EUR/USD has dropped through $1.10 to its lowest level since late February, amid a rush for the safe haven dollar.

German ZEW sentiment data caused an already panicked market to fret some more. The ZEW index, which gauged financial analyst’s sentiment and view on an economic situation dived in March, recording the steepest drop on record.

The ZEW index fell to -49.5 in March from +8.7 in February and is now at its lowest level since December 2011.

German recession

Germany is heading for a recession. The situation is fast moving. However yesterday Chancellor Angela Merkel announced a general lock down of Europe’s largest economy. All shops are to be closed, no touristic travel domestically or abroad, restaurants open until 6pm and no sports or cultural events allowed. So, consumption will drop dramatically. Large car manufacturers have also announced a temporary halt to production. The supply shock demand shock will be crippling and the economic impact will be staggering.

And the problem is not just Germany, Italy, Spain and France, the largest economies in the eurozone all face severe pressure from the coronavirus outbreak, as governments lock down countries with already very fragile economies.

Germany is heading for a recession. The situation is fast moving. However yesterday Chancellor Angela Merkel announced a general lock down of Europe’s largest economy. All shops are to be closed, no touristic travel domestically or abroad, restaurants open until 6pm and no sports or cultural events allowed. So, consumption will drop dramatically. Large car manufacturers have also announced a temporary halt to production. The supply shock demand shock will be crippling and the economic impact will be staggering.

And the problem is not just Germany, Italy, Spain and France, the largest economies in the eurozone all face severe pressure from the coronavirus outbreak, as governments lock down countries with already very fragile economies.

US retail sales miss

Meanwhile US data is also disappointing. Retail sales declined a -0.5% in February, missing expectations of 0.2% increase. These figures show that consumption, the main driver of the US economy had started to slow even before coronavirus social distancing measures were enforced, raising fears that the data out of the coming months will be hideous.

Meanwhile US data is also disappointing. Retail sales declined a -0.5% in February, missing expectations of 0.2% increase. These figures show that consumption, the main driver of the US economy had started to slow even before coronavirus social distancing measures were enforced, raising fears that the data out of the coming months will be hideous.

Offshore Dollar Market Stress

Despite the Fed’s best efforts to ease pressures in the money markets recent signals suggest that the moves haven’t worked. This is most likely a result of lenders hoarding the dollar in expectation of increased liquidity needs from companies and growing concerns over bad loans. The pressure was most explicit in the euro/dollar 3-month FX spread which widened to 124 bps at one point, its widest level since the European debt crisis and up from just 20 bps earlier this month. This means that market player are willing to pay higher premiums for dollars, an amber warning signal flashing.

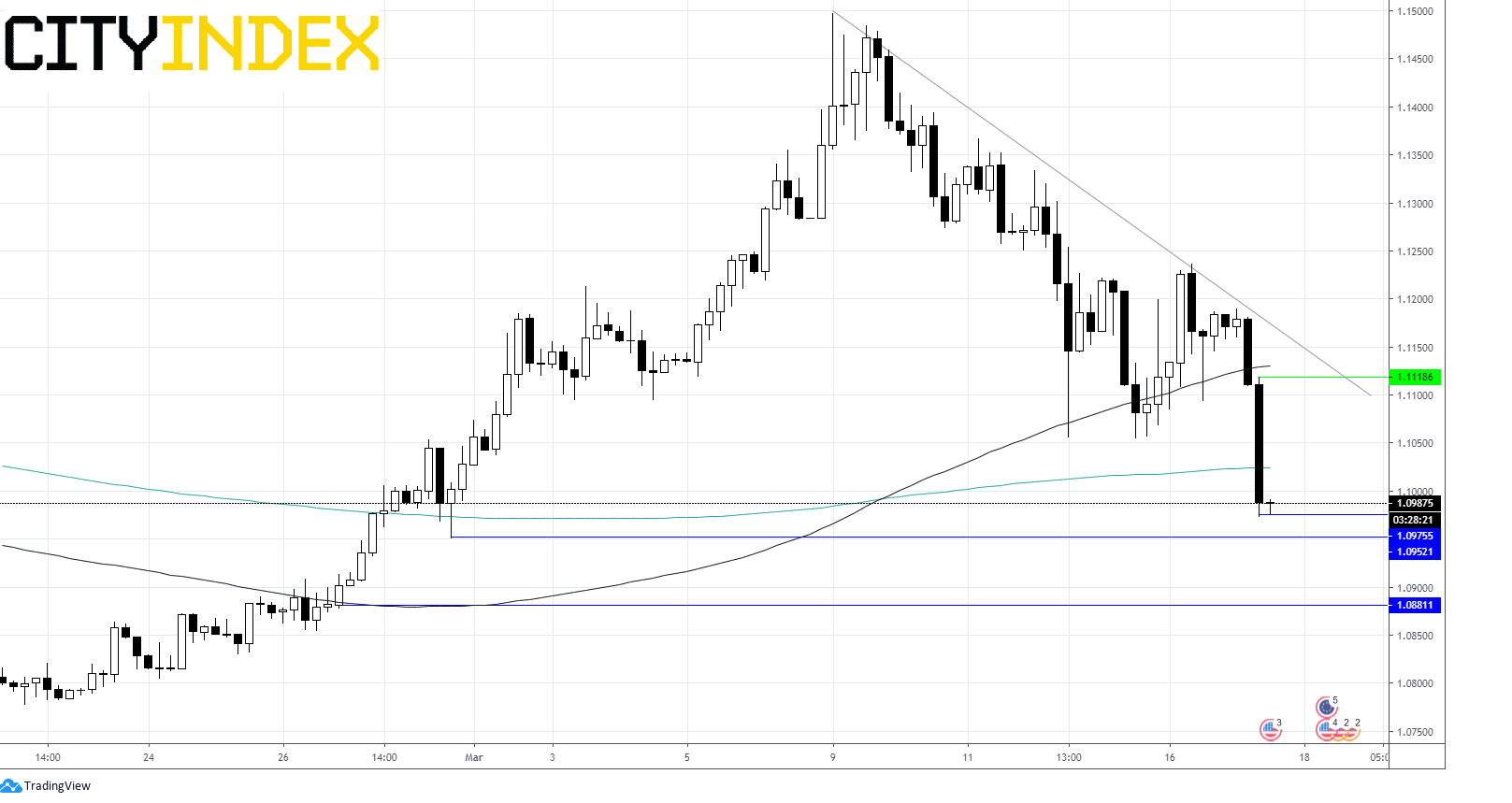

EUR/USD hit a 14 month high on 9th March. Since then a correction has been is play which could see the pair retest the year low. Global turbulence in the financial markets and fears of a recession are seeing traders seek out safe havens such as the dollar and the yen.

Despite the Fed’s best efforts to ease pressures in the money markets recent signals suggest that the moves haven’t worked. This is most likely a result of lenders hoarding the dollar in expectation of increased liquidity needs from companies and growing concerns over bad loans. The pressure was most explicit in the euro/dollar 3-month FX spread which widened to 124 bps at one point, its widest level since the European debt crisis and up from just 20 bps earlier this month. This means that market player are willing to pay higher premiums for dollars, an amber warning signal flashing.

Levels to Watch

EUR/USD is down over 1.5% at $1.10, it has picked up off session lows of US$1.0974. It trades below its 50, 100 and 200 sma and comfortably below the descending trendline.

Immediate support can be seen at $1.0974 (today’s low) prior to $1.0953 (low 28th Feb) and $1.0880 (low 26th Feb).

Resistance can be seen at $1.1026 (200 sma), $1.1118 (today’s high) and $1.1130 (100 sma). We would be looking for a move above $1.1170 to negate on the current bearish trend on 4 hour chart.

Latest market news

Today 08:15 AM