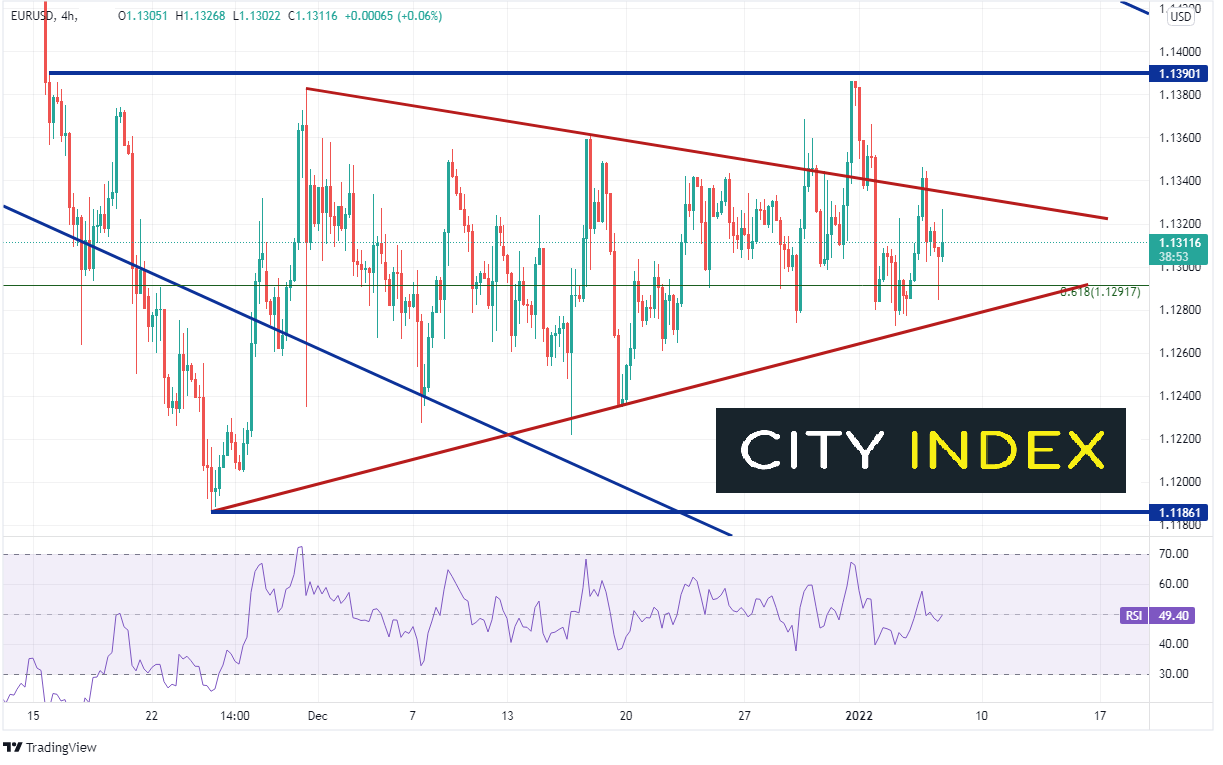

However, at the time of this writing, EUR/USD is near unchanged. And, a 240-minute timeframe of the pair shows that EUR/USD has been in a range between 1.1186 and 1.1390 since November 15th, 2021. This is roughly a 200-pip range for nearly 2 months. And, the price action has formed a symmetrical triangle with price now approaching the apex (low volatility until a significant breakout).

Source: Tradingview, Stone X

Therefore, if people are looking to trade the Euro, they may be interested at looking at other Euro pairs which have more volatility!

Everything you wanted to know about the Euro

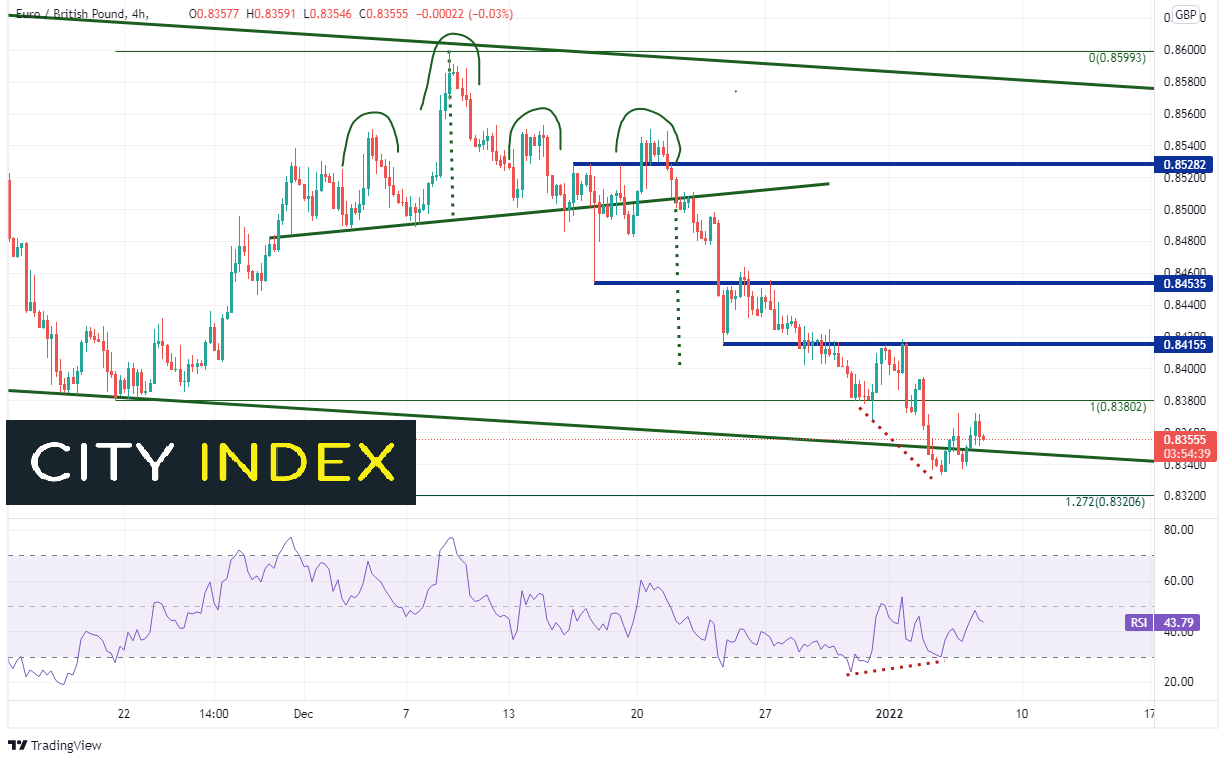

On the same timeframe, EUR/GBP has been in a range between 0.8330 and 0.8600, roughly 270 pips. However, whereas EUR/USD has been trading in the triangle, EUR/GBP has been moving lower from the range highs on December 8th, 2021. The pair formed a head and shoulders pattern (with 2 right shoulders) and aggressively broke the neckline on December 22nd, 2021 below 0.8510. The target for a head and shoulders pattern is the height from the head to the neckline, added to the breakdown point of the neckline. This target was reached on December 28th, 2021, near 0.8400. EUR/GBP had continued moving lower and has bounced from the bottom trendline of long-term downward sloping trendline near 0.8350 and the 127.2% Fibonacci extension from the lows of November 19th, 2021 to the highs of December 8th, 2021, near 0.8320.

Source: Tradingview, Stone X

Trade EUR/GBP now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

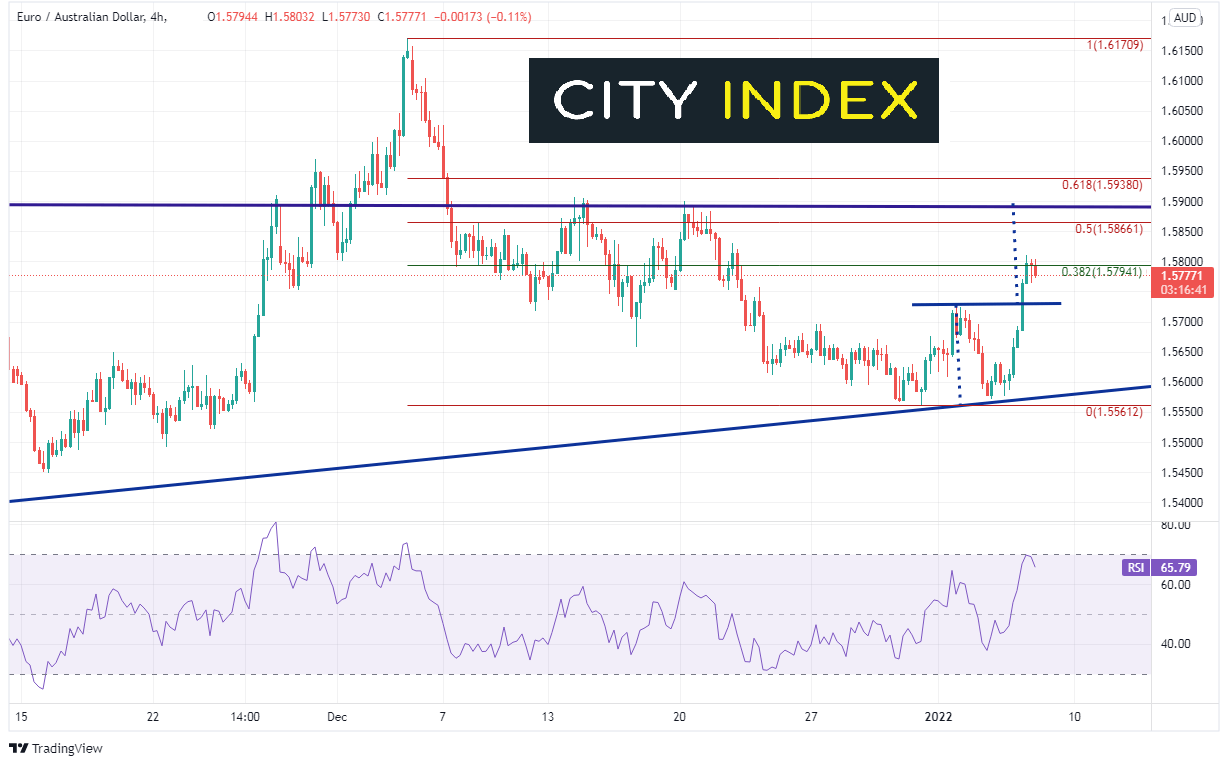

Another Euro pair for traders to look to at is EUR/AUD. Since November 15th, 2021, EUR/AUD has traded in a range between 1.5458 and 1.6171, over 700 pips! On December 3rd, 2021, the pair peaked at 1.6171 and began moving lower. EUR/AUD formed a double bottom on December 31st, 2012 and January 5th. On January 6th, broke the neckline of the double bottom and began to move towards the target near 1.5900. However, price has paused at the 38.2% Fibonacci retracement level from the December 3rd, 2021 highs to the recent double bottom lows near 1.5794. Watch for price to continue towards its target. Notice that price is near overbought territory on the RSI. Therefore, EUR/AUD may continue to consolidate as the RSI unwinds further into neutral territory.

Source: Tradingview, Stone X

Trade EUR/AUD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

During the last few months, EUR/USD hasn’t provided that many opportunities to trade over the medium term. Therefore, if traders are keen on the Euro, they may have to look at other Euro pairs. EUR/GBP and EUR/AUD are two good alternatives. Also look at EUR/CHF and EUR/MXN for other opportunities to trade the Euro!

Learn more about forex trading opportunities.